Why in the news?

The sluggish growth of private Gross Fixed Capital Formation (GFCF) as a percentage of Gross Domestic Product (GDP) at current prices has been a significant challenge for the Indian economy.

More about the news

Evolution of GFCF (also called Investment):

- From independence to economic liberalisation, investment largely remained either slightly below or above 10% of the GDP.

- It rose from around 10% of GDP in the 1980s to around 27% in 2007-08.

- From 2011-12 onwards, however, private investment began to drop and hit a low of 19.6% of the GDP in 2020-21.

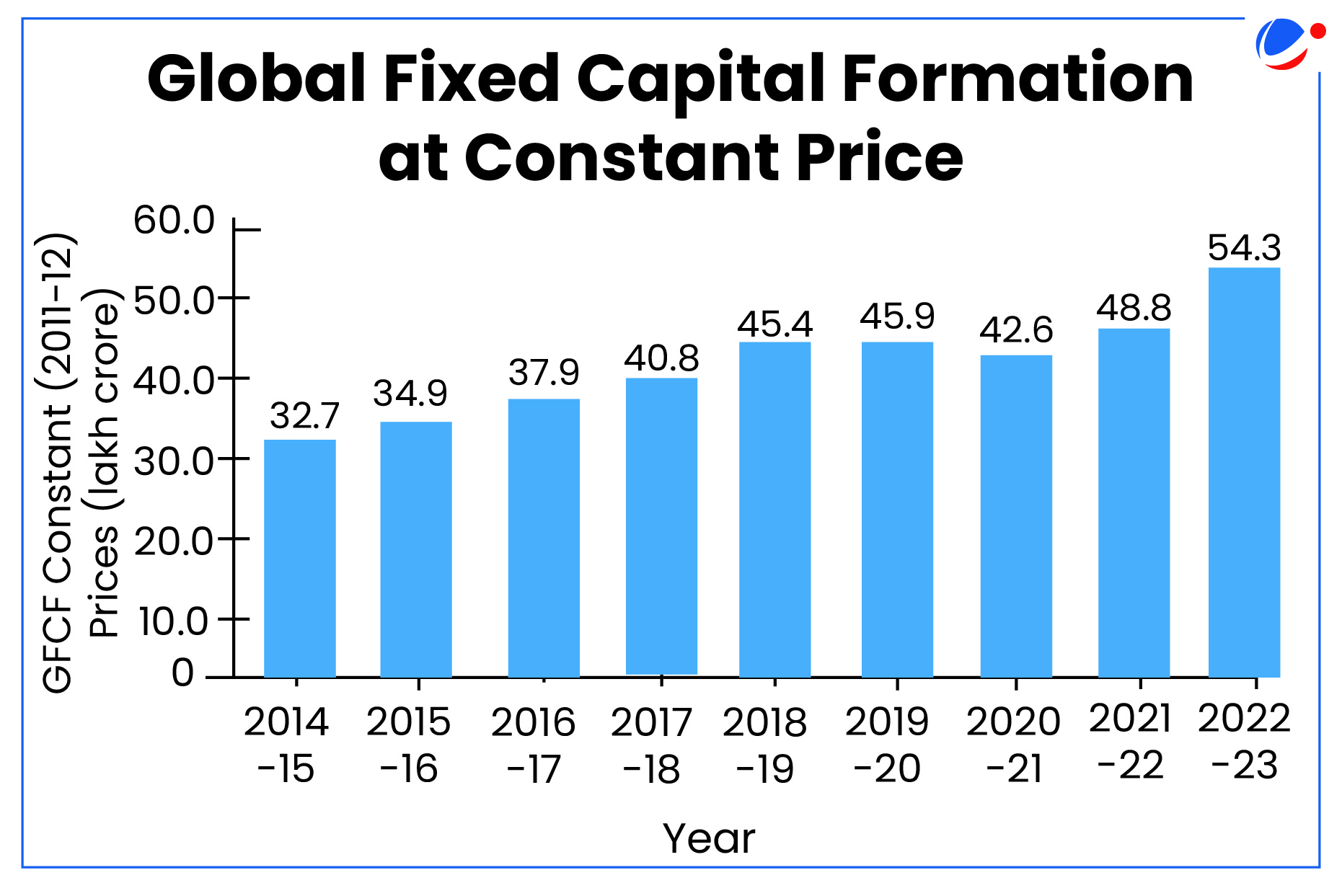

- In absolute terms, GFCF in the Indian economy increased from Rs. 32.78 lakh crore (constant 2011-12 prices) in 2014-15 to Rs. 54.35 lakh crore in 2022-23 (Provisional Estimates).

Reasons for fall in Private GFCF:

- Historically, in India, higher consumption has led to lower private investment.

- Unfavourable government policy and policy uncertainty act as major issues affecting private investment. E.g., disputes associated with tax laws.

- The drop in private investment is due to the slowdown in the pace of reforms in the last two decades.

What are Capital Formation (CF) and Gross Fixed Capital Formation (GFCF)?

- Capital formation: It refers to the process by which resources are invested in assets like plants, equipment, machinery, etc. as well as in human capital through education, health, skill development, etc.

- Gross Capital Formation (GCF): It refers to the growth in the size of fixed capital in an economy. It includes

- Gross Fixed Capital Formation (GFCF): Like land improvements; plant, machinery, and equipment purchases; and the construction of roads, etc.

- Change in stock (CIS) of raw materials, semi-finished and finished goods: Stocks of goods held by firms to meet temporary fluctuations in production or sales.

- Net acquisition of valuables: like gold, gems, ornaments and precious stones etc.

- Net capital formation (NCF) is distinguished from GCF in that NCF includes depreciation, obsolescence and accidental damage to fixed capital.

GFCF includes | GFCF does not include |

|

|

Why GFCF is an important economic variable?

- Growth Multiplier: GFCF and GDP are positively correlated and indicate that an increase in GFCF invariably leads to an increase in GDP.

- Boosts productivity and living standards: GFCF helps workers produce a greater amount of goods and services each year, helps boost output and improves living standards.

- Promotes Self-sufficiency: Growth in GFCF enables the creation of capital assets, thus improving self-sufficiency in production as well as research in the longer term.

- Indicator of Market Confidence: GFCF is considered a meaningful indicator of future business activity, business confidence and future economic growth patterns.

- For example, Private GFCF can serve as a rough indicator of how much the private sector in an economy is willing to invest.

- Reflects overall output: GFCF as an indicator helps to determine the overall output of an economy and hence what consumers can actually purchase in the market.

What is hindering the growth of GFCF?

- Slow pace of reforms especially land acquisition has deterred investors from investing in the economy.

- Financial problems of Indian banks and many large corporations. This indirectly locks the capital available in the market which cannot be reinvested in new projects.

- High cost of borrowing slows down the cycle of lending and borrowing, thus deterring effective channelling of investment.

- High cost of borrowing stems from higher lending rates, which in turn is affected by high inflation.

Conclusion

For India to realise its dream of a $ 5 trillion economy, investment will have to play a major role. To ensure a seamless development of capital formation, economic reforms accompanied by stability in other macroeconomic variables (such as inflation) should be the way forward.