Why in the news?

Recently, the Chief Ministers of Bihar and Andhra Pradesh had demanded special financial packages for their respective States.

More about News

- Special Packages for both states Bihar and Andhra Pradesh were announced in Union Budget 2024-25.

- Announcements made:

- Irrigation and Flood Mitigation: Financial support of Rs. 11,500 crore to projects such as the Kosi-Mechi intra-state link and other schemes in Bihar.

- Purvodaya: Vikas bhi Virasat bhi: Plan for endowment rich states in the Eastern parts covering Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh for generation of economic opportunities to attain Viksit Bharat.

- Update on Andhra Pradesh Reorganization Act 2014:

- Financial support of ₹15,000 crores will be arranged in FY 24- 25.

- Completion of Polavaram Irrigation Project ensuring food security of the nation.

- Essential infrastructure such as water, power, railways and roads in Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor and Orvakal node on Hyderabad-Bengaluru Industrial Corridor.

About Special Packages to States

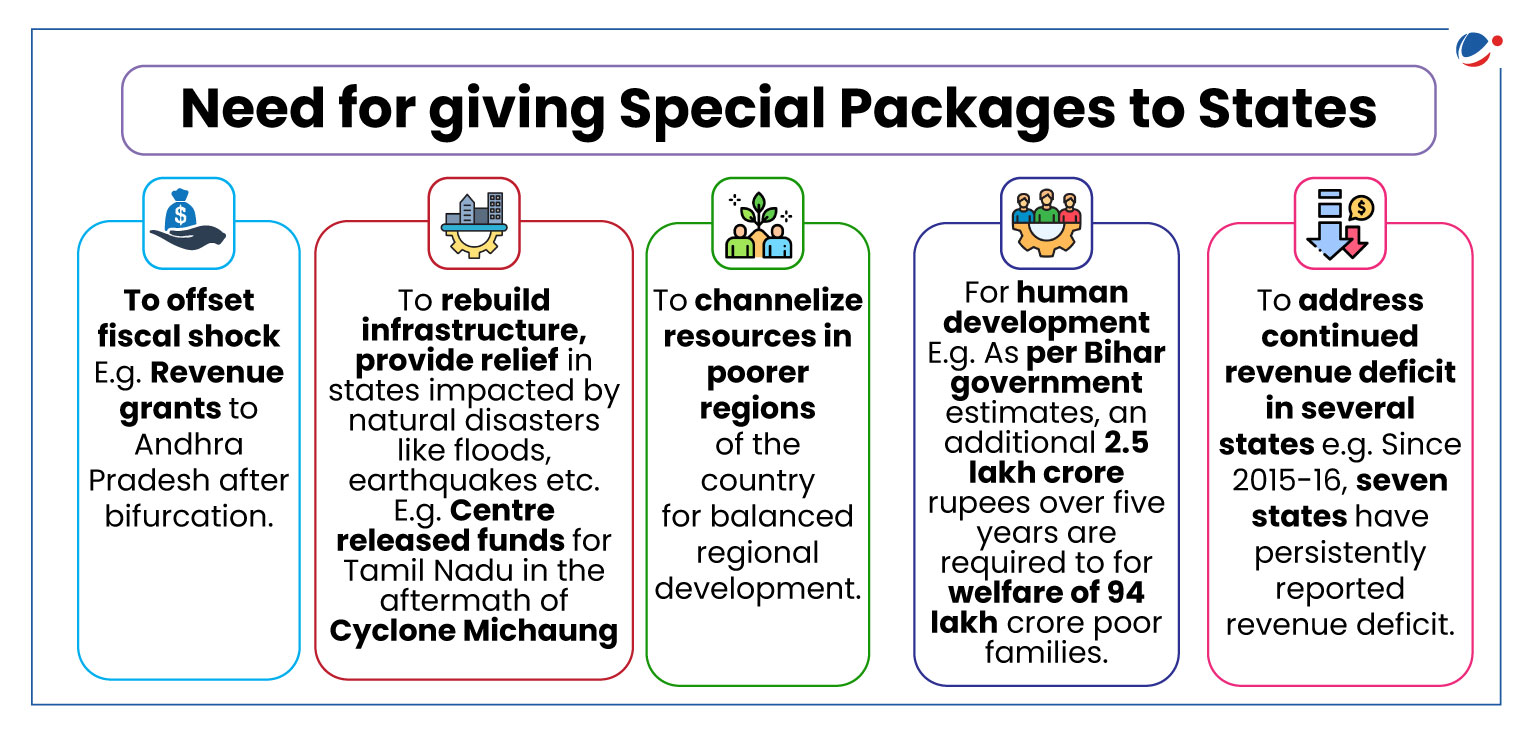

- Special Packages refers to support provided to states facing geographical and socio-economic challenges, offering them additional financial assistance and other benefits.

- Constitution has provisions that address the issues of specific States, or States that have a special status with regard to certain matters mentioned in the Constitution.

- For instance, in Articles 371A to H.

- On the contrary, special packages are purely discretionary. They may be need-based, but the need is not the proximate reason for granting a special package.

- It is an additional grant under Article 282, which falls under 'Miscellaneous Financial Provisions'.

- Article 282 (Discretionary Grants): Empowers both Centre and states to make any grants for any public purpose, even if it is not within their respective legislative competence.

Implications of giving Special Packages to States

- Fiscal prudence: Providing special packages would potentially increase fiscal burden on the Centre and also on other States.

- Governance issues: Effective utilization of special packages depends on state's administrative capacity. However, poor governance can lead to mismanagement, under-utilization and leakages of funds, undermining the utility of granting additional resources.

- Dependency: Short-term gains from special packages may discourage structural reforms to ensure long-term self-reliant growth, and may lead states to become dependent on central assistance.

- Federal issues: Unequal or politically motivated distribution of special packages can strain relationship between central and state governments.

- Social Unrest: Perception of uneven or unfair distribution of benefits might lead to social unrest and dissatisfaction among the different communities in the state.

- Further, states not receiving special packages might feel neglected leading to inter-state and centre-state conflicts.

Way ahead

- Framework: Develop clear, objective framework for allocation of special packages based on measurable criteria like poverty levels, infrastructure deficits, disaster impact etc. and to reduce influence of political lobbying.

- Customized development plans: Create customized initiatives to meet each state's specific needs, focusing on areas like infrastructure and employment.

- Public-Private Partnerships: Engaging private sector to mobilise additional funding, expertise and to reduce fiscal burden on centre.

- Monitoring: Implement strict monitoring and evaluation mechanisms, enhance state's administrative efficacy to plug leakages, address misuse of funds and ensure efficient utilisation of state's revenue and central grants.

- Decentralization: By providing greater fiscal autonomy, decision-making authority, and prioritizing spending as per local needs, it can reduce demand for special packages.

- E.g. 14th Finance Commission recommended that Centre should intervene in schemes where there are large externalities or national priorities involved.