Introduction

- Global economic environment remains uncertain due to geopolitical tensions, trade disruptions, divergent growth and inflation outcomes across major economies.

- Despite short-term global resilience, vulnerabilities like fiscal pressures, fragmented supply chains, and increased reliance on economic policy instruments for strategic purposes persist.

- Against this backdrop, Indian economy has maintained strong growth momentum, largely driven by domestic demand, in FY26 with real GDP growth at 7.4% in First Advance Estimates.

Chapter Precap

Global Economic Growth – Fragile and Diverging

| Trends in Domestic Economy

|

Domestic Macroeconomic Fundamentals

| Labour Market Developments

|

Global Economic Growth – Fragile and Diverging

- USA's imposition of reciprocal tariffs on imports from its trade partners (April 2025): Initially it raised fears of slower growth and higher inflation in global economy, but impacts were temporary in short run.

- Issues in advanced economies (AEs): E.g., in USA inflation remained stubbornly above 2% target with rising unemployment rate.

- Deflationary pressures in Chinese economy: Stemming from the crisis in its property sector, indicating tepid domestic demand.

- Divergent trajectories of central bank policy rates across major economies: It has implications for capital flows as fund houses trot the globe in search of higher yields.

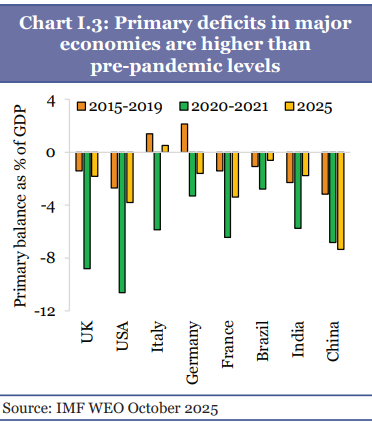

- Expansionary Fiscal policies in major economies: Except in Brazil and India, projected primary deficits for 2025 are still significantly higher than pre-pandemic levels.

- Elevated Long-term borrowing costs: These pressures are showing in elevated bond yields across major AEs, particularly in the ultra-long tenure segment.

- E.g., 30-year bond yields in Japan exceeded the highest on record in data since 1999.

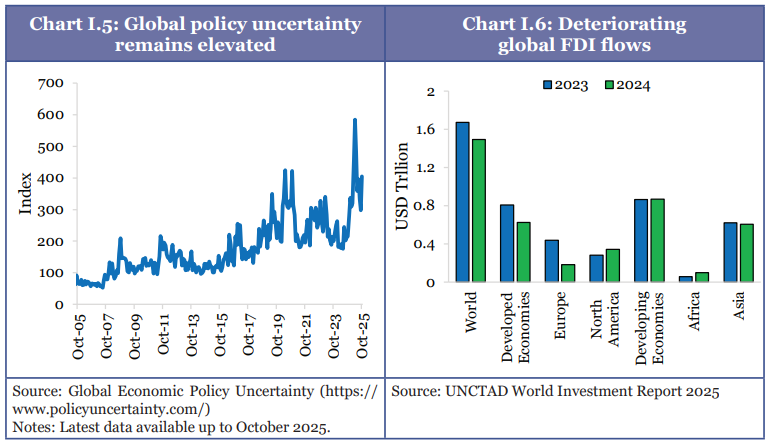

- Elevated Global economic uncertainty compared to historical trends: This is due to fragmentation in geopolitical relationships and lower visibility on policy continuity, leading to deterioration in global foreign direct investment (FDI) flows.

- As per United Nations Conference on Trade and Development's (UNCTAD) World Investment Report 2025, FDI flows in 2024 declined by 11% YoY, excluding certain conduit economies.

- Rapid resurgence of 'Economic Statecraft': It reflects rising geopolitical competition, concerns over technological dominance and vulnerabilities exposed in traditional global value chains.

- Economic statecraft defined as deliberate use of economic instruments to achieve foreign policy, or national security objectives such as compelling a country to stop hostilities with a third party or to liberalise its markets.

- It differs from Economic policy that employs traditional instruments, including fiscal, monetary, and trade tools, to achieve economic objectives like reducing deficits, controlling inflation, and promoting economic growth.

- Drivers behind Resurgence of Economic statecraft:

- Rise of ultra-nationalism and inward-looking policies.

- Scepticism towards free trade and multilateral institutions due to persistent global imbalances.

- Absence of updated global norms on subsidies, investment, and competition.

- Intensifying geopolitical tensions and militarisation (e.g., increased defence spending by Japan).

Trends in the Domestic Economy

Advance Estimates for FY26 reflect strong growth momentum

- First Advance Estimates (FAE) for FY26: Released by Ministry of Statistics and Programme Implementation (MoSPI)-

- Real GDP growth rate: 7.4%

- Gross Value Added (GVA) growth rate: 7.3%.

- It reaffirms India's status as the fastest-growing major economy for the fourth consecutive year.

Demand side: Domestic drivers anchor GDP growth in FY26

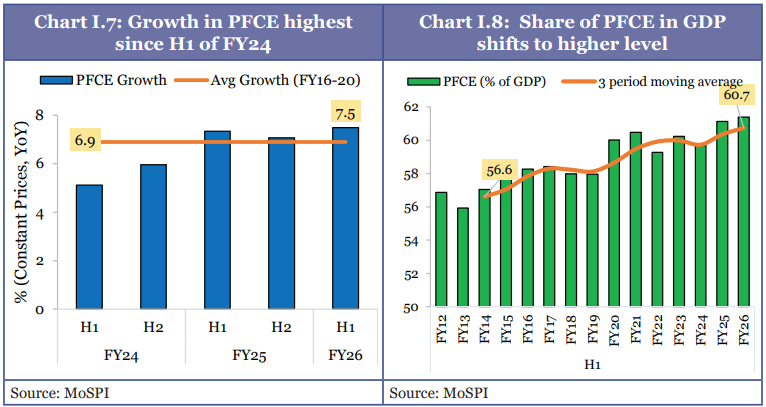

- Private Final Consumption Expenditure (PFCE): It grew by 7.0% in FY26, reaching 61.5% of GDP, the highest since 2012 (FY23 also recorded 61.5% share).

- This growth is supported by low inflation, stable employment, and increasing real purchasing power.

- Moreover, strong agricultural performance has bolstered rural consumption, and gradual improvements in urban consumption, aided by tax rationalisation, reaffirm that momentum in consumption demand is broad-based.

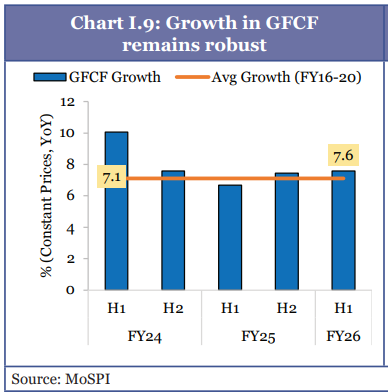

- Investment: It has continued to anchor growth in FY26, with the share of Gross Fixed Capital Formation (GFCF) estimated at 30%.

- Investment activity strengthened in first half of FY26, with GFCF expanding by 7.6%, and remaining above pre-pandemic average of 7.1%.

- This momentum was buoyed by sustained public capital expenditure and a revival in private investment activity.

- External demand: In first half (H1) of FY26, exports of goods and services grew by 5.9%, exceeding the growth seen in H1 of FY25, and remaining above pre-pandemic average, supported by trade diversification.

Industry and Services lead supply-side growth in FY26

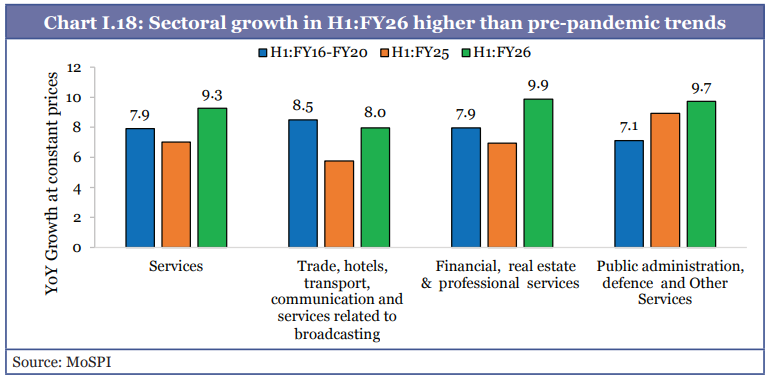

- From supply-side perspective, growth in GVA during FY26 was led by industry and services sectors, supported by sustained capital expenditure, improved capacity utilisation, and steady demand for services.

- Services: It is estimated to have grown by 9.1% in FY26, indicating a broad-based expansion across sector.

- GVA for Services increased by 9.3% in H1 FY26.

- Industrial sector: It is projected to grow by 6.2% in FY26, up from 5.9% in FY25.

- Manufacturing sector: It expanded by 8.4%, reflecting resilient demand conditions and improved utilisation of existing capacities.

- Construction activity: It recorded 7.4% growth, lower than FY25 but underpinned by sustained public capital expenditure and ongoing momentum in infrastructure projects.

- Utilities: Growth in electricity, gas, water supply and other utilities was relatively modest at 2.4%, lower than pre-pandemic trend.

- Mining sector: It contracted by 1.8%, partly due to disruptions caused by excessive rainfall.

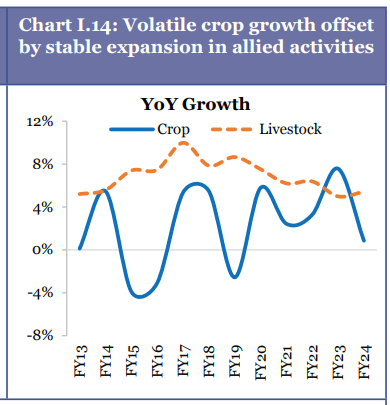

- Agriculture and allied services: They are estimated to grow by 3.1% in FY26.

- Agricultural GVA grew by 3.6%, higher than 2.7% growth recorded in FY25.

- Allied activities, particularly livestock and fisheries, have grown at relatively stable rates of around 5-6%.

- Crop-sector growth (accounts for more than half of agricultural GVA) has not exhibited a sustained upward trend, reflecting limited productivity gains over time.

- Rabi sowing has been progressing well, aided by replenished reservoir levels, adequate soil moisture, and sufficient availability of inputs.

Strengthen India's National Statistical System: From Data Generation to Data ReadinessGovernment has strengthened National Statistical System to support better evidence-based policymaking through-

|

Assessment of Domestic Macroeconomic Fundamentals

Inflation dynamics in the economy

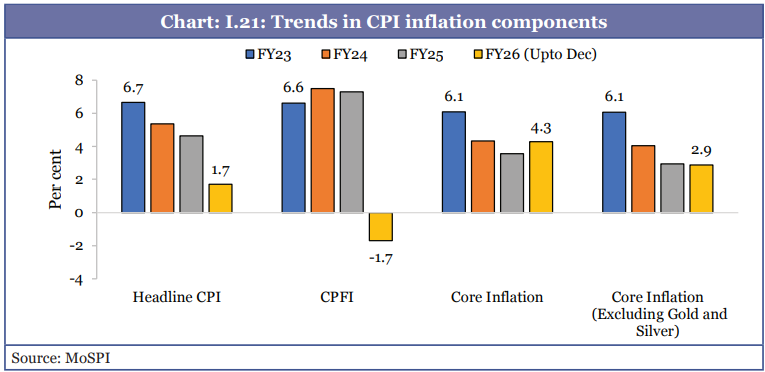

- Domestic inflation dynamics in FY26 (April-December) reflect a broad-based easing in price pressures, led by a sharp disinflation in food prices.

- Headline CPI inflation: It declined to 1.7%, driven primarily by corrections in vegetable and pulse prices, supported by favourable farm conditions, supply-side interventions, and a strong base effect.

- Core inflation: It has exhibited persistence, largely influenced by price spikes in precious metals.

Supportive fiscal policy strategy underpinning domestic demand

- Gross tax revenue collection: It progressed resiliently during the year, with direct tax collections reaching nearly 53% of the budgeted annual target (as on November 2025).

- Indirect tax collections: They remained robust despite lower inflation and import volatility, with gross GST collections in absolute terms recording multiple all-time highs during the year.

- Recent tax policy reforms, including restructuring of personal income tax and rationalisation of GST rate, have supported consumption demand.

- Central government remains on track to attain a fiscal deficit target of 4.4% of GDP in FY26.

- Credit ratings agency, S&P Ratings, has acknowledged the credibility of and the commitment to the fiscal glide path, while upgrading India's rating from 'BBB-' to 'BBB'.

Monetary Transmission and the Changing Credit Mix

- Monetary support measures provided to Banking system through:

- 125 basis-point cut in policy repo rate since February 2025,

- Liquidity infusion via Cash Reserve Ratio (CRR) reductions (₹2.5 lakh crore),

- Open market operations (₹6.95 lakh crore), and

- Forex swap of about $25 billion.

- Gross non-performing asset (NPA) ratios: It declined to multi-decade lows of 2.2% in banking sector.

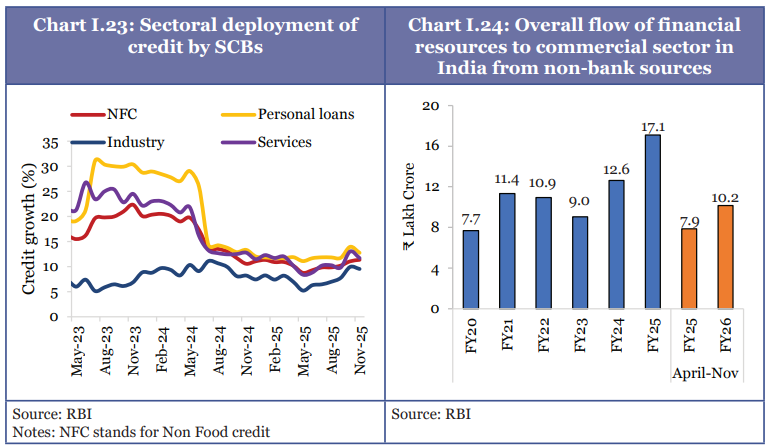

- YoY growth of outstanding Non-food credit stands at a reasonably stable rate of around 11.4% as of November 2025. However, India's commercial sector is tapping into alternative sources of financing, thereby offsetting any moderation in bank credit.

- In April-November 2025, within overall flow of financial resources, there has been an increase in flow from non-bank sources which rose by 29.3% YoY, alongside a robust expansion in non-food bank credit of 18.3%.

External sector projected to be stable, but headwinds persist

- India's total exports (merchandise and services): It reached a record USD 825.3 billion in FY25, with continued momentum in FY26.

- Merchandise exports and imports: It grew by 2.4% and 5.9% respectively (April–December 2025), while services exports increased by 6.5%.

- Rise in merchandise trade deficit has been counterbalanced by an increase in services trade surplus.

- Remittances: They have surpassed gross FDI inflows in most years, underscoring their importance as a key source of external funding.

- Current account deficit: It remains moderate at 0.8% of GDP in H1 FY26.

- Capital account: Within the capital account, gross FDI inflows continued to rise significantly.

- Repatriation flows: They have marginally declined by 4.2%.

- Foreign Portfolio Investments (FPI) flows: They have been weak due to elevated uncertainty and increased interest in AI-related financial investments in countries such as the US, Taiwan, and Korea.

- Weak rupee: Widened Balance of Payment (BOP) deficit (USD 6.4 billion in H1 FY26) coupled with market uncertainty over the outcome of a trade deal with the US has exerted pressure on the Indian Rupee, causing it to weaken.

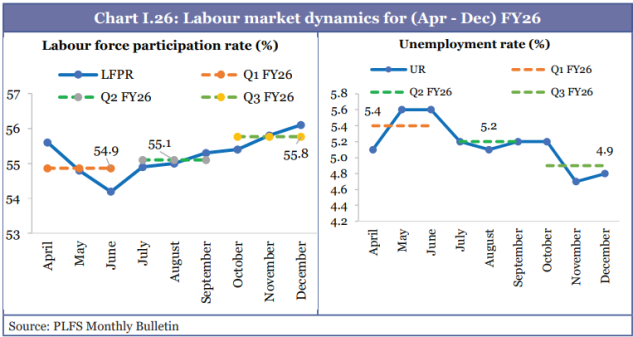

Labour market developments

- India has witnessed improvements in labour market, supported by a combination of regulatory reforms, expanded social protection, and targeted skill development initiatives.

- Recognition of gig and platform workers, with provisions to enable their registration and inclusion within social security schemes, marks a step towards formalising non-traditional forms of employment.

- Social sector initiatives, supported by targeted welfare schemes, economic reforms, and expanded access to essential services, have contributed to a reduction in poverty levels.

- In June 2025, World Bank revised the international poverty line from USD 2.15 to USD 3.00 per day (PPP, 2021 prices).

- Based on revised poverty line, India's poverty rates in 2022-23 are estimated at 5.3% for extreme poverty and 23.9% for lower-middle-income poverty.

Outlook and Way Forward

- Outlook for the global economy remains dim over the medium-term, with downside risks dominating.

- At the global level, growth is expected to remain modest, leading to broadly stable commodity price trends.

- Inflation across economies has trended downward, and monetary policies are therefore expected to become more accommodative and supportive of growth.

- Ongoing trade negotiations with the United States are expected to conclude during the year, which could help reduce uncertainty on the external front.

- Conditions like healthier balance sheets across households, firms and banks; resilient consumption demand remains and improving private investment provide resilience against external shocks and support the continuation of growth momentum.

- With domestic drivers playing a dominant role and macroeconomic stability well anchored, the balance of risks around growth remains broadly even.

- Projection for real GDP growth in FY27 lie in range of 6.8 to 7.2%.

What does the Budget say?

- Six Pillars of Growth and Development

- Sustaining Economic Growth

- Strengthening the Foundations of Growth

- People-Centric Development

- Trust-Based Governance

- Ease of Doing Business and Ease of Living

- Fiscal Matters

- To accelerate and sustain economic growth, interventions were proposed in six areas:

- Scaling up manufacturing in 7 strategic and frontier sectors (Biopharma SHAKTI, India Semiconductor Mission 2.0, Electronics Components Manufacturing Scheme, Dedicated Rare Earth Corridors, 3 dedicated Chemical Parks enhancing domestic production, Strengthening Capital Goods Capability, Integrated Programme for the Textile Sector).

- Rejuvenating legacy industrial sectors;

- Creating "Champion MSMEs";

- Delivering a powerful push to Infrastructure;

- Ensuring long-term energy security and stability; and

- Developing City Economic Regions

Glossary

| Terms | Meanings |

| Gross Value Added (GVA) | Value of output (at basic prices) minus the value of intermediate consumption (at purchaser prices). It is a measure of the contribution to GDP made by an individual producer, industry or sector. |

| Private Final Consumption Expenditure (PFCE) | Expenditure incurred by resident households and Non-Profit Institutions Serving Households (NPISH) on final consumption of goods and services, whether made within or outside economic territory. |

| Gross Fixed Capital Formation (GFCF) | Value of new investments in fixed assets, like buildings, machinery, and equipment. |

| Headline Inflation | Change in value of all goods in the basket. |

| Core inflation | Excludes food and fuel items from headline inflation. |

| Non-Performing Asset (NPA) | Reserve Bank of India defines NPA in India as any advance or loan that is overdue for more than 90 days. |

| Foreign Direct Investment (FDI) | Ownership stake in a foreign company or project made by an investor, company, or government from another country. |

| Repatriation | Ability to move liquid financial assets from a foreign country to an investor's country of origin. |

| Repo Rate | Rate at which central bank, like RBI, lends money to commercial banks. |

| Cash Reserve Ratio (CRR) | Percentage of a bank's total deposits that must be kept as cash with RBI. |

| Open Market Operations (OMO) | Market operations conducted by RBI by way of sale or purchase of G-Secs to/ from the market to adjust the rupee liquidity conditions in market. |

| Balance of Payment (BoP) | BoP statistics systematically summaries economic transactions of an economy with rest of the World (i.e. Transactions between resident & non-resident entities) during a given period. |

| Non-Food Bank Credit | Total amount of credit extended by financial institutions to individuals and businesses for purposes other than food procurement. |