Why in the News?

Lok Sabha cleared the Finance Bill, 2024 amending Long Term Capital Gain (LTCG) tax provision on immovable properties.

More on the news

- The Amendment comes after proposal to remove indexation benefit in the calculation of LTCG on sale of immovable properties in Budget 2024-25.

- The amendment continued the abolishment of indexation benefits, however, grandfathered properties acquired prior to 23rd July 2024.

Key Provisions of Amendment Act

- Choices to taxpayers: The amendment offers taxpayers a choice

- Taxpayers can choose to pay the lower tax amount of the following two

- Old scheme/regime - Pay 20% LTCG tax with indexation benefit on sale of property acquired before July 23, 2024.

- New Scheme/regime - Pay 12.5% LTCG tax without indexation (down from earlier 20%).

- However, for purchases of property after the cut-off date of July 23, 2024, only the new regime will be applicable.

- Taxpayers can choose to pay the lower tax amount of the following two

- Enhanced Exemption: Exemption limit of 1 lakh for LTCG on listed equity, Equity oriented mutual fund and units of business trust has increased to 1.25 lakh.

- Similarly, the rate for these assets for long-term has increased from 10 to 12.5%.

What is Long-Term Capital Gains (LTCG) Tax?

- Capital gains tax is levied on the profit earned from the sale of capital assets, such as real estate, stocks and bonds.

- There are 2 types of capital gains taxation Long-Term Capital Gains (LTCG) Tax & Short-Term Capital Gains (STCG) Tax.

- LTCG Tax is levied on the profit earned from the sale of assets held for longer periods.

- The holding period varies depending on the type of asset (More than 12 months for Listed equity shares, Equity oriented Mutual funds; 24 Months for Unlisted Equity shares, immovable assets like House/land etc.; and 36 months for movable assets like Gold).

- How are LTCGs Taxed?

- For equity shares and mutual funds, LTCG exceeding Rs 1.25 lakh is taxed at 12.5% without the benefit of indexation.

- For other assets like property, LTCG is taxed according to recent amendments.

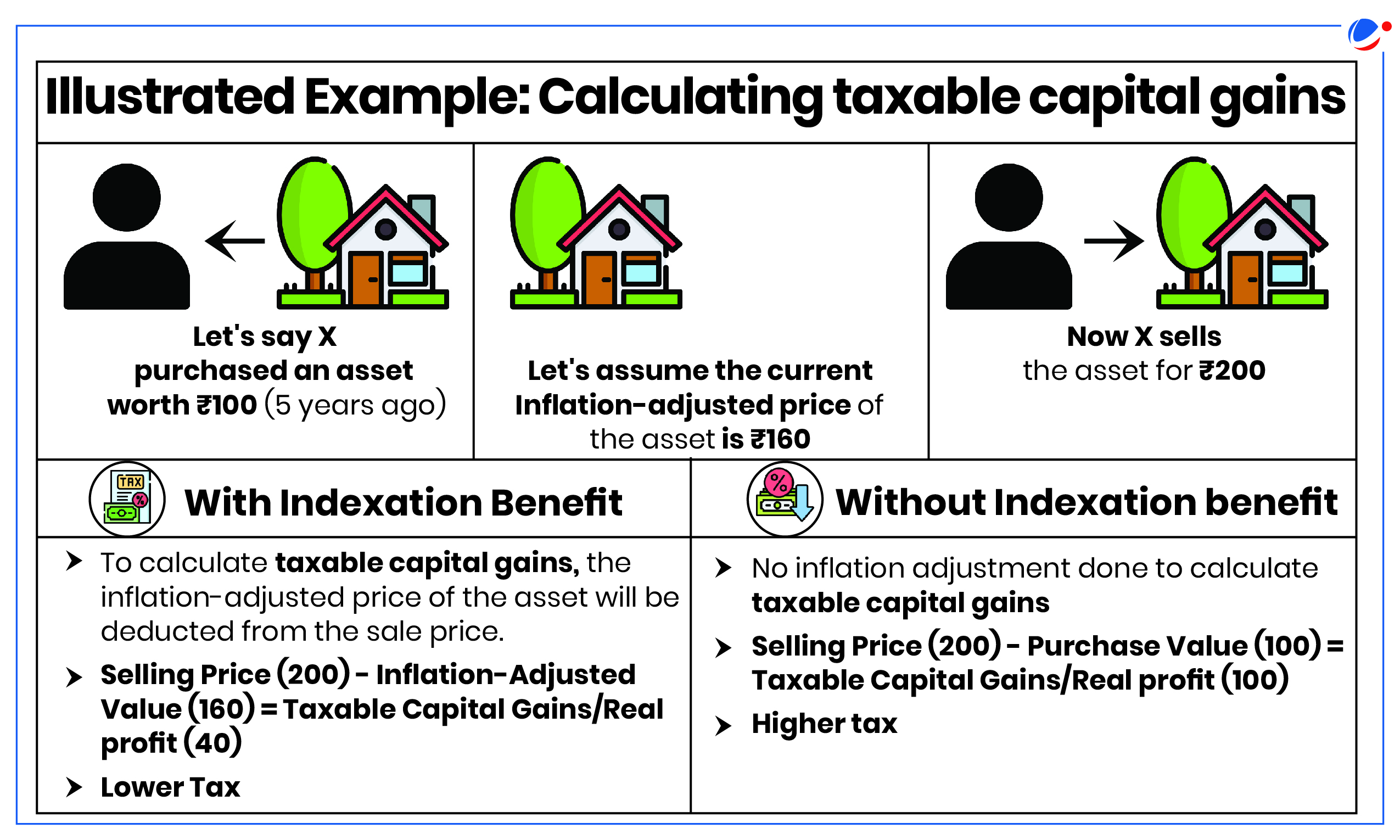

What is indexation and how is it calculated?

- Indexation: It refers to adjusting the purchase price of an asset for inflation while computing the capital gain.

- Union Budget 2024 eliminates indexation benefit for all assets (barring property acquired prior to July 23, 2024).

- Cost Inflation Index (CII) is used in the calculation of Inflation adjusted price of an asset which estimates the increase in an asset's price as a result of inflation.

- It's notified each year by the Income Tax department and is defined under Section 48 of the Income Tax Act, 1961.

| Inflation adjusted price = (CII of the year of sale / CII of the year of purchase) x Actual purchase price of the asset |

- Benefits of indexation:

- Allows a taxpayer to neutralize the impact of inflation while lowering the tax liability.

- Ensures that taxpayers are taxed on real gains than gains at prevailing prices, which are a result of general increase in prices, and not economic growth.

Significance of Current Amendments

- Flexibility in Tax Calculations: It provides an option for property owners to choose between two regimes where tax liability is less and ensures that indexation benefits will not apply if a taxpayer incurs a loss.

- Real Estate Growth: Restoring indexation would promote investment in real estate by reducing the financial burden associated with selling a property.

- Curb Black Market: By reducing the tax burden, restoring indexation can help to promote greater compliance with tax laws.

Concerns Associated with Amendments

- Higher Tax Liability: 12.5% LTCG tax without indexation may lead to a higher tax liability than 20 % with indexation in several cases.

- May increase black money transactions: Due to potential sale of properties at circle rates (minimum price at which a real estate is to be sold).

- Tax Evasion: Higher tax liability could encourage undervaluing of assets resulting in a loss of tax revenue for the government.

- Disincentive for Investment: The higher tax liability may discourage individuals from investing in property, particularly as a long-term asset.

Conclusion

Restoring the indexation benefit for LTCGs on property sales is a fair and equitable measure that benefits both taxpayers and the economy. However, it also raises concerns regarding unfair cutoff date, undervaluing of assets, tax erosion etc. Thus, there is need for careful consideration and potential adjustments to the LTCG tax regime to ensure a fair and equitable system for all taxpayers.