Introduction

- The services sector contributes more than half of the Gross Value Added (GVA).

- India is the world's seventh-largest exporter of services, with its share in global services trade more than doubling from 2% in 2005 to 4.3% in 2024.

- The sector remains the largest recipient of Foreign Direct Investment (FDI) inflows.

- Services have also emerged as the most stable and resilient component of GDP.

- The sector has recorded average annual growth of around 7-8 % year after year.

Chapter precap

Global trends

| India in services

|

Sub-Sectoral Performance

| |

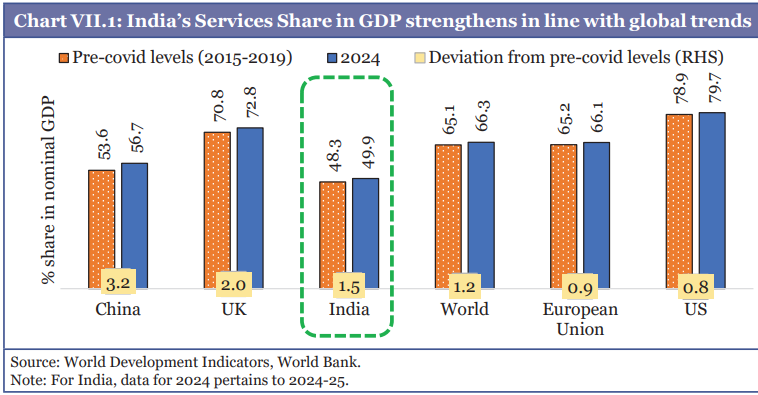

Global Services Trends and India's Experience

- Structural Rebalancing

- The COVID-19 pandemic severely disrupted contact-intensive services (e.g., tourism) while accelerated the expansion of high valued digitally delivered services (e.g., IT, finance).

- Services growth in the post-pandemic period has faced headwinds from slower global growth.

- India, by contrast, has remained relatively resilient, with services growth in 2024 staying close to its pre-pandemic levels.

- Shifts in Trade and Capital Flows

- India recorded a relatively stronger expansion in services trade as a share of GDP, compared to several advanced economies.

- Services accounted for an average 53.5 % of global FDI during 2022-2024.

- In India, Services-sector FDI inflows accounted for an average of 80.2 % of total FDI during FY23-FY25, up from 77.7 % in the pre-pandemic period.

- Information and communication services (25.8 %) received highest FDI followed by professional services, Finance and insurance, energy and gas and trading.

State-level and Sector-level dynamics (NITI Aayog Findings)

|

Can the export of services help improve state capacity?

|

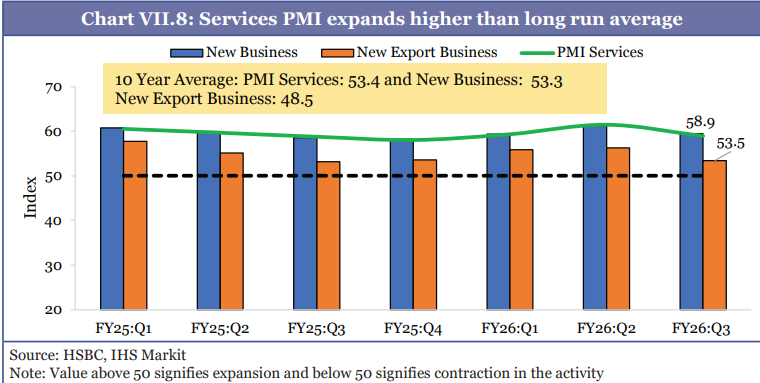

Recent Trends In India's Service Sector Performance

Services Exports

- Average growth in services exports has more than doubled from 7.6 % in the pre-pandemic period (FY16-FY20) to 14.0 % during FY23-FY25.

- Software services account for over 40 % of total services exports.

- Professional and management consulting services have emerged as the second-largest contributor.

Trade agreements for Promoting Services

- India has increasingly leveraged free trade agreements, comprehensive economic partnerships, and bilateral engagements to enhance market access and competitiveness.

- E.g., Under India-UK CETA Concluded (Jul 2025), the UK has granted comprehensive market access across 137 services sub-sectors, reducing barriers and easing cross border mobility.

Servicification of manufacturing

- Services are increasingly integrated into manufacturing through activities such as design, R&D, logistics, software development, etc.

- Domestic services value added accounted for about 17.7 % of India's manufacturing export value in 2020.

Sub-Sectoral Performance and Drivers

Tourism Sector

- In FY24, travel and tourism contributed 5.22 % to GDP while supporting an estimated 8.46 crore direct and indirect jobs, or about 13.3 % of total employment in the overall economy.

- Domestic tourism remained the backbone of the sector.

- International Tourist Arrivals (ITAs), including foreign tourist arrivals (FTAs) and arrivals of non-resident Indians (NRIs), rose to 20.57 million, marking an increase of 8.9 % over 2023.

- Medical tourism's share in foreign tourist arrivals rose from about 2.2 % in 2009 to around 6.5 % in 2024.

- Skilled medical professionals and established healthcare infrastructure, medical and wellness tourism have emerged as a key comparative advantage for India.

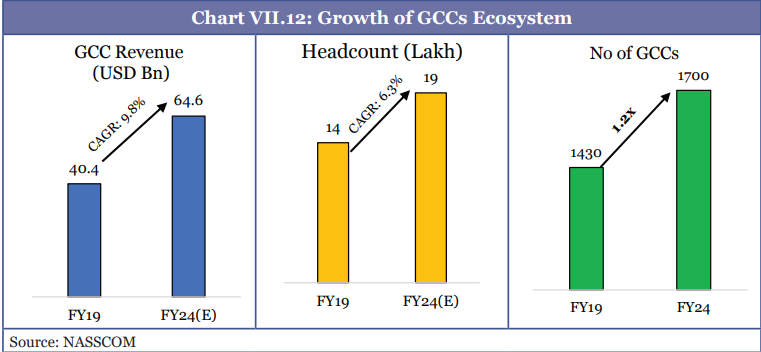

Information Technology and IT-Enabled Services

- The expansion of Global Capability Centers (GCCs) into Tier 2 and Tier 3 cities has supported more geographically dispersed employment and strengthened linkages with local innovation and startup ecosystems.

- India's data centre capacity is projected to reach about 8 GW by 2030

- Despite generating nearly 20 % of the world's data, India hosts only about 3 % of global data centres.

- Deep Tech companies experienced a 78 % rise in funding in CY2024.

- Technology startup ecosystem (the world's third largest) comprises about 32,000-35,000 startups.

- Cybersecurity market is estimated at about USD 6.0 billion in 2023, growing at about 30 %.

- India is placed among the world's most cyber-resilient countries (as per the International Telecommunication Union's Global Cybersecurity Index).

Artificial Intelligence (AI) and India's Services Exports

|

- India has improved its ranking in UNCTAD's Frontier Technology Readiness Index, from 48th in 2022 to 36th in 2024 among 170 economies.

- Weaker outcomes in ICT penetration and skills are key constraints in the wider diffusion of frontier technologies across firms and regions.

Transport Services

- Directly contribute around 4.5 % to GVA.

- Ports:

- Cargo handled at Indian ports increased from about 1052 million tonnes in FY15 to around 1603 million tonnes in FY25.

- The average turnaround time of container vessels at major ports declined from approximately 43 hours in FY15 to nearly 30 hours in FY25.

- Aviation Services

- In FY25, overall air passenger traffic increased by 9.4 %, reaching 411.8 million passengers.

- Railway freight services

- Operational efficiency has also improved, with average daily freight loading rising from 4.2 million tonnes in 2024 to about 4.4 million tonnes in 2025.

- Rail freight services offer a 50 % cost-effective cargo route compared to road transport.

Telecommunication

- Contribute directly to about 1.2 % of GVA.

- Total telephone connections rose from about 933 million in 2014 to over 1.2 billion by November 2025.

- Tele-density increased from 75 % to 86.8 %.

- Internet subscriptions expanded from about 25 crore to 101.8 crore by September 2025.

- India has developed end-to-end indigenous 4G and 5G (NSA) core network technologies.

Commercialising Space and Ocean Services

- Space sector is valued at about USD 8.4 billion (around 2 % of the global space market), it is projected to expand to USD 44 billion over the next decade.

- Commercial launches have been a key export source, with India launching 393 foreign satellites for 34 countries between 2015 and 2024.

Media and entertainment services

- Sector's size is around ₹2.5 trillion in 2024.

- Digital media emerged as the primary growth engine, contributing approximately one-third of the sector's total revenues.

- Broadcasting and advertising have shifted decisively from linear TV to OTT and mobile platforms

- The concert economy (part of Orange Economy) is in nascent stage but scaling in India, supported by a young population, rising incomes, digital ticketing platforms etc.

Real estate and housing services

- The 'real estate and ownership of dwellings' sector has contributed about 7 % to GVA.

Conclusion and Way Forward

- The expansion of digitally delivered, knowledge-intensive and experience-based services has strengthened India's underlying comparative advantages.

- key areas for improvement

- For IT and IT-enabled services, timely reskilling, the wider diffusion of digital technologies, and the creation of a supportive policy environment for innovation and scaling. Policy supports include

- Recognition of data centres and cloud service providers as a distinct category, rather than classifying them as "commercial buildings" under the National Building Code, 2016.

- Releasing more anonymised public data to leverage scalable cloud-based Digital Public Infrastructure while maintaining robust security standards.

- Tourism requires the creation of niche segments, such as long-distance hiking trails, and a national marina development policy to unlock the blue economy.

- For IT and IT-enabled services, timely reskilling, the wider diffusion of digital technologies, and the creation of a supportive policy environment for innovation and scaling. Policy supports include

- Singapore's model offers valuable lessons for India.

- Since the early 2000s, Singapore has implemented successive multi-year Research, Innovation and Enterprise (RIE) plans to align public R&D investment, industry participation and talent development with evolving economic priorities.

What does the budget say?

- Care Economy: Training of 1.5 lakh caregivers in the coming year, aligned with the National Skills Qualifications Framework (NSQF).

- Tourism Promotion:

- Medical Value Tourism: Support for states to set up five Regional Medical Hubs.

- Skilling: Establishment of a National Institute of Hospitality and upskilling of 10,000 tourist guides across 20 iconic sites.

- Digital Infrastructure: Creation of a National Destination Digital Knowledge Grid.

- Niche Tourism: Development of ecologically sustainable trails—Mountain, Turtle, and Bird-watching trails.

- Heritage Tourism: 15 archaeological sites to be developed as experiential destinations using immersive technologies.

- Orange Economy (AVGC):

- Focus on Animation, VFX, Gaming, and Comics, projected to need 2 million professionals by 2030.

- AVGC Content Creator Labs in 15,000 schools and 500 colleges.

- Establishment of a new National Institute of Design in eastern India.

- IT & Digital Services Support:

- Software and KPO services grouped under "Information Technology Services" with a 15.5% safe harbour margin.

- Safe harbour threshold raised from ₹300 crore to ₹2,000 crore.

- Data Centres: Tax holiday till 2047 for foreign cloud service providers using data centres in India.

Glossary

Purchasing Managers' Index (PMI) | A number between 0 and 100 indicating the overall health of an economy.

|

Global Capability Centers (GCCs) | They are fully owned and integrated hubs typically established in talent-rich locations to build significant value and intellectual property (IP) using collaborative, distributed teams. |

Orange Economy | Refers to the part of the economy driven by creativity, culture, and intellectual property, comprising activities where value comes primarily from ideas, knowledge, artistic expression, and cultural content, rather than from physical goods. |

Deep Tech | Startups or companies based on substantial scientific advances and high-tech engineering innovation (e.g., AI, biotech, quantum computing). They usually require long R&D periods and large capital investments. |

Tele-density | The number of telephone connections for every 100 individual. |