PM-SYM provides universal pension coverage through financial security for unorganized workers, creating a more inclusive social security framework in India.

- Unorganized sector contributes around 50% of nation’s GDP. There are over 30.51 crore unorganized workers registered on e-Shram portal (2024).

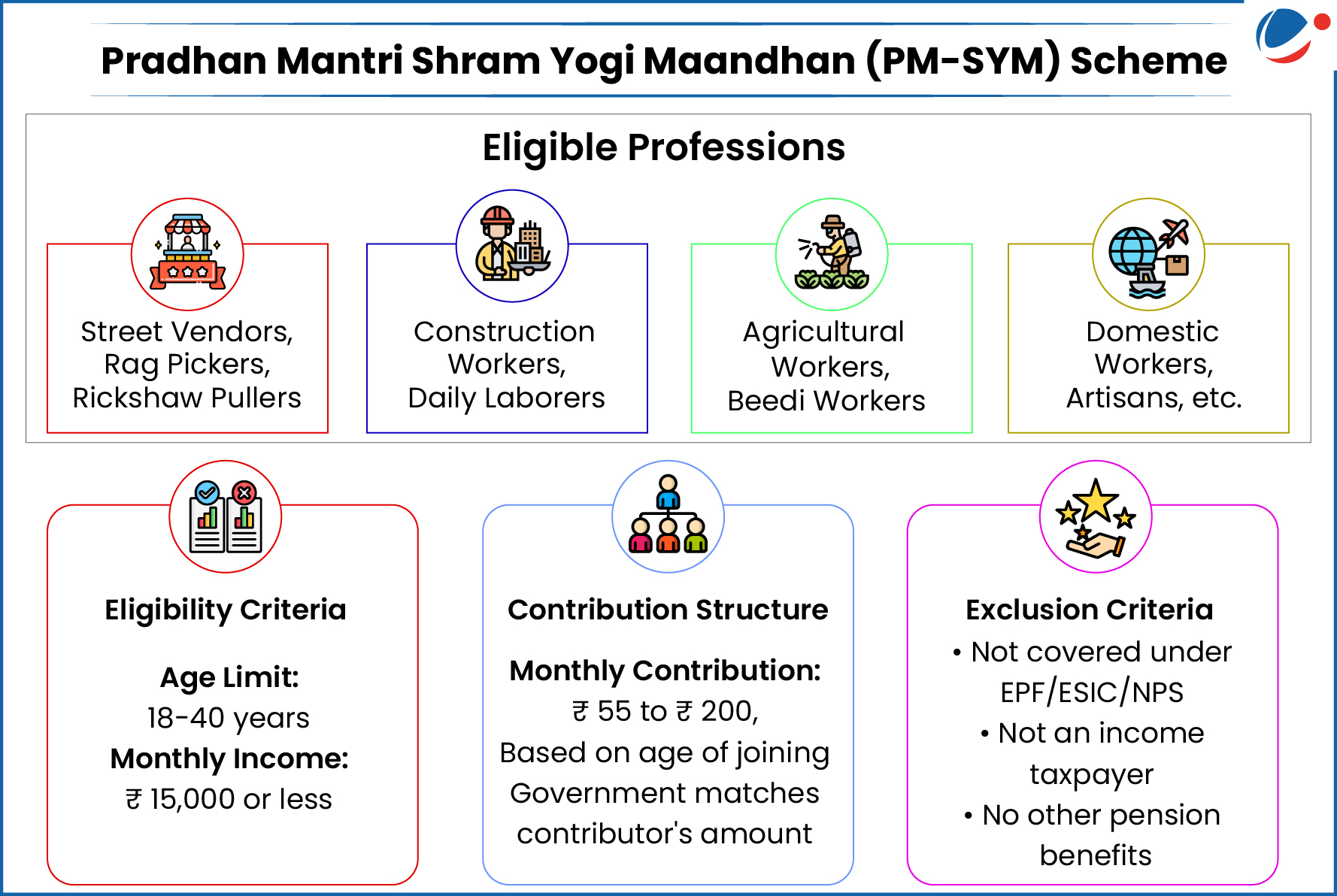

About PM-SYM

- Ministry: Central Sector Scheme launched in 2019 by Ministry of Labour and Employment

- Objective: Voluntary and contributory pension scheme ensuring a minimum monthly pension of Rs. 3,000 after age of 60.

- Pension Fund Manager: Life Insurance Corporation of India (LIC)

- Enrollment: At Common Service Centres or Maandhan portal.

- Contribution by Subscriber: Shall be made through ‘auto-debit’ facility from savings bank account/ Jan- Dhan account.

- Other Features:

- Family Pension: If subscriber dies during receipt of pension, only the spouse can receive 50% of pension amount.

- If a beneficiary has given regular contribution and died before age of 60 years,

- His/her spouse will be entitled to continue scheme subsequently by payment of regular contribution or exit as per provisions of exit and withdrawal.

- If a beneficiary has given regular contribution and died before age of 60 years,

- Donate-a-Pension Module: Encourages employers to pay premium for their staff to increase enrolment.

- Family Pension: If subscriber dies during receipt of pension, only the spouse can receive 50% of pension amount.

- Implementation and Current Status:

- Coverage: 36 States/UTs

- Enrollments: ~46,12,330 (March 2025)

- Top 3 States: Haryana, Uttar Pradesh, Maharashtra.