As per the report, number of operational Carbon Pricing (CP) instruments has grown, from 5 (2005) to 80 presently, with India, Brazil, and Türkiye actively developing them.

Key Highlights of the Report

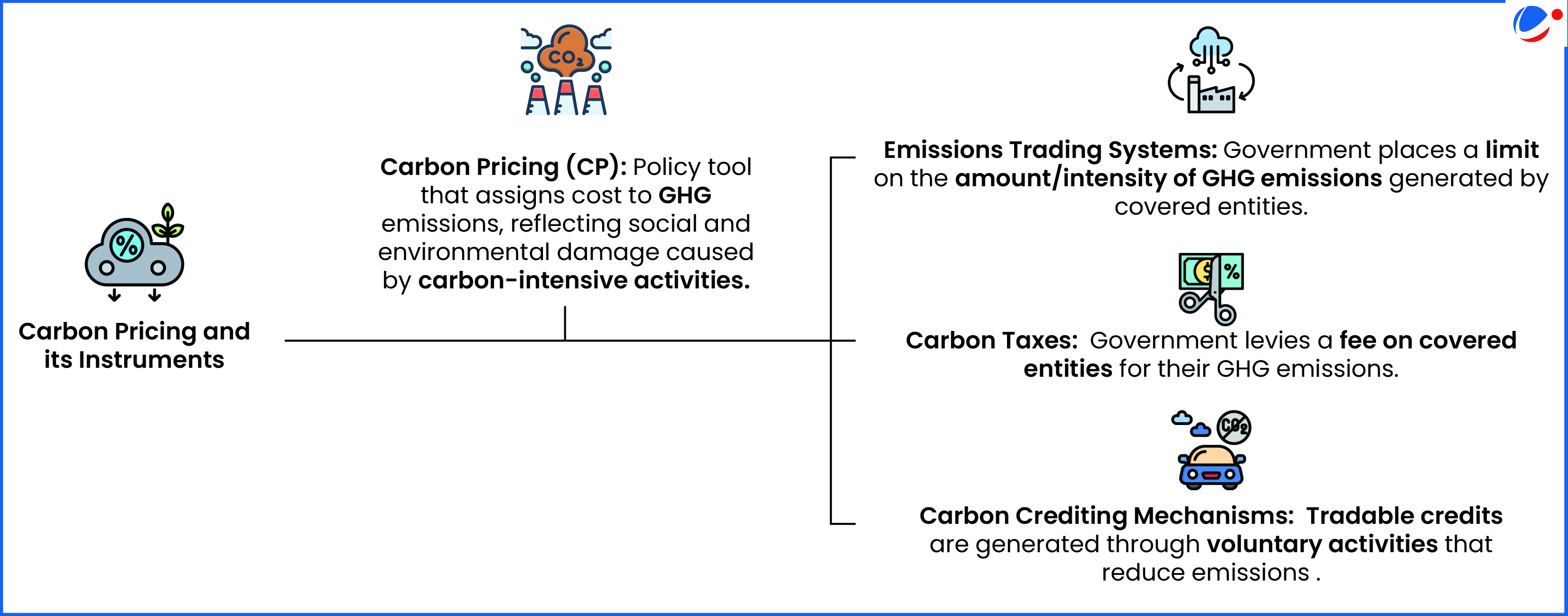

- Coverage: CP covers around 28% of global Greenhouse Gas (GHG) emissions, with 43 carbon taxes and 37 Emission Trading Systems (ETSs).

- Revenue Generation: Globally, ETSs and carbon taxes continued to generate over USD 100 billion (2024) for public budgets.

- Sector Wise Coverage: Power followed by industry sector have the highest coverage.

- Agriculture and Waste remains largely uncovered.

- Carbon Credit Supply Vs Demand: Supply continued to outstrip demand, with almost 1 billion tons of unretired credits in 2024, globally.

Key Provisions on CP

Global

- Article 6 of Paris Agreement (CoP 21, UNFCCC): Provides basis for facilitating international recognition of cooperative carbon pricing approaches.

- COP29 (Baku, Azerbaijan), UNFCCC (United Nations Framework Convention on Climate Change) adopted the final rules for Article 6.2 (cooperative approaches) and Article 6.4 (the Paris Agreement Crediting Mechanism).

- Carbon Border Adjustment Mechanisms (CBAMs): Imposes Carbon price at the border on emissions from imported goods. E.g., EU’s CBAM.

India

- Carbon Credit Trading Scheme (2023): Provides two mechanisms,

- Compliance Mechanism: Obligated entities complies with prescribed GHG emission reduction norms.

- Offset mechanism: Non-obligated entities registers projects for GHG emission reduction/removal/avoidance for Carbon Credit Certificates.