Why in the News?

Recently, Department of Financial Services notified amalgamation of 26 Regional Rural Banks (RRBs) on the principles of "One State One RRB".

More on the news

- The amalgamation was done by the Central Government in exercise of the powers conferred under Regional Rural Banks Act, 1976.

- This is the fourth phase of amalgamation and post amalgamation, there will be 28 RRBs (down from 43 earlier) in 26 states and 2 UTs.

- E.g., Baroda U.P. Bank, Aryavart Bank and Prathama U.P. Gramin Bank in the State of Uttar Pradesh have been amalgamated into a single RRB – Uttar Pradesh Gramin Bank.

- The first phase of amalgamation (FY 2006 to FY 2010) was based on recommendations of the Dr. Vyas Committee with focus on merging RRBs under the same sponsor bank within a state.

About Regional Rural Banks

- Genesis: Regional Rural Banks were established in 1975 based on the recommendations of the Narasimham Working Group.

- The first five RRBs were set up on 2nd October 1975 through an ordinance, which was later replaced by the Regional Rural Banks Act, 1976.

- Ownership: Jointly owned by Government of India (50% stake), the concerned State Government (15%), and the sponsoring commercial bank (35%).

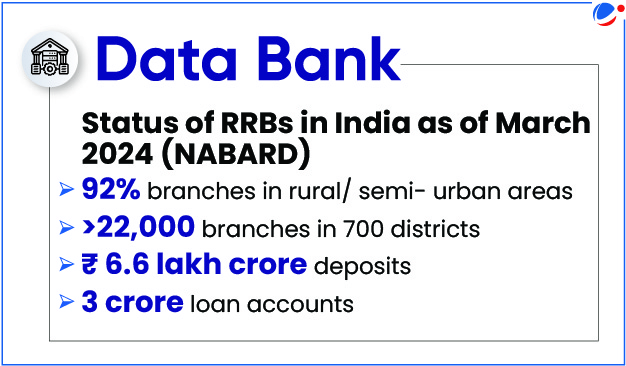

- Regulation and Supervision: RRBs are regulated by the Reserve Bank of India (RBI) under the Banking Regulation Act, 1949 and supervised by the National Bank for Agriculture and Rural Development (NABARD).

- For tax purposes, they are treated as cooperative societies under the Income Tax Act, 1961.

- Requirements:

- Must allocate 75% of ANBC (Adjusted Net Bank Credit) or CEOBE (Credit Equivalent of Off-Balance Sheet Exposure) whichever is higher to Priority Sector Lending (PSL).

- Must maintain a Capital to Risk-Weighted Assets Ratio (CRAR) of 9%, as per RBI norms.

Significance of One State One RRB

- Accelerated business growth: Total RRB business as a percentage of India's GDP is expected to reach ~5.2%6 by FY30 from ~3.7%6 as of FY24.

- Financial Benefits: The amalgamated RRB will have-

- Greater capital base to meet RBI mandated capital adequacy norms;

- Improved liquidity position owing to increased availability of funds and improved efficiency due to economies of scale.

- Improved compliance: A unified RRB can centralise compliance functions, such as anti-money laundering checks, KYC verification and reporting to the RBI and NABARD.

- Strengthened lending capacity: This enables higher credit flow to rural sectors, particularly MSMEs and agriculture.

- In 2022-23, Regional Rural Banks accounted for 11.2% of total agricultural ground level credit

- Promoting financial inclusion: Improved tech and infrastructure can expand digital reach and support product innovation aligned with government schemes.

- For instance, some RRBs have successfully implemented customer-centric digital services such as Micro-ATMs, call centres, net banking, Video KYC, RTGS, and IMPS.

- Enhanced competitiveness: Pooled resources and expertise may allow diversified and locally tailored products which will boost market position and rural outreach.

- Products such as microfinance options for small businesses, seasonal crop-linked savings schemes and products bundled with insurance plans etc. can be offered.

- Consolidated IT and technological infrastructure: It can result in superior overall capabilities for the merged entity – including improved cybersecurity, fraud prevention, big data analytics etc.

- Other benefits:

- Operational efficiency through rationalization of branch network, elimination of redundant processes and reduction in operational overheads.

- Availability of a large pool of capable personnel with diverse skills.

- Enhanced oversight and operational guidance by aligning RRBs with regionally strong sponsor banks can.

Challenges in Amalgamation of RRBs | |

Operational | Governance and stakeholder management |

|

|

Financial | Technological |

|

|

Conclusion

To ensure the success of the "One State-One RRB" amalgamation, it is crucial to harmonize HR policies, integrate digital systems, streamline branch operations, and tailor products to local needs. Strengthening NPA recovery, forming state-level monitoring committees, and conducting regular financial reviews will help address challenges and promote financial stability and rural inclusion.