Public debt can drive development by funding critical expenditures, but excessive debt growth poses challenges, especially for developing nations.

- UNCTAD’s 2024 report warns of rising debt risks, urging immediate global action to ensure stability.

Key Findings of the Report

- Global Debt Surge: Public debt reached $97 trillion in 2023, with developing countries' debt rising twice as fast as developed nations.

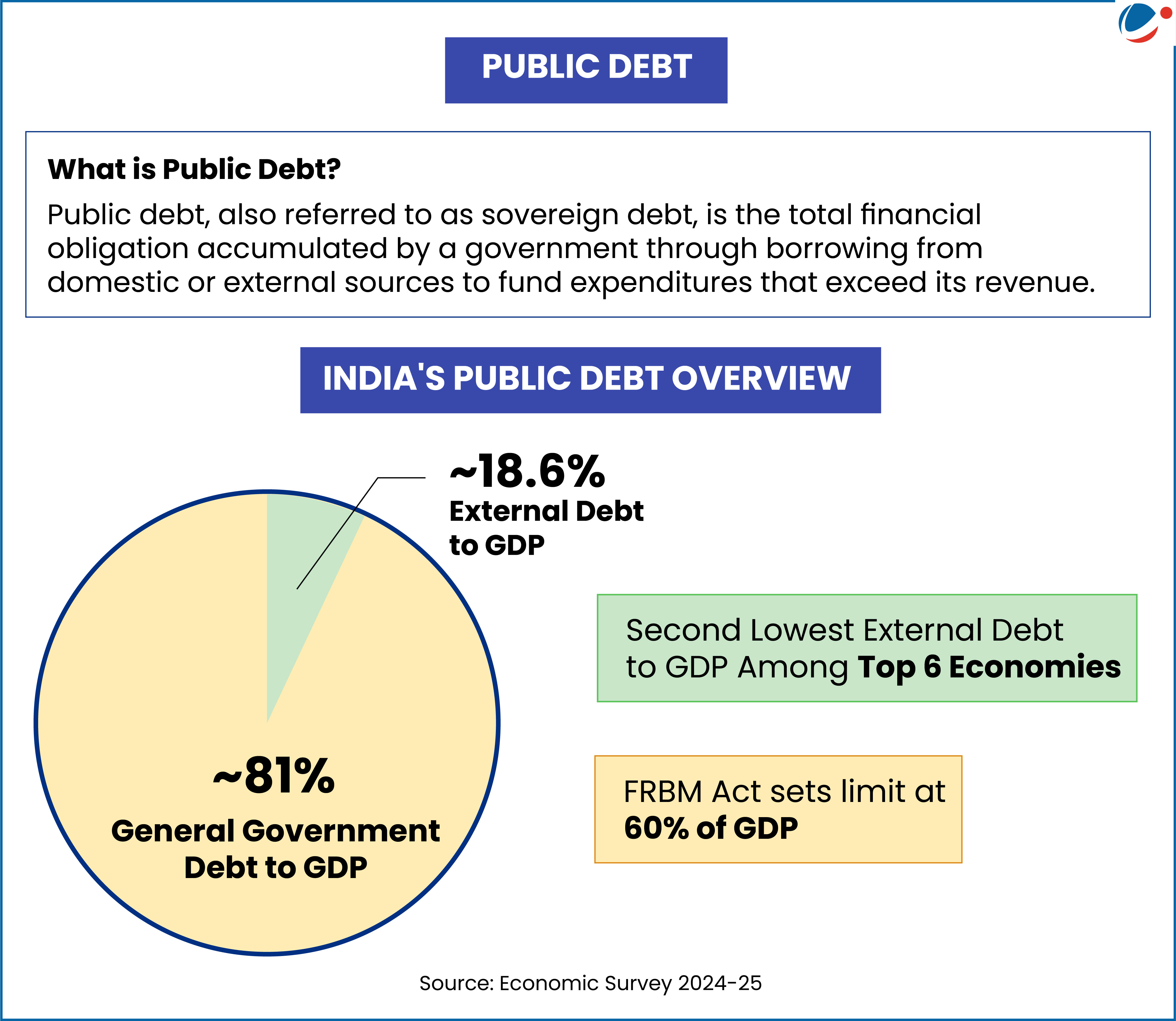

- India's public debt was recorded at 2.9 trillion US dollars.

- Debt Servicing Strains: 54 developing nations spend more on interest payments than on social sector.

- Unequal Financial System: Developing nations pay 2 to 12 times more in interest than developed countries.

Challenges Posed by the Rising Global Public Debt

- Debt Overhang: High debt levels can stifle economic growth by discouraging investment and consumption.

- Liquidity Challenge: The withdrawal of nearly $50 billion by private creditors from developing countries has worsened liquidity constraints.

- The creditor base with West-dominated institutions (private, multilateral, and bilateral creditors) makes debt restructuring expensive.

Recommendations

- Debt restructuring mechanisms to address coordination challenges.

- Expand contingency financing to prevent debt crises.

- Enhance participation of developing countries in global financial governance.