A new study has revealed that the Surat Emission Trading Scheme (ETS) launched in 2019 has been successful in controlling particulate matter emissions.

- Pollution abatement costs also dropped by over 10 %, and compliance with environmental laws rose among participating plants.

About Surat ETS

- Overview: It is the world’s first-ever market for trading in particulate matter emissions.

- It is also India’s first pollution trading scheme of any kind.

- The concept of ETS first originated in US, targeting sulfur dioxide (SO2) pollution.

- Objective: To curb air pollution in accordance with the polluters pay principle.

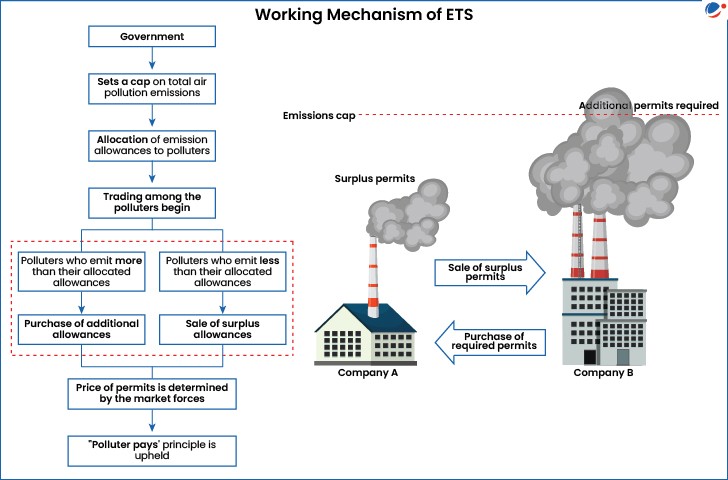

- Working Mechanism: It is based on market-linked ‘cap and trade’ mechanism (Refer Image).

- This approach has been used in Europe for greenhouse gases and in China for carbon emissions.

- ETS uses Continuous Emissions Monitoring Systems (CEMS) devices for monitoring.

- Trading: Industries trade permits on a platform developed by NeML (National Commodities and Derivatives Exchange e-Markets).

- Participating units are also required to submit an 'Environmental Damage Compensation' amount (rate varies according to size of industry).