The scheme will cover UPI Person-to-Merchant (P2M) transactions and will be implemented at an outlay of 1,500 crore for FY 2024-25.

Key Highlights of the Scheme

- Incentive: Incentive of 0.15% per transaction will be provided for transactions upto Rs.2,000 pertaining to category of small merchants.

- Incentive is paid to the Acquiring bank (Merchant's bank) and shared with Issuer Bank (Customer's Bank), Payment Service Provider Bank and App Providers.

- Objective:

- Promotion of indigenous BHIM-UPI platform.

- Achieving the target of 20,000 crore total transaction volume in FY 2024-25.

- Penetration of UPI in tier 3 to 6 cities, especially in rural & remote areas by promoting innovative products such as feature phone based (UPI 123PAY) & offline (UPI Lite/UPI LiteX) payment solutions.

- Key Benefits: Enable small merchants to avail of UPI services at no additional cost.

- Earlier, in 2020, Merchant Discount Rate was made zero for BHIM-UPI transactions.

- MDR refers to the rate merchants are charged for accepting Debit Card and Credit Card payments and funds paid via net banking and Digital Wallets.

- Earlier, in 2020, Merchant Discount Rate was made zero for BHIM-UPI transactions.

About Bharat Interface for Money (BHIM), 2016

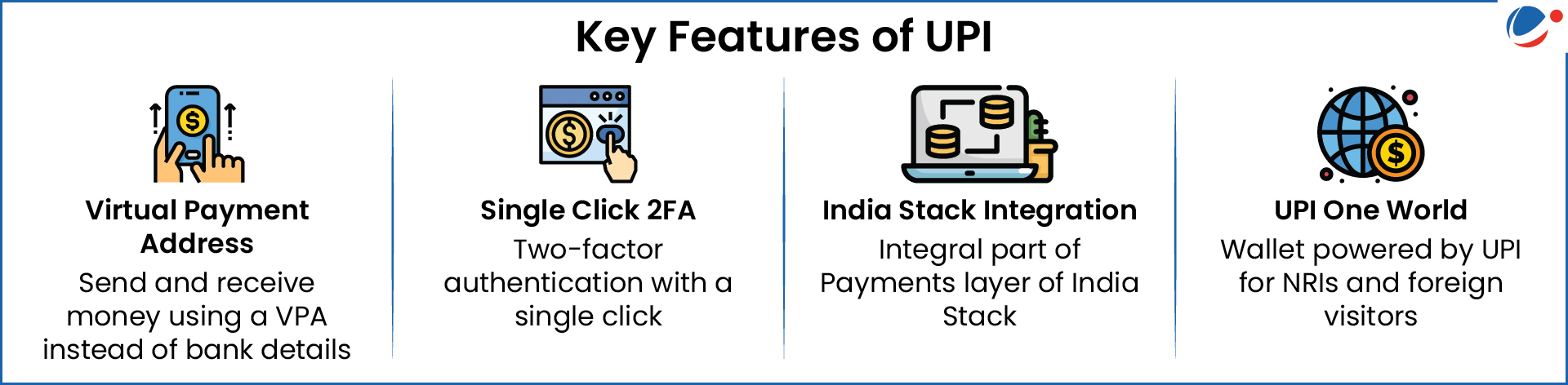

- A payment app that enables easy transactions using the Unified Payments Interface (UPI).

- UPI is a system that powers multiple bank accounts into a single mobile application (of any participating bank)

- Developed by National Payments Corporation of India (NPCI) to drive digital payments.

Related NewsNPCI International Payments Limited (NIPL)NIPL has partnered with Singapore-based payment company to expand the acceptance of UPI. About NIPL

|