Why in the News

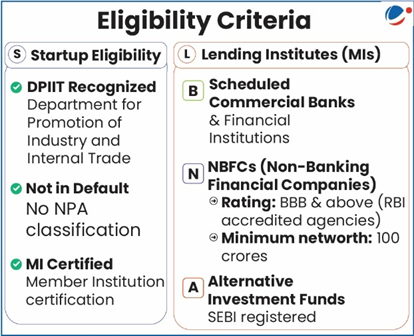

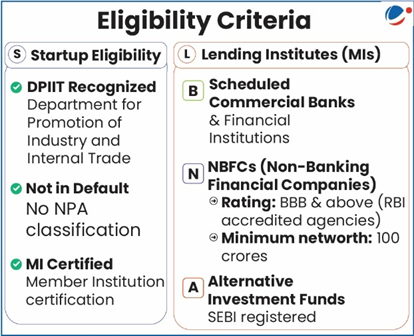

The Department for Promotion of Industry and Internal Trade (DPIIT), notified the expansion of the Credit Guarantee Scheme for Startups (CGSS) to increase capital mobilization for startups.

Objectives | Key Features |

|

|

Periodically curated articles and updates on national and international developments relevant for UPSC Civil Services Examination.

High-quality MCQs and Mains Answer Writing to sharpen skills and reinforce learning every day.

Watch explainer and thematic concept-building videos under initiatives like Deep Dive, Master Classes, etc., on important UPSC topics.

A searchable repository of past resources — News Today, Monthly Magazine, PT 365, Mains 365, etc. — for easy revision.

A comprehensive overview of all our flagship, foundation, and advanced courses for UPSC preparation.

A short, intensive, and exam-focused programme, insights from the Economic Survey, Union Budget, and UPSC current affairs.

Need help? 8468022022

The Department for Promotion of Industry and Internal Trade (DPIIT), notified the expansion of the Credit Guarantee Scheme for Startups (CGSS) to increase capital mobilization for startups.

Objectives | Key Features |

|

|

Discover more articles, videos, and terms related to this topic

Loading video...

Please select a subject.

linked

No references added yet

Please login to continue using this feature.

Login to your account for a personalized experience.