Why in the News?

Recently Karnataka government published draft Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill.

More about the Bill

- Welfare Board: Provides for establishment of 'Welfare Board' at state-level, for securing welfare of Gig-Workers.

- Establishment of a welfare fund: Consists of welfare fee (Levied on transactions b/w worker & aggregator or on overall turnover of company) & contributions from Union and State governments.

- Rights-based bill: It seeks to protect the rights of gig workers and places obligations on aggregators in relation to social security, occupational health and safety of workers.

- Other Features: Provides safeguards against unfair dismissals, two-level grievance redressal mechanism, and more transparency with regards to automated monitoring and decision-making systems deployed by platforms.

- Currently, Rajasthan is only state to have legislation for welfare of gig workers.

Issues with Bill

- Disclosure of algorithmic monitoring and providing reasons for terminations can impact ease of doing business.

- Bill does not address issue of minimum wages or working hours for gig workers.

- Welfare board model provides some welfare schemes for gig workers, but it does not replace institutional social security benefits e.g. provident fund, gratuity, or maternity benefits.

- Unlike Code on Social Security, 2020 ('COSS') which defines and regulates both 'gig workers' and 'platform workers' separately, Bill regulates only subset of platform-based gig-workers.

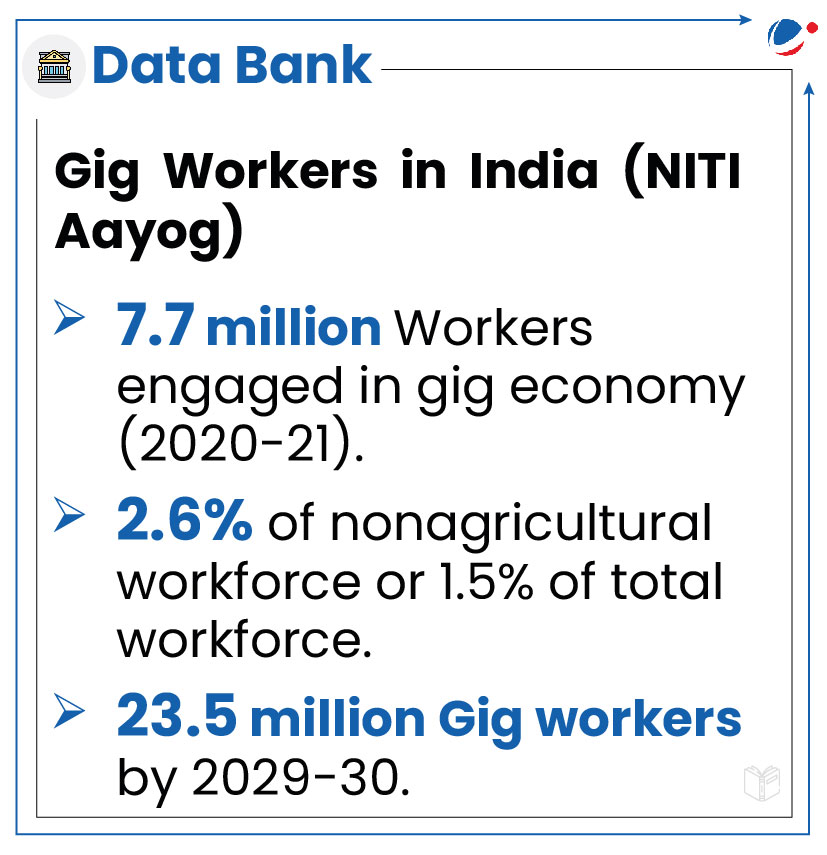

Gig Workers

- As per Code on Social Security, 2020, it means a person who performs work or participates in a work arrangement and earns from such activities outside of traditional employer-employee relationship.

- Broadly classified into 2 categories:

- Platform based: Whose work is based on online software apps or digital platforms. E.g., delivery workers of Zomato.

- Non-platform based: Casual wage workers in conventional sectors, working part-time or full-time. E.g., domestic workers.

- Drivers of Growth: Technological advancements, urbanization, rising middle-class consumption demands, shifts in consumer preferences towards on-demand services, and desire for greater work-life balance among workers.

Challenges for Gig Workers

- Digital Divide: Access to internet services and digital technology can be a restrictive factor for workers.

- Data protection: Opaque decisions made by platform companies on how to collect; store and share personal data of workers impact Right to privacy of workers.

- Lacking 'employee' status: Has resulted in several consequences e.g. inability to form unions to represent their interests, exploitative contacts, etc.

- Uncertain Nature of Job: Lack of job security, irregularity of wages, and uncertain employment status for workers.

- Lack of social Protection: workers lack safeguards such as Health Insurance, Employees Provident Fund etc.

- Algorithmic management: Workers face stress due to pressures resulting from algorithmic management practices and performance evaluation on the basis of ratings.

Steps taken for Gig Economy in India

- Code on Social Security, 2020: Provides for extension of social security benefits to gig workers as well.

- Code on Wages, 2019: provides for universal minimum wage and floor wage across organized and unorganized sector which include gig workers.

- e-SHRAM Portal: which is a National Database of Unorganised Workers including gig workers.

- Pradhan Mantri Suraksha Bima Yojana (PMSBY): All eligible registered unorganised workers including gig workers are entitled to get benefit of an accidental insurance cover of Rs. 2.0 Lakh for a year.

- The Centre for Labour Studies, National Law School of India University (NLSUI), Bangalore has been engaged for assistance in framing of a new Scheme for the Gig & Platform workers as well as workers in the unorganized Sector.

- Memorandum of Understanding (MoU) has been signed by Employees Provident Fund Organisation (EPFO) with NLSUI.

Way Forward

- Proper Estimation of Gig Workers: By having separate enumeration exercises.

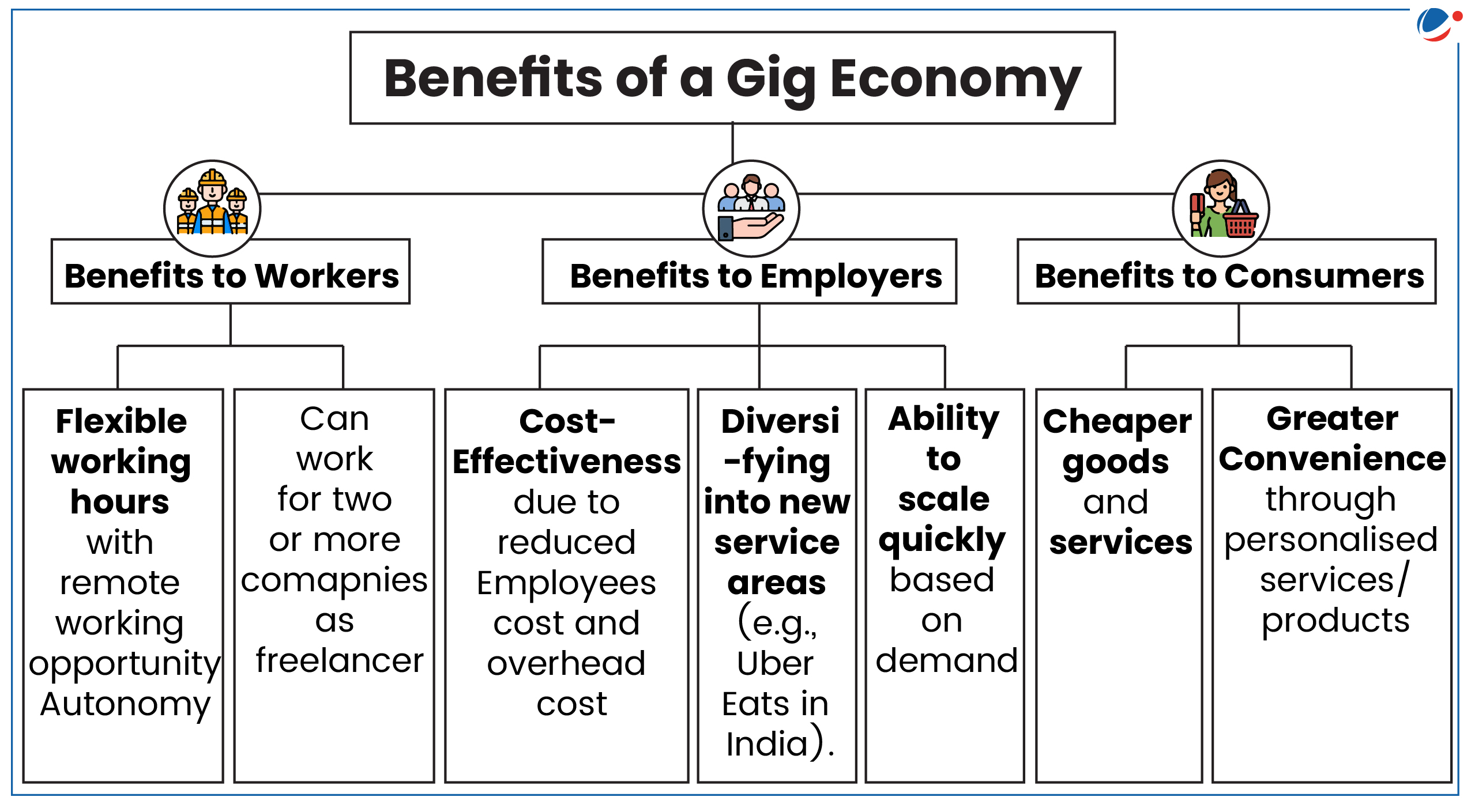

- Catalyze Platformization: Introducing Platform India initiative (similar to Startup India).

- This platform can help self-employed individuals to sell their produce to wider markets in towns and cities; Ferrying of passengers for hire etc.

- Accelerate Financial Inclusion: Institutional credit to vulnerable section through financial products specifically designed for platform workers by leveraging FinTech industry.

- Enhancing Social Inclusion in Digital Economy: By enabling different sections of workers e.g. women workers and PwDs to take up employment opportunities in platform sector through skill development, access to finance etc.

- Skill Development for Platform Jobs: Pursue outcome-based, platform-led models of skilling and job creation.

- Integrate employment and skill development portals such as E-shram and National Career Services Portals or Udyam portal with ASEEM portal.

- Universal Social Security Coverage: By extending social security measures in partnership mode as envisaged in Code on Social Security 2020.

- Social Security includes paid sick leave, Occupational Disease and work accident Insurance, Retirement/Pension Plans and Other Contingency Benefits etc.

- Tripartite dialogue: Between governments, platform unions and EBMOs on labour issues & worker well-being in platform economy.