Introduction

- Inflation has moderated significantly from its post-pandemic highs, with advanced economies stabilising at 2–3 % and emerging markets, including India experienced a notable decrease in the rate of inflation.

- Retail inflation (Consumer Price Index (CPI)) in India has followed a downward trajectory, reaching 1.7 % in 2025–26.

Chapter Precap

Global inflation

| Domestic Inflation

|

Regional and Sectoral Dynamics

| |

Global Inflation

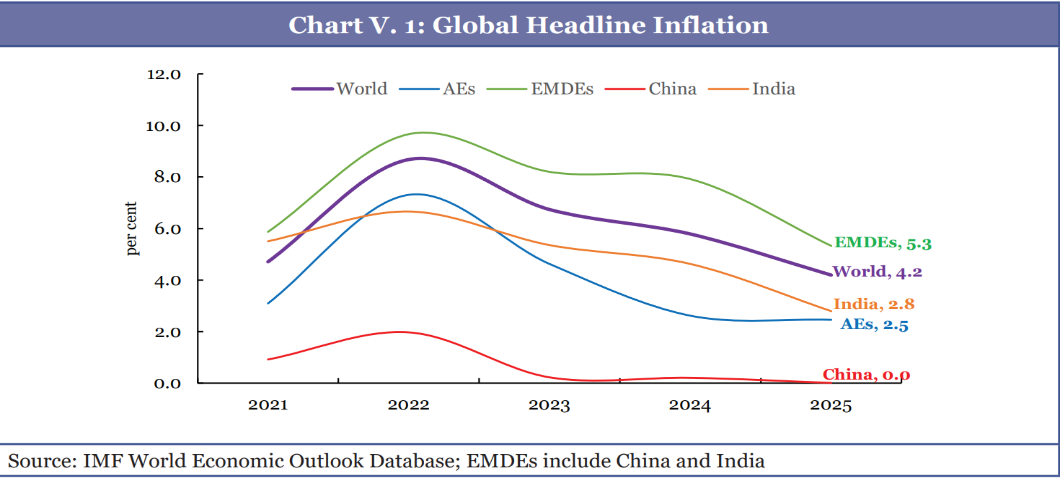

- Global headline inflation has declined from a peak of 8.7 % in 2022 to 4.2 per cent in 2025.

- Monetary Policy Responses: Central banks in advanced economies (AEs) reduced policy rates; RBI reduced its policy rate by 125 basis points.

- Drivers of Global Inflation: Decline in oil and food prices. E.g., inflation in oil remained in negative territory though out the year

- Moderation in key industrial metals like AL, Fe supported industrial disinflation, though copper prices surged later due to AI/data-centre demand and tight supplies.

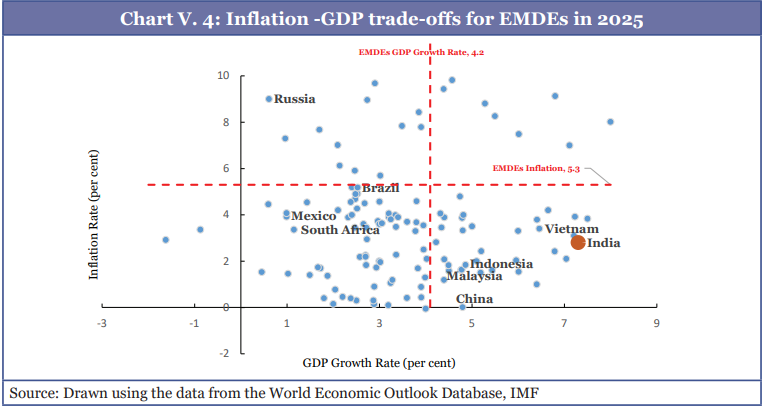

- Growth-Inflation Trade-off in EMDEs: Among major EMDEs (Emerging and Developing Economies), India recorded one of the sharpest declines in headline inflation alongside a robust GDP reflecting strong macroeconomic fundamentals without overheating.

- Global rating agencies (e.g., S&P) acknowledged the credibility and effectiveness of India's inflation management.

- Inflation stayed at the lower bound of the RBI's target range of 2-6 %.

Domestic Inflation

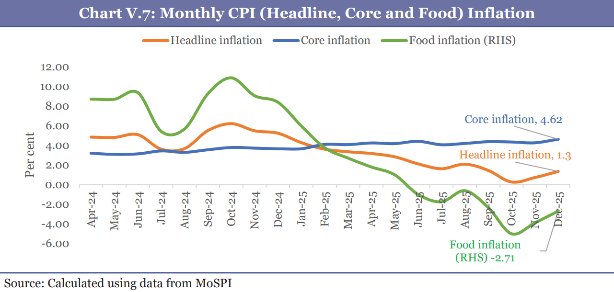

- Retail Inflation: Over the past 4 years, average retail inflation (Consumer Price Index (CPI)), has followed a downward trajectory falling to 1.7 % in 2025.

- Wholesale Price Index (WPI)-based inflation, has consistently been lower than CPI.

- Inflation was 0.3 % in October 2025—the lowest reading in the current CPI (2012=100) series.

- This disinflation was primarily food-led, supported by favourable weather and higher output.

- Core Inflation:

- It increased from 3.5 % in FY25 to about 4.3 % in FY26 mainly due to sharp increase in the prices of precious metals—gold and silver.

- When precious metals are excluded, core inflation shows a declining trajectory.

- The 4 major components of the core CPI basket- clothing and footwear, housing, health and transport and communication account for 1/3d of the CPI basket and more than 60 % of the core measure.

- Over the past 2 years inflation has been gradually easing in 3 of the 4 components, while fluctuating in the 4th (transport) but eased from mid-2025.

- Dominance of the base effect- Base effect exerted strong downward pressure on inflation in FY26, outweighing momentum effects in most months.

- It increased from 3.5 % in FY25 to about 4.3 % in FY26 mainly due to sharp increase in the prices of precious metals—gold and silver.

Drivers of Food Disinflation

- Overall Price decline in vegetables, pulses, cereals, horticulture commodities. E.g., Prices for potatoes, onions, tomatoes, and garlic contracted by 20 to 40 %.

- Pulses: After elevated prices in the previous years Inflation eased due to improved production.

- Protein rich foods such as egg, meat and fish saw rising prices in the later months even though Inflation in milk products, remained stable at 2.6%.

- Edible oils: Domestic prices, which are highly sensitive to global trends due to high import dependence (over 50 per cent), fell sharply.

- Key Interventions:

- Imposition of import duties e.g. on yellow peas, masoor, chana to support domestic production

- Buffer stocking, timely market releases, especially for TOP (Tomato, Onion, Potato) commodities and use of rail logistics enabled reduced price volatility esp. in pulses.

Agriculture creates a benign environment for inflation

- Favorable Climatic Conditions: Precipitation levels were supportive, with roughly 30 states and Union Territories recording normal or excess rainfall.

- Robust Production and Yields: Cereals production reached a record high of approximately 3,320 lakh tonnes in 2024–25. This was driven by strong yields across rice, wheat, and coarse cereals.

GDP Deflators: Manufacturing's Reversal In Terms Of Trade

- Sectoral Divergence: The agricultural GDP deflator grew faster than any other sector followed by services, industry and manufacturing.

- The manufacturing sector's terms of trade relative to agriculture have steadily declined over the past two decades, indicating faster growth in agricultural prices than in manufacturing prices.

- If the ratio of the manufacturing deflator to the agricultural deflator is greater than 1, manufacturing prices are higher relative to agricultural prices, implying better terms of trade for manufacturing.

- The manufacturing sector's terms of trade relative to agriculture have steadily declined over the past two decades, indicating faster growth in agricultural prices than in manufacturing prices.

- Drivers of the Divergence

- Agriculture (Inflationary Support): Agricultural prices have risen partly due to government support mechanisms, such as annual guaranteed price increases, which support higher deflator growth.

- Manufacturing (Deflationary Pressure): In contrast, the manufacturing sector operates in a globally competitive environment characterized by cost-cutting technologies and narrower margins, which limits price increases

- Economic Implications

- Resource Shift to Agriculture: The improved terms of trade for agriculture encourage a shift of resources back toward the farm sector. Evidence suggests that more land is being put to agricultural use and labor is returning to agriculture.

- Pressure on Manufacturing: Declining relative prices imply that manufacturers face tighter margins as input costs—particularly those derived from agriculture—rise relative to their output prices.

- Investment Risks: If prolonged, this squeeze on margins could deter investment in the manufacturing sector

- Resource Shift to Agriculture: The improved terms of trade for agriculture encourage a shift of resources back toward the farm sector. Evidence suggests that more land is being put to agricultural use and labor is returning to agriculture.

- Policy Need: The survey underscores the need for "Farm-to-Fork" policies that streamline supply chains, reduce intermediaries, and emphasize local sourcing to lower overall costs in the economy

Inflation: Regional Picture

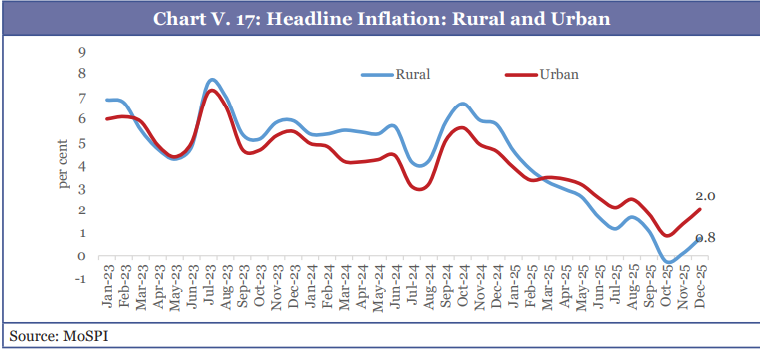

- Rural vs Urban - Rural inflation was higher IN 2023 and 2024 due to the larger weight of food in the consumption basket. However, as food prices eased in 2025, rural inflation fell below urban inflation.

- As food prices are more volatile, rural inflation across the states has shown greater relative volatility.

- Rural core inflation remains marginally higher than urban core inflation, but the gap is modest and stable.

- State-Level Dynamics: Most states followed national trend and saw reduction in inflation.

- Kerala and Lakshadweep were outliers where inflation breached the 6% upper limit.

- Drivers of State level inflation:

- State-level inflation rates show a significant positive association with wage rates, GSDP growth rate and COVID impact.

- However, it showed negative association with industrial output due to enhanced supply.

- Share of agricultural output did not have a strong impact at the local level as production structures may be oriented more to national and export markets rather than local markets

Outlook for Inflation

- RBI and IMF project a progressive increase in inflation but to stay within target ranges, supported by strong agricultural output and stable global commodity prices.

- Risks arising from currency volatility, geopolitical uncertainties, surges in base metal prices, and rising prices and demand for precious metals could exert upward pressure on prices.

Glossary

Term | Meaning |

CPI

| CPI track changes over time in the general retail prices of a basket of goods and services purchased by households for consumption |

WPI

| It is a measure of the average change of prices of a fixed set of goods at the first point of bulk sale in a commercial transaction in the domestic market over a given period of time |

Headline inflation | It refers to the change in value of all goods in the basket. |

Core inflation | It excludes food and fuel items from headline inflation. |

Disinflation

| Disinflation is a decrease in the rate of inflation unlike Deflation which is a sustained decrease in the price level of goods and services. |

Momentum effect | The momentum effect captures the month-on-month price changes in the current year, while the base effect reflects the influence of price movements in the corresponding months of the previous year on year-on-year inflation. |

GDP deflator | It is defined as the ratio of nominal GDP to real GDP.

|