Department of Financial Services notifies amalgamation of 26 RRBs on the principles of “One State One RRB”.

About RRBs Amalgamation

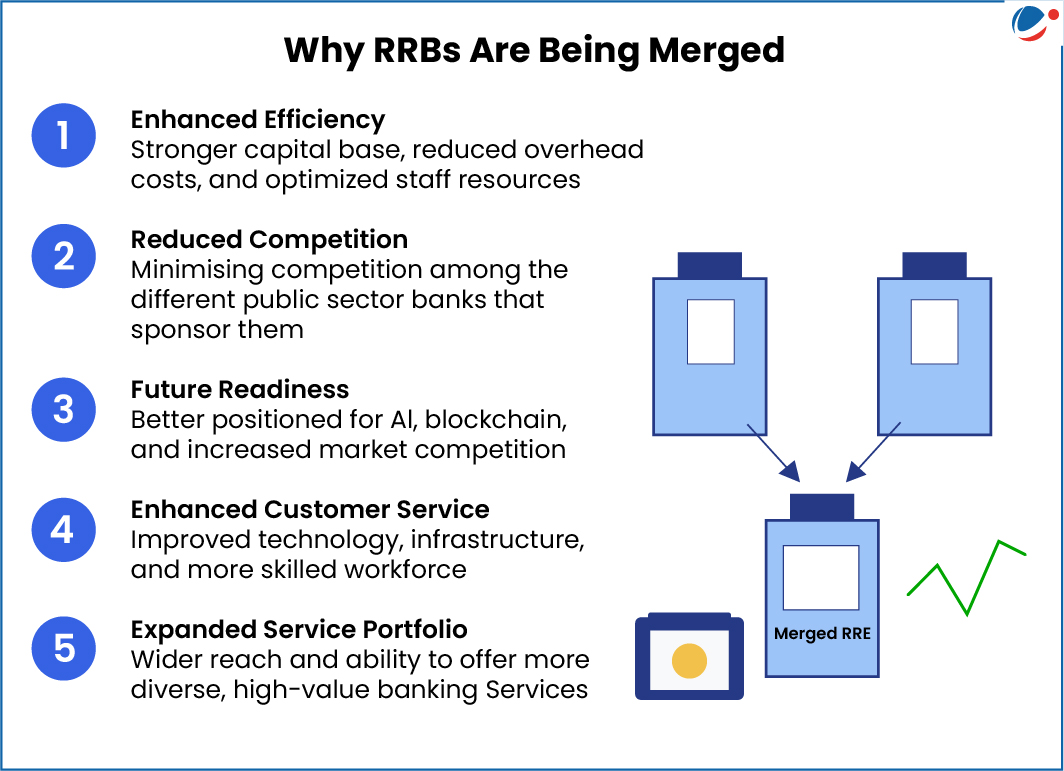

- Background: Based on Vyas Committee recommendations, the Centre began consolidating RRBs in 2004–05.

- Through three phases, the number of RRBs was reduced from 196 to 43 by 2020–21.

- Legal Provision: Under Regional Rural Banks (RRBs) Act, 1976.

- One State One RRB Principle: Each state will have only one RRB which will be sponsored by a major public sector bank.

- For example, In Bihar, Dakshin Bihar Gramin Bank and Uttar Bihar Gramin Bank will be combined into Bihar Gramin Bank, headquartered in Patna, sponsored by Punjab National Bank.

About RRBs

- Genesis: Set up in 1975 under the RRB Act, 1976.

- Aim: To provide credit and banking services to small farmers, labourers, artisans, and rural entrepreneurs to boost agriculture, trade, and small industries.

- Establishment: Set up by the Central Government on the request of a sponsor bank

- Jointly Ownership: Owned by the Central Government (50%), State Government (15%), and the sponsoring bank (35%).

- Supervision and Regulation

- RRBs are regulated by the RBI under the Banking Regulation Act, 1949.

- NABARD supervises RRBs.

- For tax purposes, they are treated as cooperative societies under the Income Tax Act, 1961.

- Key Requirements

- Must maintain a Capital to Risk-Weighted Assets Ratio (CRAR) of 9%, as per RBI norms

- Must allocate 75% of ANBC (Adjusted Net Bank Credit) or CEOBE (Credit Equivalent of Off-Balance Sheet Exposure) whichever is higher to Priority Sector Lending (PSL).