Why in the News?

India proposed Global Development Compact for the Global South to address the rising debt of the developing countries and the Global South.

What is Global Development Compact (GDC)?

India proposed a comprehensive and human-centric "Global Development Compact" for the Global South during third Voice of Global South Summit

Key features of GDC

- Comprises of four elements: Trade for development, Capacity building for sustainable growth, Technology sharing, Project specific concessional finance and grants.

- No Debt Burden: Ensure that development and infrastructure financing do not impose a debt burden on developing countries.

- It is also expected to address the concerns of countries falling into the Chinese 'debt trap'.

- Alternate development path: Help in exploring alternative pathways for economic growth, social inclusion and environmental sustenance.

Reasons for rising debts of developing countries

- High borrowing costs: Developing regions borrow at rates that are 2 to 4 times higher than those of the United States and 6 to 12 times higher than those of Germany.

- High Public Debt: Developing countries' public debt in 2023 was $29 trillion. Public debt in developing countries is rising at twice the rate of that in developed countries.

- Limited domestic resources: Developing nations often struggle with limited domestic resources, poor debt management, and low government revenues due to inefficient tax policies and weak rule of law.

- Political Instability: It results in policy uncertainty, eroding investor confidence. This accompanied with downgrading of sovereign credit rating translates to higher interest and increased borrowing costs.

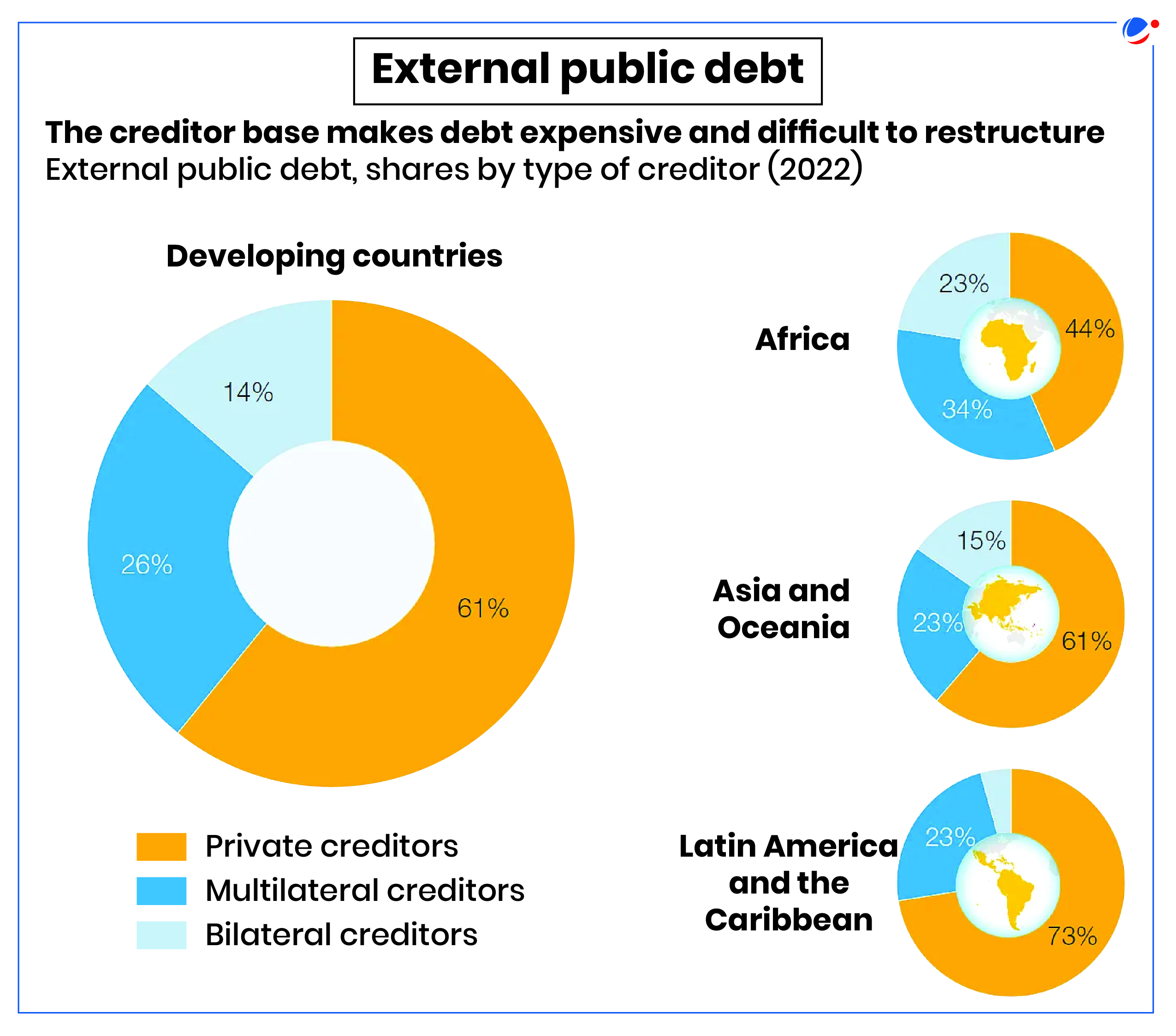

- High reliance on private creditors (including bondholders, banks, and other lenders): Since 2010, the portion of external public debt owed to private creditors has risen across all regions, accounting for 61% of developing countries total external public debt in 2022.

- New global challenges: COVID-19 pandemic, climate change, and geopolitical uncertainties, US-China trade war have exacerbated global economic pressures, disrupting energy supply chains exacerbating financial vulnerabilities in developing nations.

Impacts of high debt burden

- Issue of debt sustainability: Presently, ~60% of low-income countries are at high risk of debt distress or already in it.

- Allocation of more resources to pay interest: 54 developing countries spend more than 10 per cent of their revenues on net interest payments.

- This restricts a government's ability to increase public spending on welfare schemes. In Africa, the average person's spending on interest ($70) surpasses that of education ($60) and health ($39) per capita.

- Hamper's Climate Change Outcomes: E.g. developing countries are currently allocating a larger proportion of their GDP to interest payments (2.4%), than to climate initiatives (2.1%).

- Challenges of over reliance on private creditors: It leads to challenges of debt restructuring, high volatility especially during crises. Moreover, they are more expensive than concessional financing from multilateral and bilateral sources.

- Sovereign debt crisis and global financial instability: High debt levels in developing countries can contribute to global financial instability as it leads to a vicious cycle of borrowing and repayment, risking defaults and economic crises.

- E.g. In past three years alone, there have been 18 sovereign defaults in 10 developing countries which is greater than the number recorded in all of the previous two decades.

Recommendations by UNCTAD for sustainable and inclusive debt solutions

- Global Financial Reform: Comprehensive reform of the global financial architecture and establishment of a global debt authority to coordinate and guide sovereign debt restructuring.

- Concessional Loans: Expand multilateral and regional banks' lending capacity by increasing their base capital.

- Transparency in Financing: Reduce resource and information asymmetry to improve transparency in financing terms.

- Discourage predatory lending: Introduce legislative measures to discourage predatory lending practices.

- Crisis Resilience: Implement standstill rules to halt debt repayments during external crises.

- Automatic Restructuring: Develop automatic restructuring rules and strengthen the global financial safety net.

Conclusion

Addressing rising public debt of developing countries requires a comprehensive strategy combining domestic initiatives and international cooperation including debt restructuring, fiscal consolidation, and growth-stimulating policies for sustainable long-term solutions.