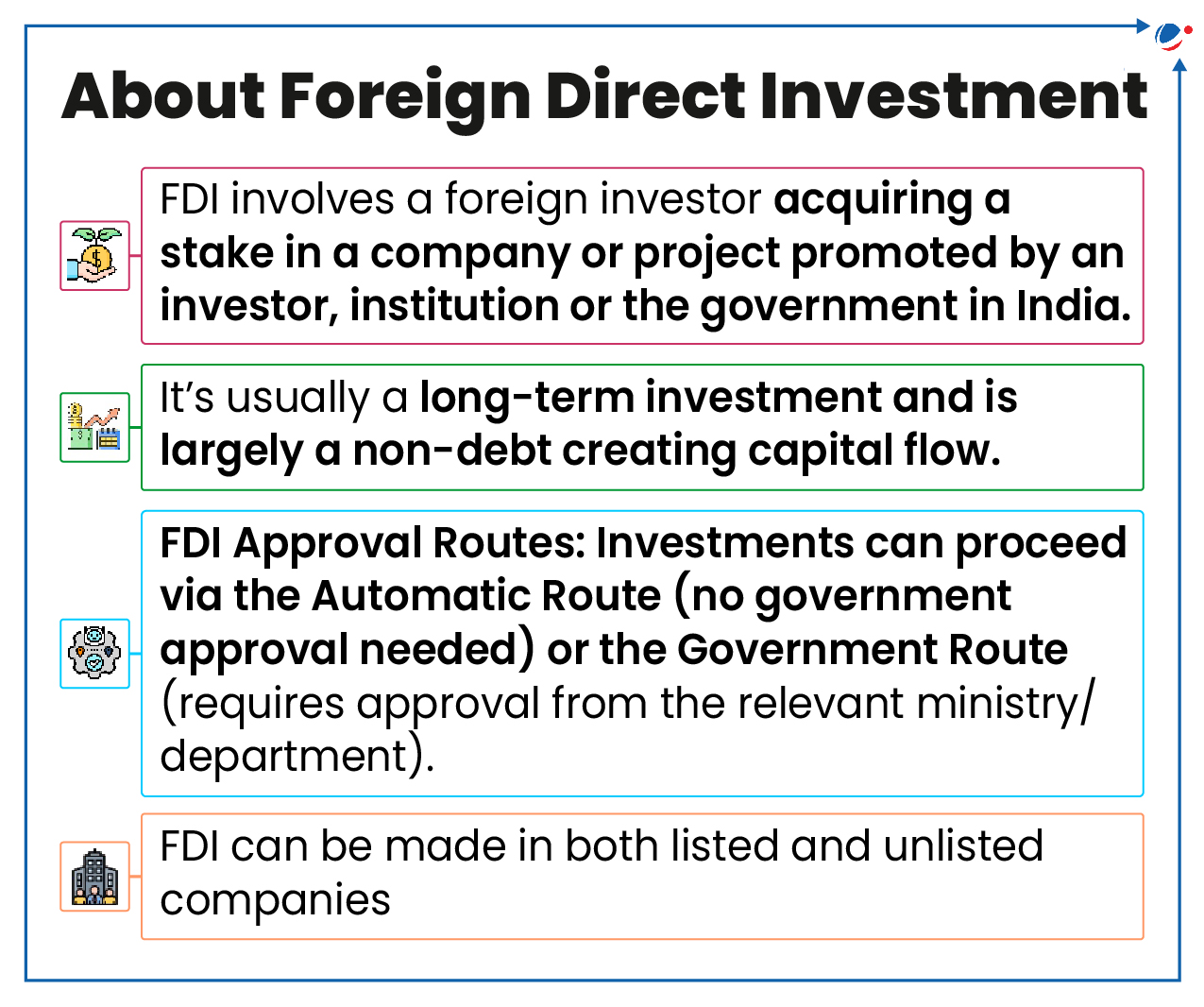

Under current regulations, foreign portfolio investment (FPIs) can hold a maximum of 10% of an Indian company’s total paid-up equity capital (amount of money that a company receives from shareholders in exchange for shares).

- Exceeding this 10% cap (prescribed limit of FPI) had previously left FPIs with two choices: Divesting (selling off) the surplus shares or reclassifying them as Foreign Direct Investment (FDI).

- In case the FPI intends to reclassify its FPI into FDI, the FPI shall follow the operational framework as given below.

RBI’S New Operational Framework on reclassification of FPI to FDI

- The facility of reclassification shall not be permitted in sectors prohibited for FDI. E.g., Chit funds, gambling, etc.

- FPI investments require government approvals, especially from land-bordering countries, and need Indian investee company's concurrence.

- Also, investment should be in adherence to entry route, sectoral caps, investment limits, pricing guidelines, and other attendant conditions for FDI under the rules.

- FPI reclassification will be guided by Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019.

Significance: Becomes easier to attract more foreign investment; Offer greater flexibility to FPI to transit to a more strategic investment, enhance clarity and transparency for foreign investors in the Indian market.

Reserve Bank of India (RBI) released 2024 list of Domestic Systemically Important Banks (D-SIBs)

- State Bank of India, HDFC Bank and ICICI Bank continue to be identified as D-SIBs in the RBI’s 2024 list.

About D-SIBs

- D-SIBs are systemically important due to their size, cross-jurisdictional activities, complexity and lack of substitute and interconnection.

- It also means that the bank is too big to fail.

- If DSBs fail, there would be significant disruption to the essential services of the banking system and the overall economy.

Declaration of D-SIBs

- Based on the D-SIBs Framework of RBI (2014).

- Framework is based on Basel Committee on Banking Supervision’s (BCBS’s) framework.

- Banks having size as a percentage of GDP equal to or more than 2% are considered for D-SIB list.

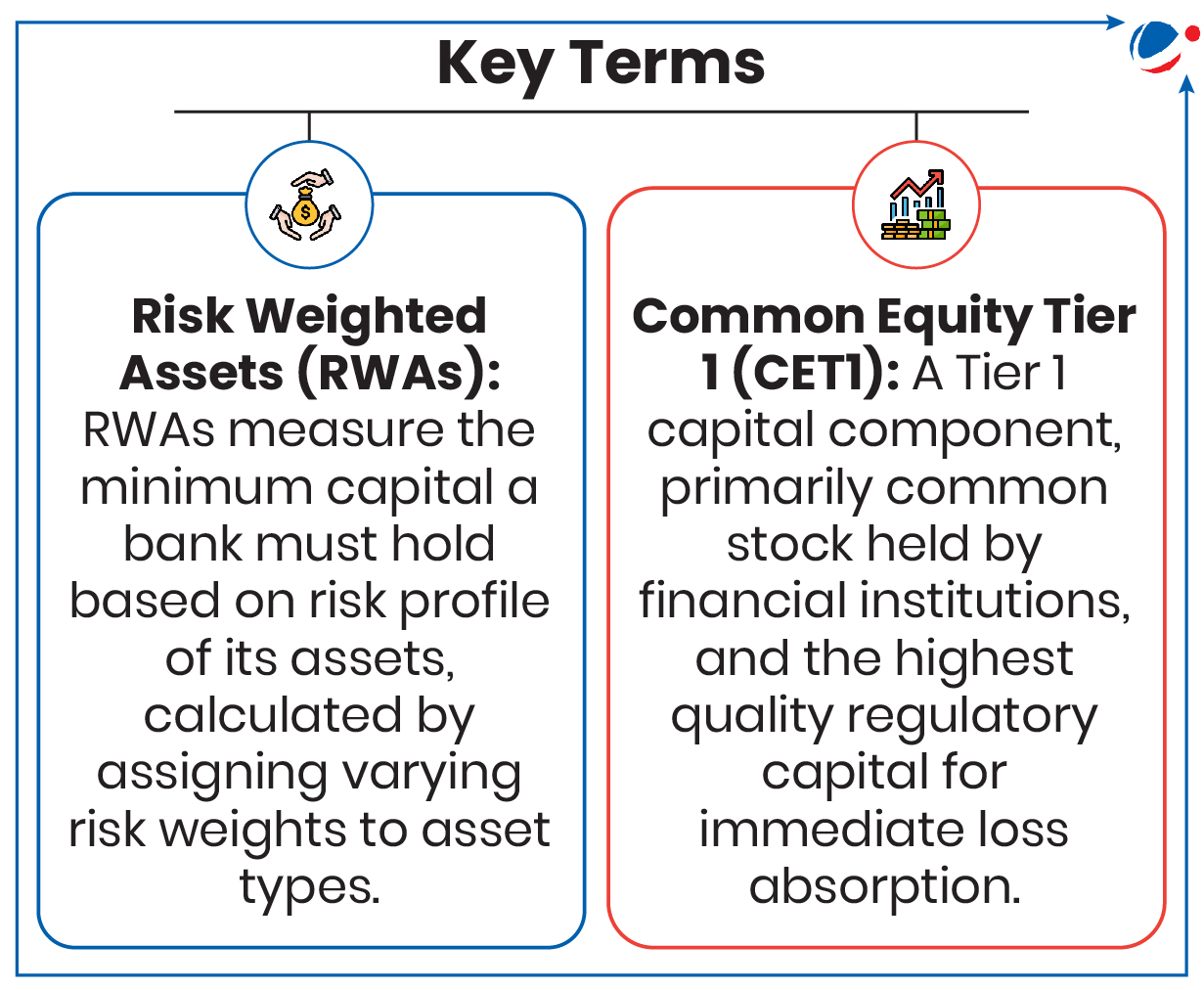

- Banks are placed in 5 buckets on the basis of Additional Common Equity Tier 1 (CET1) requirement as a percentage of Risk Weighted Assets (RWAs).

- Bucket 1 banks have to maintain lowest CET1 and Bucket 5 banks have to maintain highest.

- In case a foreign bank having branch presence in India is a Global Systemically Important Bank (G-SIB), it has to maintain additional CET1 capital surcharge.

- Financial Stability Board (FSB) releases the list of G-SIBs.

Union Cabinet recently approved establishment of Rs.1,000 crore Venture Capital Fund for Space Sector under aegis of Indian National Space Promotion and Authorisation Centre (IN-SPACe).

- A Venture Capital (VC) Fund is a specialized form of private equity financing that invests in early-stage startups with high growth potential.

- IN-SPACe is a single-window, independent, nodal agency that functions as an autonomous agency in the Department of Space (DOS).

- It acts as an interface between ISRO and Non-Governmental Entities (NGEs) to facilitate private sector participation.

- It authorizes and supervises various space activities like building launch vehicles & satellites, sharing space infrastructure etc.

About VC Fund for Space sector

- The proposed fund will support startups across the entire space supply chain-upstream, midstream, and downstream.

- Financial structure: It will operate over five years, deploying ‚Rs 150-250 crore annually.

- Investment per startup: Range from Rs 10-60 crore.

- Target: Support approximately 40 startups

- The Funds aims to strategically position India as one of the leading space economies by

- Capital infusion: To create a multiplier effect by attracting additional funding for later-stage development of the Start-up

- Accelerate private space industry’s growth: To meet the goal of a five-fold expansion of the Indian space economy in next 10 years.

- Drive advancements: In space technology and strengthening India’s leadership through private sector participation.

- Benefits:

- Retention of space companies domiciled within India

- Generating jobs in engineering, software development, data analysis, manufacturing, etc

- Creating a vibrant innovation ecosystem and boost global competitiveness.

- India’s Space sector: India (ranks 5th) constitutes 2-3% of the global space economy. It’s currently valued at $8.4 billion, with a target to reach $44 billion by 2033).

Article Sources

1 sourceScheme for Strengthening the Medical Device Industry launched by the Ministry of Chemicals and Fertilizers.

- It is a comprehensive scheme which targets critical areas of the medical device industry and is expected to make India self-reliant in the sector

- India’s medical device market is valued at approximately $14 billion and is expected to grow to $30 billion by 2030.

Features of the Scheme

- Total Outlay: 500 crore

- Components: It consists of five sub-schemes namely:

- Common Facilities for Medical Devices Clusters: aims to enhance infrastructure by creating shared facilities, including R&D labs, design and testing centers, and animal labs etc.

- Marginal Investment Scheme for Reducing Import Dependence: aims at localized production of key components, raw materials etc.

- Capacity Building and Skill Development for Medical Devices: Offers financial support for running various courses to develop skilled technical workforce.

- Medical Device Clinical Studies Support Scheme: Provide financial aid for animal studies, human trials, and clinical performance evaluations.

- Medical Device Promotion Scheme: Supports industry associations and export councils for organizing conferences, conducting studies and surveys.

- Challenges faced by the Medical device Industry: lack of infrastructures like R&D labs, design and testing center; high import dependence for high-end devices, low capital investment, inverted duty structure.

Article Sources

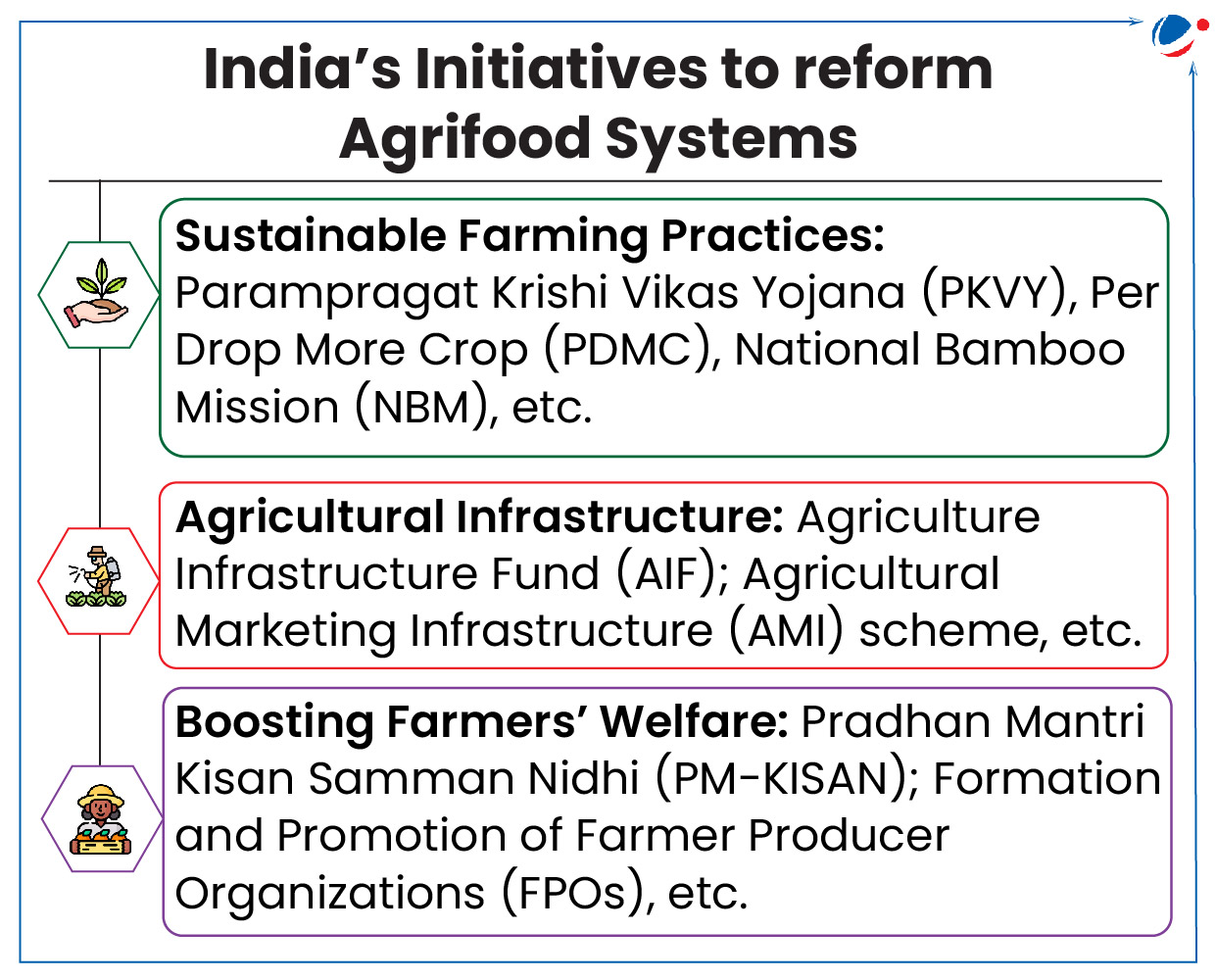

1 sourceReport emphasizes on value-driven transformation of agrifood systems and builds on the estimates of the previous edition on global hidden costs of agrifood systems (journey of food from farm to table).

- Hidden cost refers to external costs (i.e., negative externalities) or economic losses triggered by other market or policy failures.

Key findings of the report

- Hidden Costs: Industrial and diversifying agrifood systems contribute maximum to global quantified hidden costs (around 5.9 trillion 2020 PPP dollars), dominated by health hidden costs linked to non-communicable diseases.

- Unhealthy dietary patterns (like low intake of whole grains, high intake of sodium, etc.) account for 70% of all quantified hidden costs.

- Other contributing factors include: Social costs (due to undernourishment and poverty); environmental costs (emission of greenhouse gases, etc.).

- India-related findings: India’s total hidden costs stands around $1.3 trillion annually (3rd largest after China and the USA), largely driven by unhealthy dietary patterns.

Major Recommendations on transforming the Agrifood value chains

- In industrial agrifood systems (Long value-chains with high urbanization): Upgrade food-based dietary guidelines to an agrifood systems approach, mandatory nutrient labels and certifications, and information campaigns, etc.

- In traditional agrifood systems (Short value-chains with low urbanization): Complement conventional productivity-enhancing interventions with environmental and dietary levers to avoid the increase in environmental footprint.

The Union Minister of Fisheries, Animal Husbandry and Dairying launched 21st Livestock Census to have updated data on livestock population, allowing government to address key issues like disease control, breed improvement, and rural livelihoods

About 21st Livestock Census

- Schedule: To be conducted during October 2024- February, 2025.

- Key Features:

- Fully digitized (similar to 20th census);

- Data on 16 species of livestocks and their 219 indigenous breeds are going to be captured

- Covers data on pastoralists for the first time.

- Focus on Gender Roles in Livestock Rearing.

- Livestock census has been conducted every five years since 1919 (last being in 2019).

Indian Council of Agricultural Research-National Research Centre on Equines (ICAR-NRC Equine) in Haryana has been granted WOAH Reference Laboratory status.

- This recognition is specifically for its expertise in Equine Piroplasmosis disease.

- Equine Piroplasmosisis caused by tick-borne protozoan parasites, affects horses, donkeys, mules, and zebras.

About WOAH

- An intergovernmental organization founded in 1924.

- Objective: Disseminating information on animal diseases and improving animal health globally.

- Members: 183 including India.

- HQ: Paris, France

Article Sources

1 sourceIndian Scientists have developed a nanomaterial coating (made of nanoclay) for muriate of potash (MoP).

- MoP serves 80% of potassium fertilizer needs.

About Nano Fertilizers

- Nano fertilizers are nutrients that are encapsulated or coated within nanomaterial (measuring 100 nanometres or less).

- It enables controlled release and its subsequent slow diffusion into the soil.

- Benefits:

- Promotes sustainable farming: Reduces soil and water contamination.

- Cost Effectiveness: Improves nutrient absorption, reduce nutrient wastage and lower application frequency, etc.

Article Sources

1 sourceBihar’s first dry port also known as inland container depot (ICD) inaugurated in Bihta near Patna.

- Dry Ports provides a logistics facility away from a seaport or airport for cargo handling, storage, and transportation.

Significance of Bihta Dry Port

- Exports: It will boost exports, mainly agro-based, garments and leather products from Bihar.

- Improved Logistics: It will streamline cargo handling and transportation, lowering transportation costs, and securing storage and handling.

- Benefits to adjoining states: Catering to entire eastern India.

- It is connected by rail to major gateway ports of Kolkata, Haldia, Visakhapatnam, Nhava Sheva, & major national and international trade routes.

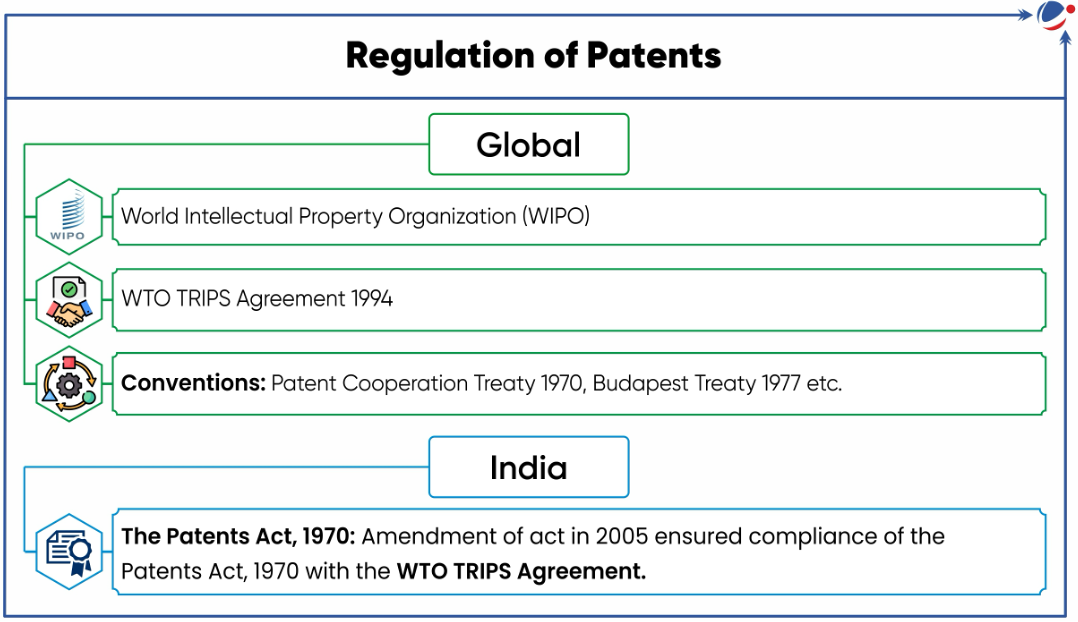

World Intellectual Property Indicators 2024 report released by the World Intellectual Property Organization (WIPO).

- According to report, India experienced significant growth in intellectual property filings, with patents filings doubling between 2018 and 2023.

Other Key Findings related to India:

- Patents: India is ranked 6th globally with 64,500 Patent Filings and country’s Patent-to-GDP ratio surged to 381 from 144 (2013 to 2023).

- Trademarks: India’s IP office hold the second highest of active registrations globally and now India ranks 4th globally in trademark filings.

- Industrial Design Filing: Ranked 10th globally with a 36% increase in 2023, showing significant growth in creative design.

Factors behind Surge in Patent filing:

- Government Initiatives and Policy Support: E. g. Patents (Amendment) Rules, 2024 (reduced renewal fee and filing frequency time) simplified patent process, National IPR Policy, 2016 etc.

- Timely clearance of applications: India granted 1.03 lakh patents in financial year 2023-24.

- Strengthened IP Infrastructure: Digitization of patent filing processes, establishment of IPR facilitation centers etc.

Challenges/Issues related to Patents in India:

- Abolition of Intellectual Property Appellate Board: Leading to creation of a void in handling appeals in IP cases.

- Evergreening of Patents: To extend patent period, guaranteeing monopoly over drugs.

- Other Issues: Compulsory licensing, lack of fixed timelines for each step in procedure etc.

Article Sources

1 sourceThe Cabinet Committee on Economic Affairs (CCEA) approved PAN 2.0 Project of the Income Tax (IT) Department.

About PAN 2.0 Project

- An e-Governance initiative for re-engineering the business processes of taxpayer registration services through technology driven transformation.

- It will be an upgrade of the current PAN/TAN 1.0 eco-system

- PAN is a ten-digit unique alphanumeric number issued by the IT Department to identify/ link transactions (tax payments, etc.) of the holder with the department.

- Issuing Agencies:Protean (formerly known as NSDL e-governance) and UTI Infrastructure Technology and Services Ltd (UTIITSL).

- Benefits: Serve as common Identifier for all digital systems of specified government agencies, Data consistency, Single Source of Truth, etc.

Article Sources

1 sourceCentral Electricity Authority approves the Uniform Protection Protocol for users of Indian Grid for implementation on Pan India basis.

About Uniform Protection Protocol

- Aim: To ensure Grid stability, reliability, security and support India’s vision for integration of 450 GW Renewable Energy into the National Grid by 2030.

- It addresses the protection requirements for thermal and hydro generating units etc.

- It will ensure proper co-ordination of protection system in order to protect the equipment/system from abnormal operating conditions, isolate the faulty equipment and avoid unintended operation of protection system.