Why in the news?

Recently, some states have moved the Supreme Court against the Centre for disputes over sharing of financial resources by the Central Government.

More on News

- Tamil Nadu, Kerala and Karnataka government moved the Supreme Court against the Centre for delay in release of disaster relief fund, imposition of net borrowing ceiling limit, and drought relief respectively.

Fiscal Federalism

- Fiscal federalism refers to how federal, state, and local governments share funding and administrative responsibilities within India's federal system.

- Fiscal federalism is often associated with three broad principles:

- Fiscal Equivalency: It requires a separate jurisdiction for each public service which should include the set of individuals that consume it.

- Decentralization theorem: Each public service should be provided by the jurisdiction having control over the minimum geographic area that would internalise the benefits and costs of such provision.

- Principle of Subsidiarity: Functions should be performed at the low level of government, implying hierarchy.

Constitutional Provisions defining India's Fiscal Federalism Arrangement

- Seventh Schedule: Constitution delineates tax bases between the Union and States listing them in the Union List and the State List respectively (Article 246).

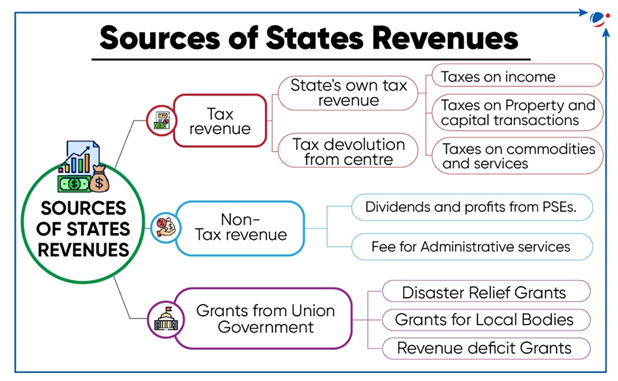

- Distribution of Revenue: A classification of tax revenues between the union and the states is as follows:

- Taxes levied and collected by the centre, but wholly assigned to the states (Article 269).

- Levy and Collection of Goods and Services Tax (GST) in course of Inter-State Trade or Commerce (Article 269-A), which is distributed between Centre and States on recommendations of GST council.

- Taxes levied and collected by the union and distributed between the union and the states (Article 270) on the recommendation of Finance Commission.

- Grants-in-Aid: Centre provides grants-in-aid to states as per Article 275.

- Borrowings: As per Article 292, the union government has powers to borrow money either within or outside the country while under Article 293, a state government can borrow within India (and not abroad).

- Also, if a state is indebted to the Union, it may not resort to further borrowing without the prior consent of the Union Government.

- Finance Commission (FC): Article 280 provides for a Finance Commission (constituted by President after every five years) to adjudicate sharing of resources between Union and States.

Issues between Centre-State Financial Relations

- Borrowing limits on states: Centre is increasingly restricting borrowing by States to equivalent of 3% of Gross State Domestic Product (GSDP) for the 2023-24 financial year (As per recommendations of 15th Finance commission).

- It has also made enhanced borrowings conditional on implementation of reform measures such as power sector reforms.

- Vertical fiscal imbalance: Power to raise taxes rests largely with Union government (such as income tax, CGST, taxing foreign transactions, rents on natural resources etc.) while post-GST, the state governments may only tax the consumption of goods and services (SGST).

- Burden of developmental expenditure: RBI has categorised the budgetary expenditures as 'developmental' (expenditures on socio-economic services) and 'non-developmental' (interest payments, pensions, subsidies etc.).

- As a proportion of the GDP, the combined developmental expenditures by all State governments increased from 8.8% in 2004-05 to 12.5% in 2021-22.

- Intergovernmental fiscal transfers: Over the years, the share of Union Finance Commission tax transfers has declined for a few States.

- 15th Finance Commission has designed tax transfer formula based on population (15%), area (15%), income distance (45%), demographic transition (12.5%), forest and ecology (10%) and tax effort (2.5%).

- The weightage given to the distance of per capita income adversely affects growing States.

- Non-sharing of cess revenue with states: There has been a 133% rise in collection of major cesses and surcharges levied by the Union government during 2017-18 and 2022-23.

- These account for about 25% of total taxes but are excluded from being distributed to the states.

- Decline in grants-in-aid: Grants-in-aid to States have fallen from Rs.1,95,000 crore in 2015-16 to Rs.1,65,000 crore in 2023-24.

- Besides these statutory transfers, discretionary spending, earlier mediated by the Planning Commission, now depends solely at the discretion of the Centre.

- Increasing share in centrally sponsored schemes: States are required to bankroll a higher proportion of expenditure under these partially central funded schemes while they have no role in design of such schemes.

Way Forward

- Role of 16th FC: There needs to be a negotiation with the 16th FC for specific-purpose transfers to tackle State-specific issues such as demographic transition, inward and outward migration and climate change crisis.

- Equity can be made the overarching concern of the 16th FC and Human Development Index could be considered as a strong candidate in horizontal tax distribution.

- Reviewing Off-budget borrowings: There is a need to review the off-Budget borrowing practices of both the Union and the States.

- Off-Budget borrowings mean all borrowings not provided for in the Budget but whose repayment liabilities fall on the Budget. They are generally unscrutinised and unreported.

- Addressing horizontal imbalance: Recognising that each state requires a certain minimum fiscal resource value regardless of the population, rich states should also be guaranteed a minimum share in tax devolution.

- Vice-versa, a ceiling should be defined for poor states also.

- Major principles that should guide fiscal federalism in India include:

- The Centre as well as the States should be autonomous and neither should be unduly dependent on the other for its finances.

- Both should be able to obtain enough funds for their legitimate expenses.

- The receipts should grow with the need for expenditure.