In Rhutikumari v. Zanmai Labs Pvt. Ltd, the Court granted protection to an investor whose digital assets were frozen on a crypto exchange after a massive cyberattack.

- In 2020, New Zealand High Court too held crypto currencies, as digital assets and a form of property capable of being held on trust.

Key Highlights of the Ruling

What is Cryptocurrency?

|

- Nature of Cryptocurrency: The court held that it is not a tangible property nor is it a currency. Rather, it is a property, which is capable of being enjoyed, possessed and being held in trust.

- The Court reaffirmed previous SC rulings on the principles of property and held them to apply equally to cryptocurrencies.

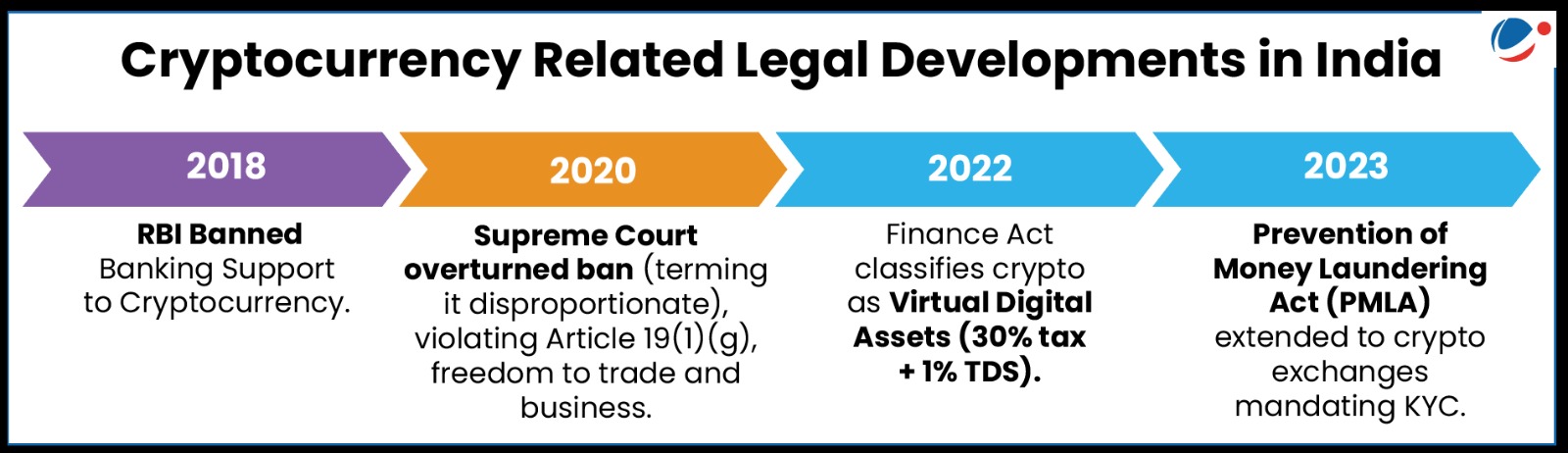

- Legal Clarification: The court held that under Indian law, cryptocurrency is classified as a Virtual Digital Asset (VDA) and it is not treated as a speculative transaction under Income Tax Act, 1961.

- Clarification on the RBI Ban (2018): The Court held that RBI had not banned virtual currencies as such; it had only prohibited banks from facilitating their trade.

Significance of the Ruling

- Addresses the Regulatory Grey Zone: The ruling marks a landmark judicial acknowledgment of digital assets as legally ownable property.

- Protects Investors: It could allow investors to seek traditional property remedies like bank guarantees rather than relying on exchange-driven loss-sharing schemes.

|