Why in the News?

As part of the expenditure reforms, the NITI Aayog has initiated a process for revamping of Centrally Sponsored Schemes (CSSs).

More on the News

- Development Monitoring and Evaluation Office (DMEO) of the NITI Aayog has invited proposals to engage consultancy firms to support the evaluation of CSSs in nine broad sectors.

- These 9 sectors are: Agriculture and Allied Sector; Women and Child Development; Education, Urban Transformation & Skill Development; Rural Development Sector; Drinking water and sanitation; Health Sector; Water Resources, Environment and Forest Sector; and Social Inclusion, Law & Order and Justice Delivery.

About Centrally Sponsored Schemes

- Definition: CSSs are Schemes that are funded jointly by centre and state and implemented through the State in sectors falling in the State and Concurrent Lists of the Constitution.

- Features: Current framework of the CSSs is based on the report by Sub-Group of Chief Minsters on Rationalisation of CSSs (2015).

- Focus: The focus of CSSs should be on Schemes that comprise the National Development Agenda for realizing Vision 2022, where the Centre and States need to work together.

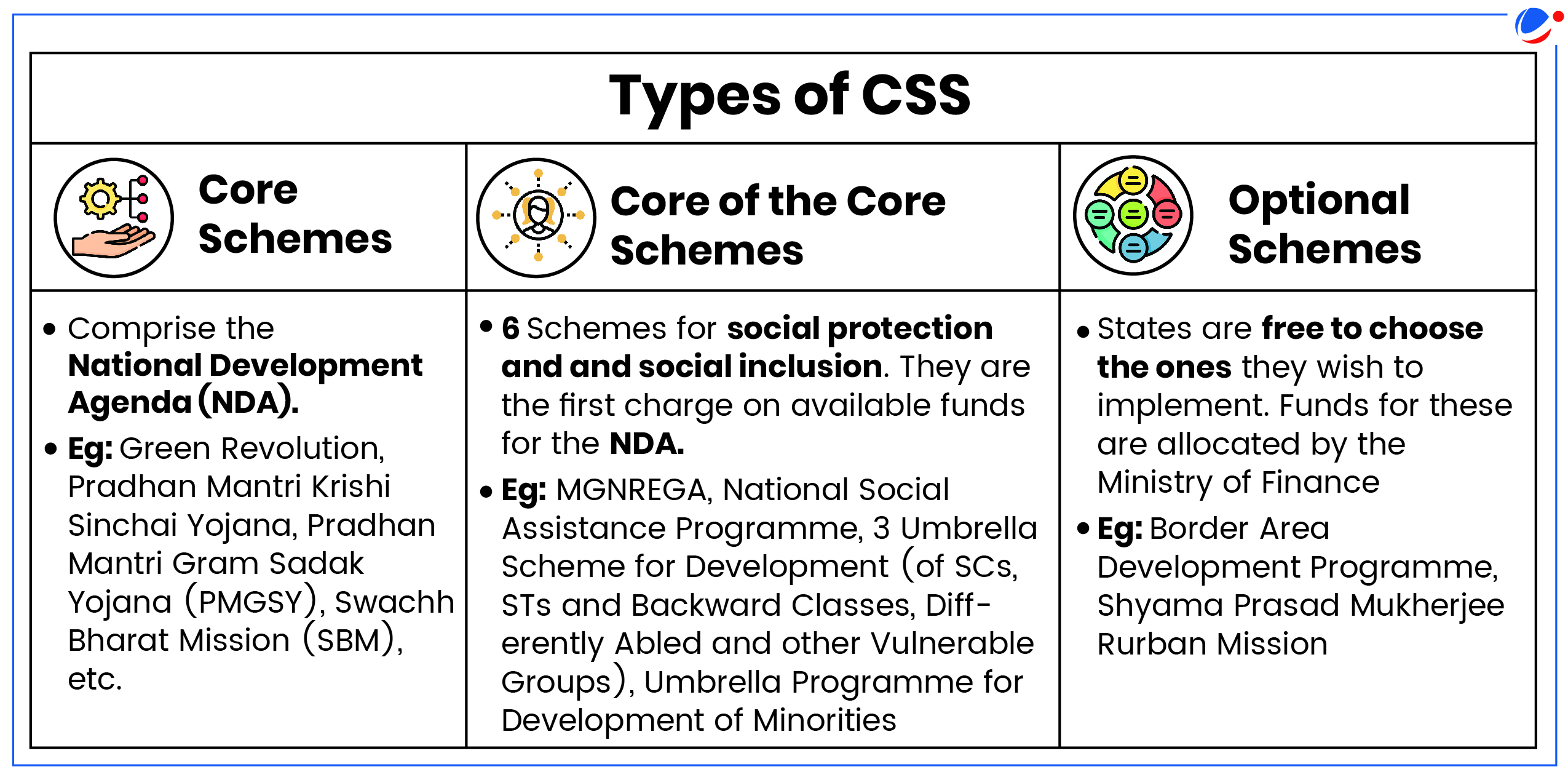

- Current Status: Currently there are 75 CSSs in 3 categories and they constitute around 10.4% of the Centre's budget expenditure.

- Funding: All transfers to States for CSSs are being routed through the Consolidated Fund of the State.

- Following the recommendations of the 14th Finance Commission (FC) and the abolition of Plan-Non Plan distinction from 2017, Centrally Sponsored Schemes (CSSs) and Central Sector schemes (CSs) have become the primary mode of specific purpose transfers made by the Union to the States.

- Funding pattern for Core Schemes:

- 8 North Eastern States and 3 Himalayan States: Centre: State is 90:10

- Other States: Centre: State is 60:40

- Union Territories: without Legislature, Centre 100%.

- Monitoring: NITI to have concurrent jurisdiction in the monitoring of CSSs and also oversee Third-Party Evaluation.

Rational of CSSs

|

Issues associated with current framework of CSSs

- Resource distribution issues: The Budget Estimate for FY 2021-22 shows that 15 schemes account for 91.14% of total expenditure. Even within an 'umbrella' schemes, there are many sub-schemes that receive minuscule amounts.

- Green Revolution CSS has 18 different sub-schemes. The Rainfed Area Development and Climate Change Sub-scheme has an allocation of ₹ 180 cr. whereas National project on Agro-Forestry has an allocation of ₹ 34 cr.

- Large number of Schemes: Existence of Large number of small schemes or multiple small sub-components of a scheme leads to duplication of efforts and a thin spreading of resources.

- Less fiscal space for items in Union List: Union's expenditure on state items has gone up considerably, hence constrained fiscal space for the items in the Union list.

- Example, Defence expenditure has reduced from 2% of the GDP in 2011-12 to 1.5% in 2019-20 RE (National Institute of Public Finance and Policy).

- 'One size fits all' approach: Contours of the CSSs are defined by the Union Ministry making it difficult to accommodate inter and intra state differences.

- Lower absorption capacity in some states: CSSs requires matching contributions from states, leading to lower investment in states where it is needed most.

- Further, states with lower GSDP are also unable to absorb the released funds on time due to inadequate capacity in terms of manpower, skills, technical expertise and weak governance.

- Suboptimal monitoring: Currently, the CSSs focus more on processes (what and how to do) rather than outcomes, so monitoring is based on inputs, not actual results.

Way forward

- Prioritising funding: Gradually stop the funding for the CSSs and their subcomponents that have either outlived their utility or have insignificant budgetary outlays not commensurate to a national programme (15th FC)

- A threshold level of fundings: According to the Arvind Varma Committee in 2005, a new CSS should be introduced only if the annual outlay is greater than ₹ 300 crores.

- For the existing smaller schemes, the amount should be transferred to states as Normal Central Assistance.

- Inflation indexed Funding: Financial norms of certain components of schemes like cooking cost of midday meal or PM-POSHAN Scheme should be linked to the wholesale price index and should be revised every 2 years.

- Improved Governance: According to the 15th Finance Commission:

- The funding pattern of the CSSs should be fixed upfront in a transparent manner and should be kept stable.

- Financing can be provided based on bilaterally agreed 'compacts' related to specific objectives (for example, service delivery outputs or specific outcomes) instead of exhaustively discussed implementation plans.

- To support this approach, the Union Government can support initiatives to enhance data systems, monitoring and evaluation and transparency.

- The flow of monitoring information should be regular and should include, apart from routine statements of financial and physical progress, credible information on output and outcome indicators.