Need for New Norms arises as some banks were not recognizing required provisions for Non-Performing Assets (NPAs) as an expense.

- These new norms (applicable to Urban, state and central co-operative banks) will bring uniformity in treatment of Bad & Doubtful Debt Reserve (BDDR).

- Several co-operative banks established BDDR for financial stability (For managing bad loans).

New Norms

- All provisions (related to “BDDR” or other head) under Income Recognition, Asset Classification, and Provisioning (IRACP) norms must be charged as an expense to Profit and Loss Account.

- After accounting for all provisions as per IRACP norms and other regulations, co-operative banks may make appropriations of net profits to BDDR.

Co-operative Banks

- Works on principle of cooperation and are owned and operated by their members.

- Can be divided into Rural and Urban co-operative banks.

Issues with co-operative Banks

- Regional Disparity: Almost 82 per cent of total UCBs and around 90 per cent branches of all UCBs are concentrated in Western and Southern regions of country (2020).

- Dual Regulation: Managerial, administrative activities are overseen by state governments while banking activities are regulated and supervised by RBI /NABARD.

- Other issues: Inadequate avenues for raising capital, High Gross NPAs etc.

SEBI notifies norms for mutual funds for preventing fraudulent transactions and front running.

Front Running

- Refers to usage of non-public information to directly or indirectly buy or sell securities, or enters into options or futures contracts, in advance of a substantial order. (Securities and Exchange Board of India (SEBI))

- It undermines confidence in the financial markets and creates an uneven playing field for other investors.

- It is illegal in India.

White category sectors will now not require prior permission of the state pollution control boards to establish and operate under the Air Act, 1981 and Water Act, 1974.

- The permissions officially known as ‘consent to establish’ (CTE) and ‘consent to operate’ (CTO) are granted to regulate industries that discharge effluents or emit pollutants into the environment.

- White category industries will have to inform SPCBs through self-declarations.

White Category Sectors

- Those industries which are practically non-polluting are categorised under the ‘white category’ by the Central Pollution Control Board.

- It includes Wind and solar power projects, assembly of air coolers, bicycle assembly etc.

Article Sources

1 sourcePrime Minister released 109 high yielding, climate resilient and biofortified varieties of crops.

- These crops have been developed by the Indian Council of Agricultural Research (ICAR) and release of new varieties of crops is the example of a "lab to land" programme.

- ICAR has been running crop-improvement programme to develop new crop varieties and hybrids with wider adaptability and higher yield.

- Crop-improvement process uses different strategies such as

- Genomics-assisted selection

- Phenomics (systematic measurement and analysis of qualitative and quantitative traits)

- Conventional breeding or Biotechnology-based approaches like genetic engineering and genome editing.

Need of Crop Improvement

- Managing Impact of Climate Change: Climate resilient seeds can yield good crop even in adverse weather (heat waves, droughts, etc.). E.g. Bt cotton

- Climate resilient crops will reduce crop losses due to diseases and pests attacks.

- Food Security: Agricultural yields are projected to drop by 16% by 2030 (World Economic Forum).

- Nutritional Security: Government seeks to promote biofortified crops by linking them with the programmes like Mid-Day Meal (PM Poshan Scheme), etc., to make India free from malnutrition.

- Also, these are affordable as biofortified varieties crop does not involve any additional cost on preparing the enriched food grains. E.g. vitamin-A rich maize grains.

- Rising Farmers Income: High-yielding and adaptable crop varieties contribute to higher incomes.

About Biofortification

About Lab to Land programme

|

Article Sources

1 sourceStates can purchase rice from Food Corporation of India (FCI) under the OMSS Domestic without participating in the e-auction from August 1, 2024.

- It aims to reduce the huge surplus of stocks prior to the commencement of the new procurement season.

OMSS – Domestic

- It refers to offering of food grains (wheat & rice) in the open market at prices, fixed by the Ministry of Consumer Affairs, Food & Public Distribution through e-auction.

- It aims to control the price in the market with the aim to curb inflation.

Article Sources

1 sourceNITI Aayog publishes a report titled “Strategy for the development of Seaweed Value Chain”.

- Seaweeds are numerous types of marine plants and macro algae that thrive in rivers, lakes, and other bodies of water.

- Cultivation of seaweeds are part of aquacultures. Fishing and aquaculture sector contributes 1.5% of India’s GDP.

Significance of Seaweed Farming

- Economic: Valuable for bioactive compounds and applications in food, pharmaceuticals etc.

- Environmental: Important role in Carbon Sequestration & climate resilience.

- Nutrition imperative: Provide vital minerals and Vitamins like A, B1, B12, etc.

Challenges faced by Seaweed Farming

- Lack of a comprehensive policy framework.

- Lack of availability of quality Seeds.

- Ecological concerns (Exotic species impact on biodiversity and coral reefs).

Recommendations For Promoting Seaweed Farming

- Regulatory and governance reforms: Forming National Steering Committee; Priority Sector Lending (PSL) for seaweed, etc.

- Social Security and Financial Support: Providing crop insurances; mobilization of farmers through SHGs etc.

- Infrastructure and institutions: Establishment of seed banks, processing centers, marketing centers etc.

UN’s Ad Hoc Committee to Draft Terms of Reference for a United Nations Framework Convention on International Tax Cooperation approved a package of guidance for UN Global Tax Convention.

- It aims at establishing a UN Global Tax Treaty for legitimate, fair, stable, inclusive and effective international tax system.

- Developing countries (including India) largely voted in favour of treaty’s terms of reference while industrialized nations such as Australia, Israel, Japan, UK and USA voted against it.

Objectives of UN Global Tax Convention

- Strengthening international tax cooperation and making it inclusive and effective.

- Addressing existing tax-related challenges including digitalization and global operations of large Multinational Corporations (MNCs).

- Mobilize domestic resources and use tax policy for sustainable development.

- Accelerating implementation of Addis Ababa Action Agenda on Financing for Development and 2030 Agenda for SDGs.

Commitments of UN Global Tax Convention

- Fair allocation of taxing rights including equitable taxation of MNCs.

- Addressing tax-related illicit financial flows, tax evasion and tax avoidance by high-net worth individuals.

- Address taxation of income derived from cross-border services.

- Effective mutual administrative assistance in tax matters and resolution of tax disputes.

Other Global Initiative

|

Article Sources

1 sourceIndia is 2nd largest user of NTMs in 2023 as per WTO’s ‘World Tariff Profiles’ Report, 2024.

About Non-Tariff Measures (NTMs)

- NTMs are defined as policy measures, other than ordinary customs tariffs, that can be potentially detrimental to international trade in goods, changing quantities traded, prices, or both.

- Examples- Quotas or price controls, Sanitary and Phytosanitary measures, Technical Barriers to Trade, etc.

- Though many NTMs aim primarily at protecting public health or the environment, they also affect trade through information, compliance, and procedural costs.

Article Sources

1 source‘Debt for Development Swaps: An Approach Framework Paper’ has been released by the International Monetary Fund (IMF).

About Debt Swaps

- These are agreements between a government and one or more of its creditors to replace sovereign debt with one or more liabilities that include a spending commitment towards a specific development goal.

- Criteria that need to be considered in determining the appropriateness of swaps include country’s initial debt situation, net financial benefits etc.

- Classified into two categories, namely, bilateral (official bilateral debt is written-off) and commercial debt swaps (target debt held by private creditors).

- Development goals include nature conservation, climate action, education, nutrition, support for refugees, etc.

Article Sources

1 sourceIt is the WTO’s flagship statistical publication.

- WTSR 2023 looks into the latest developments in world trade, featuring key data on global trade in merchandise and commercial services.

- Key highlights:

- India retains 8th position in global agriculture exports in 2023

- India ranked 18th in merchandise exports and 7th in services exports.

- China, USA and Germany remained the top three merchandise exporters in 2022.

Article Sources

1 sourceThe report by ILO represents the 20th anniversary publication of GET for Youth and focuses on achievements, challenges and outlook for youth employment.

Key Highlights of Report

- Post Covid recovery: Global youth unemployment rate in 2023 is 13%, the lowest in 15 years, and 64.9 million unemployed youth, the lowest since 2000.

- NEET (Not in Employment, Education or Training) Status: 20.4% of youth were in NEET in 2023, indicating broader labour market exclusion.

- 2 in 3 young NEETs are women.

- Global Challenges:

- Inequalities of Opportunity: 4 in 5 young adult workers are in regular paid job in high-income countries, compared to 1 in 5 in low-income countries.

- Regional disparities: Growth in youth labour force in Africa by 2050 while all other regions face contraction.

- Also, 1 in 3 youth in Arab states and North Africa are unemployed.

- Youth well-being concern: Many young people are stressed about job loss, state of economy, and lack of social mobility across generations.

- Educational Mismatch: 2 in 3 young adult workers in developing economies hold qualifications that do not match well to their job.

Recommendations from the report

|

Article Sources

1 sourceAmendment has been brought as banking sector has evolved over years, and seeks to improve bank governance.

- Bill proposes to amend RBI Act, 1934, Banking Regulation Act, 1949, SBI Act, 1955, Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 and Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980.

Key Provisions of Bill

- Increased Nominees: Allows depositors to nominate up to four nominees simultaneously (With proportion of their shares specified) and successively.

- Successive nomination: Several nominees listed in specific order, nominees would be contacted for claiming funds according to order.

- Investor education and protection fund (IEPF): Enables transfer of unclaimed dividends, shares, and interest or redemption of bonds to IEPF when they remain unclaimed for seven consecutive years.

- Bill allows individuals to claim transfers/refunds from IEPF.

- Substantial interest in shareholding: Threshold in shareholding has been increased from Rs 5 lakh to Rs 2 crore for directorships.

- Provision for Cooperative Banks:

- Extends tenure of directors in cooperative banks from 8 years to 10 years.

Significance

- Provide consistency in reporting to RBI

- Reduce unclaimed deposits (over ₹42,000 crore in march 2023) by increasing nominee number.

- Unclaimed deposits are balances in savings/current accounts that are not operated for 10 years, or term deposits not claimed within 10 years from date of maturity.

WFP and Government of Odisha Jointly launched 24/7 'Grain ATM' in Bhubaneswar.

- India's first 24/7 'Grain ATM,' called 'Annapurti,' will be set up across Odish to provide food grains to beneficiaries with 24/7 access under the National Food Security Act (NFSA).

- NFSA entitles up to 75% of the rural population and 50% of the urban population to receive subsidized food grains.

About Annapurti

- It is a Made-in-India product (designed and developed by WFP India)

- It dispenses the type and quantity of the selected grain (wheat, rice or millet) to each beneficiary, after biometric authentication.

- It can provide universal access to food grains and reduce the waiting time by 70%.

- It is energy efficient and can be connected to solar panels for automatic refilling.

- At the 2022 WFP Innovation Awards, it was recognized as one of the WFP’s top 5 innovative solutions for disrupting hunger.

Union Minister of Consumer Affairs, Food and Public Distribution launched pilot project for transformation of 60 Fair Price Shops (FPS) into Jan Poshan Kendras.

- FPSs are shops licensed to distribute essential commodities issued under the Essential Commodities Act (1955) to the ration card holders under Targeted Public Distribution System.

About Jan Poshan Kendras

- Kendras will offer a diverse range of nutrition-rich food items to consumer as well as provide an additional source of income to the FPS dealers.

- They have to store 50% products under the category of nutrition while the rest for keeping other household items.

- The pilot will cover states of Gujarat, Rajasthan, Telangana, and Uttar Pradesh.

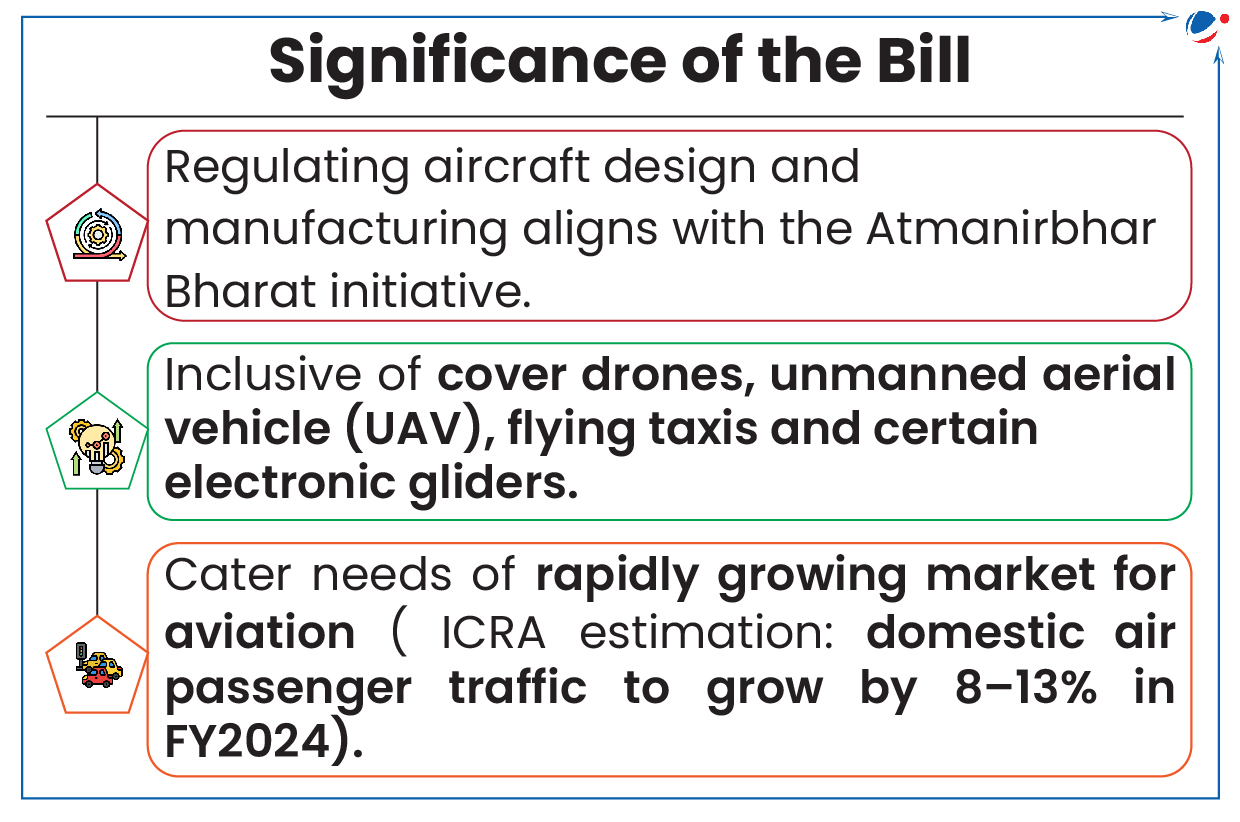

It will replace the 90-year-old Aircraft Act, 1934 (for the control of the manufacture, possession, use, operation, sale, import and export of aircraft).

Key Highlights of the Bill

- Aim: To address the ambiguities in the existing law and for ease of doing business & manufacturing in aviation sector.

- Important Provisions:

- To empower the Central Government to make rules to implement the Convention relating to international civil aviation.

- E.g., Chicago Convention (1944) and the International Telecommunication Convention (1932).

- To give the Directorate General of Civil Aviation (DGCA), the Bureau of Civil Aviation Security (BCAS), and the Aircraft Accident Investigation Bureau (AAIB) increased powers.

- To empower the Central Government to issue orders (like detaining aircraft) in emergency in the interest of public safety.

- To empower the Central Government to make rules to implement the Convention relating to international civil aviation.

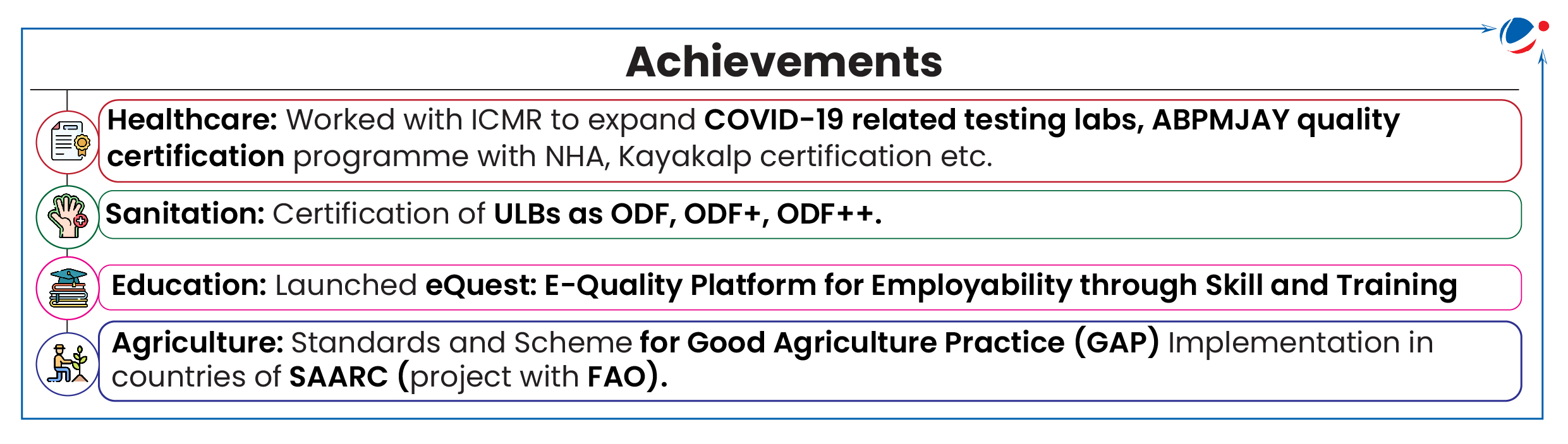

Quality Council of India (QCI) introduced QCI Surajya Recognition & Ranking Framework.

About Framework

- It aims at recognising and rewarding states and organizations that excel in quality and innovation to achieve the aim of a Developed (Viksit) India.

- It is categorized under four pillars:

- Shiksha (Education),

- Swasthya (Health),

- Samriddhi (Prosperity), and

- Sushasan (Governance).

About QCI

- It was established as the national body of accreditation in 1996 and is an autonomous non-profit organization under the Societies Registration Act, 1860.

- Based on the recommendation of the Expert Mission of European Union.

- It was jointly set up by the Government of India and the Indian Industry (ASSOCHAM, FICCI, CII).

- Nodal Department: Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry.

- Governing Council:

- 39 members including the Chairperson and Secretary General with equal representation of Government, Industry and other Stakeholders.

- Chairperson is nominated by the Prime Minister.

- Role of QCI

- National Accreditation Body (NAB): To promote quality through the National Quality Campaign in line with global standards.

- Create a mechanism for third-party assessment of products, services and processes.

- Improve the quality of life and wellbeing of the citizens of India.

Article Sources

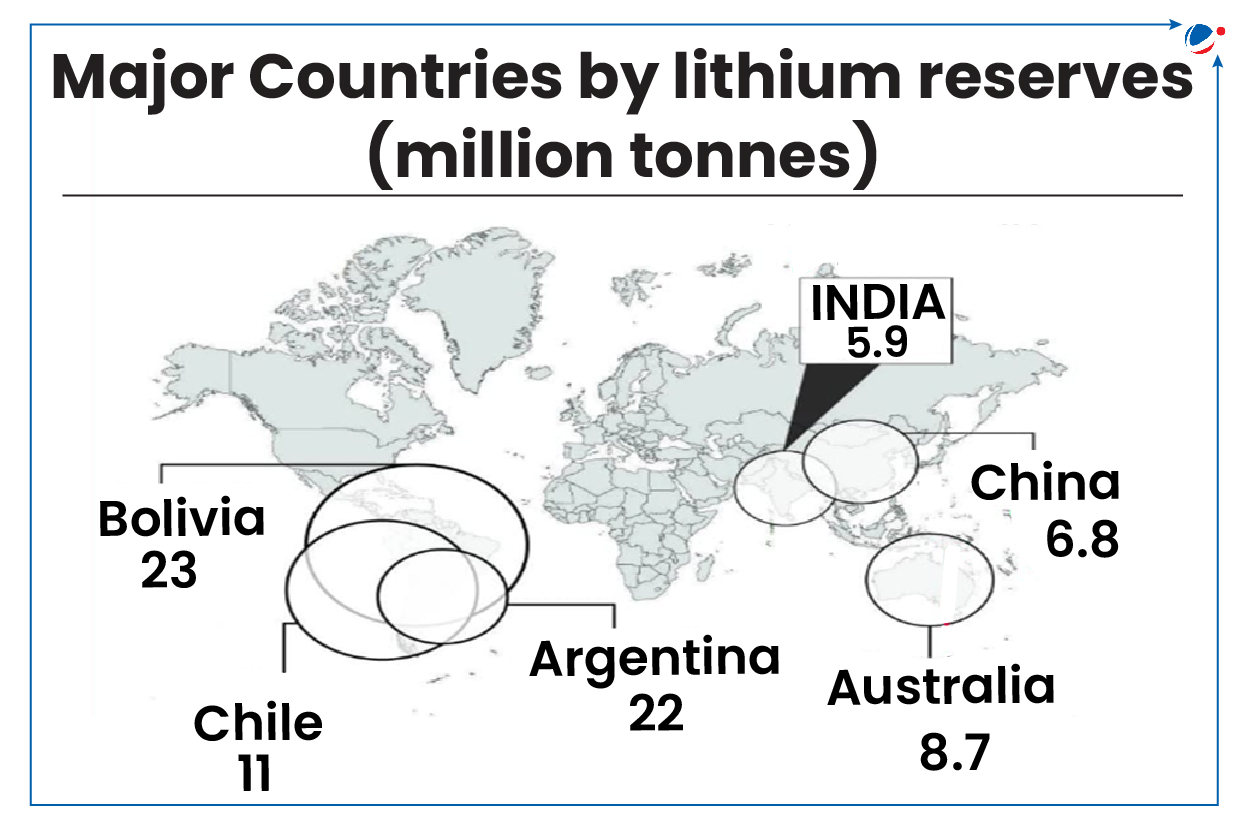

1 sourceAtomic Minerals Directorate for Exploration and Research has established 1,600 tonnes of Lithium resources in Mandya district.

- Lithium reserve discovery will lead to

- Reduced Import Dependence (Currently India majorly depends on China and Hong Kong)

- self-sufficiency in energy storage needs & Green transition

- Industrial development E.g. Vehicle and automobile industry development

About Lithium (white gold)

- Lithium is a soft, silvery-white alkali toxic metal and has the lowest density of all metals.

- It has been identified as critical and strategic minerals under Mines and Mineral (Development and Regulation) (Amendment) Act 2023.

Applications of Lithium

- Batteries: Rechargeable Li-Ion batteries for mobile phones, EVs etc. and non-rechargeable batteries for heart pacemakers, clocks etc.

- Alloys: Alloyed with aluminum and magnesium to improve strength and reduce weight e.g. armor plating, aircraft, bicycle frames, and high-speed trains etc.

- Industrial Use: Used in air conditioning, industrial drying systems and glass ceramics.

Steps Taken

- KABIL explores strategic minerals in overseas territories.

- Australia India Critical Minerals Investment Partnership

- Geological Survey of India (GSI) is exploring Lithium reserves in India.

- Ministry of Mines joined Mineral Security Partnership (MSP) led by USA.

Article Sources

1 sourceCentral Government notified Tantalum as a Critical and Strategic Mineral under the Mines and Minerals (Development and Regulation) Act, 1957.

About Tantalum

- Tantalum is a rare metal with the atomic number 73

- It’s grey, heavy, very hard, and corrosion-resistant.

- Characteristics:

- When pure, tantalum is ductile (can be stretched, pulled, or drawn into a thin wire).

- Extremely high melting point.

- Uses: Making capacitors in electronic devices, surgical equipment & implants, components for chemical plants, nuclear power plants, aeroplanes and missiles etc.