Why in the News?

The 56th meeting of the GST Council has approved Next-Gen GST reform (GST 2.0) that includes rate rationalization with a simplified two-slab structure.

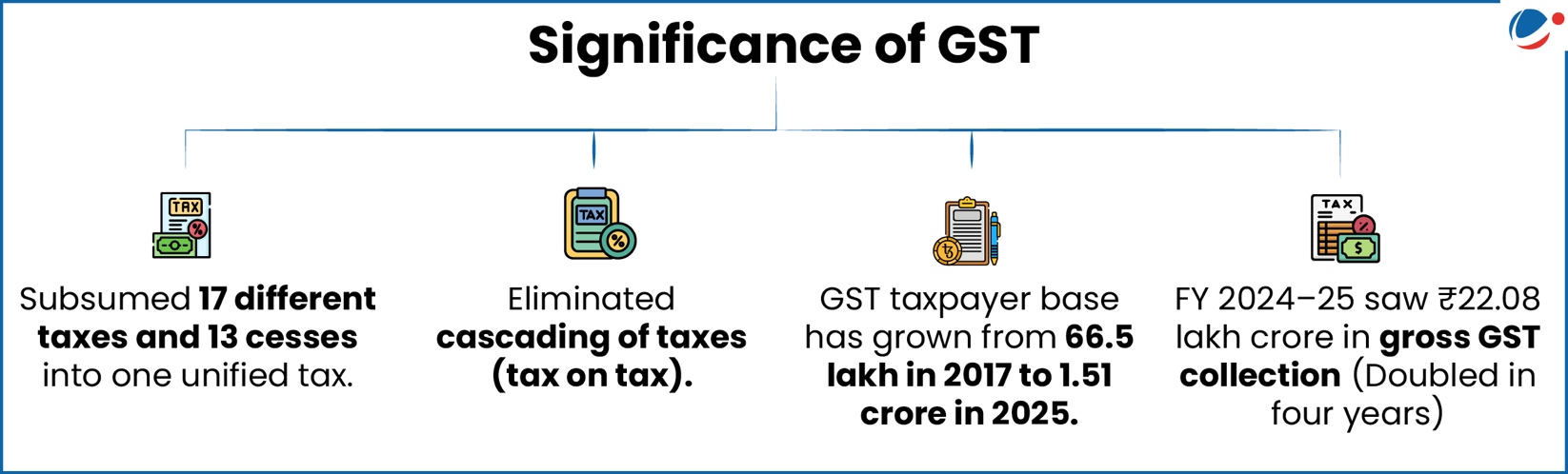

Evaluation of GST 1.0

- About GST: It is a single indirect tax on the supply of goods and services across India.

- It was Introduced by the 101st Constitutional Amendment Act, 2017.

- Main components of GST: Central GST (CGST), State GST (SGST), Union Territory GST (UTGST) and Integrated GST (IGST).

- CGST, SGST and UTGST are on intra-state transactions; IGST is on inter-state transactions, collected by the Centre and shared with states

- Destination-Based Tax: Revenue goes to the state/UT where the goods or services are finally consumed.

GST 2.0: Key Reforms and Recommendations

- The New Rate Structure:

- Two-slab system of 5% and 18%, removing the earlier 12% and 28% rate.

- A 40% Special De-Merit Rate applies to 'sin' goods and select luxuries, replacing the compensation cess levy.

- The median tax rate effectively moves from 12% to 5%.

Relief for Citizens and Key Sectors:

|

- Dispute Resolution: The Goods and Services Tax Appellate Tribunal (GSTAT) is set to be operational for appeals before the end of September 2025.

- It has been formally launched by the government (See in the next article).

- Registration Ease: A simplified, optional GST registration scheme is recommended for small and low-risk businesses, guaranteeing automated registration (operational from November 1, 2025).

- Simplified registration for small suppliers using e-commerce operators (ECOs) has also been approved in principle.

- Export Benefits: Recommended that the place of supply for "intermediary services" will be determined as per the location of the recipient of such services (earlier it was decided by Place of supply).

- This will help Indian exporters of such services to claim export benefits.

- Intermediary services involve facilitating the supply of goods or services between two parties without altering them.

Benefits of the Recent Changes

- Social Protection: Exemption of GST on insurance and essential medicines strengthens household security and access to healthcare.

- Lower Prices, Higher Demand: Cheaper goods and services increase household savings and stimulate consumption.

- The boost to nominal GDP growth is estimated at 20-30 basis points (bps).

- Support for MSMEs: Reduced rates on inputs like cement, auto parts, and handicrafts lower costs and make small businesses more competitive.

- Ease of Living: A two-rate structure means fewer disputes, quicker decisions, and simpler compliance.

- Wider Tax Net: Simpler rates encourage compliance, expanding the tax base and improving revenues.

Key Challenges in recent changes

- Revenue foregone: It could lead to a revenue loss of ~₹48,000 crore (on the FY23-24 consumption base), as per the Finance Ministry.

- Removal of input tax credit (ITC): Fromgoods such as healthcare products and insurance.

- Earlier, insurance companies used ITC to reduce GST on premiums by adjusting it against GST paid on inputs.

- Now, with no GST on policyholders, they can't claim this set-off, leading to higher costs.

- Compliance Complexity and Technological Integration: Despite rationalized tax slabs, businesses continue to face transitional challenges such as adjusting pricing structures and upgrading billing systems.

- Issue of Inverted Duty Structure (IDS): In some cases, the GST on raw materials is higher than on the final product. For example, bicycles are taxed at 5%, but inputs like plastic and steel are taxed at 18%.

- Anti-Profiteering Mechanism: National Anti-Profiteering Authority (under Section 171 of the CGST Act, 2017) was established to ensure that the reduction in rate of tax or the benefit is passed on to the recipient.

- It was dissolved and integrated with the Competition Commission of India (CCI) in 2022.

- There is a lack of NAA or a similar dedicated body, as GST 2.0 involves large rate changes, and profiteering is a tax compliance issue.

Conclusion

The simplified GST structure with lower rates marks a new phase in India's tax system, aiming to boost affordability, business competitiveness, and compliance, while driving inclusive growth and economic transformation. Regular rate reviews, fiscal monitoring, and taxpayer awareness will further build trust, expand the tax base, and enhance revenue sustainability.