Why in News?

The Enforcement Directorate has reported conviction rate of 94% under Prevention of Money Laundering Act cases and helped recover over ₹34,000 crore for victims.

What is meant by Money Laundering?

- It is the processing of criminal proceeds to disguise their illegal origin. This process enables criminal to enjoy these profits without jeopardising their source.

- 3 Stages of Money Laundering:

- Placement (moving the funds from direct association with the crime)

- Layering (disguising the trail to foil pursuit)

- Integration (making the money available to the criminal from what seem to be legitimate sources).

About Enforcement Directorate: (Headquarter: New Delhi)

|

Despite its crucial role in combating economic crimes, ED faces several operational and structural challenges that impact its effectiveness and credibility.

Challenges faced by the Enforcement Directorate (ED):

Operational Challenges:

- Overreaching Jurisdiction and Federal Friction: ED's actions have been subject to criticism by Supreme Court for sometimes exceeding its jurisdiction and potentially "violating the federal structure".

- Political Targeting and Loss of Independence: Concerns frequently surface regarding the agency's operational independence due to allegations of political influence and partisan motivations.

- Resource and Manpower Constraints: Sanctioned strength of ED has not increased since 2011, despite assuming additional responsibilities like enforcing the Fugitive Economic Offenders Act (FEOA), 2018.

Structural and Legal Challenges:

- Broad Discretionary Powers: Expansive powers vested in the ED under the PMLA, including the authority to arrest, provisionally attach assets, and reversed burden of proof, have generated debates regarding their potential negative impact on due process and civil liberties.

- Judicial Backlogs and Constitutional Hurdles: Pending constitutional challenges to the PMLA before the Apex Court have delayed numerous trials, a factor identified by the FATF.

- Inter-Agency Litigation and Resource Drain: Accused individuals frequently launch a complex web of litigations straining resources and delaying the resolution of cases.

Emerging Technological Challenges:

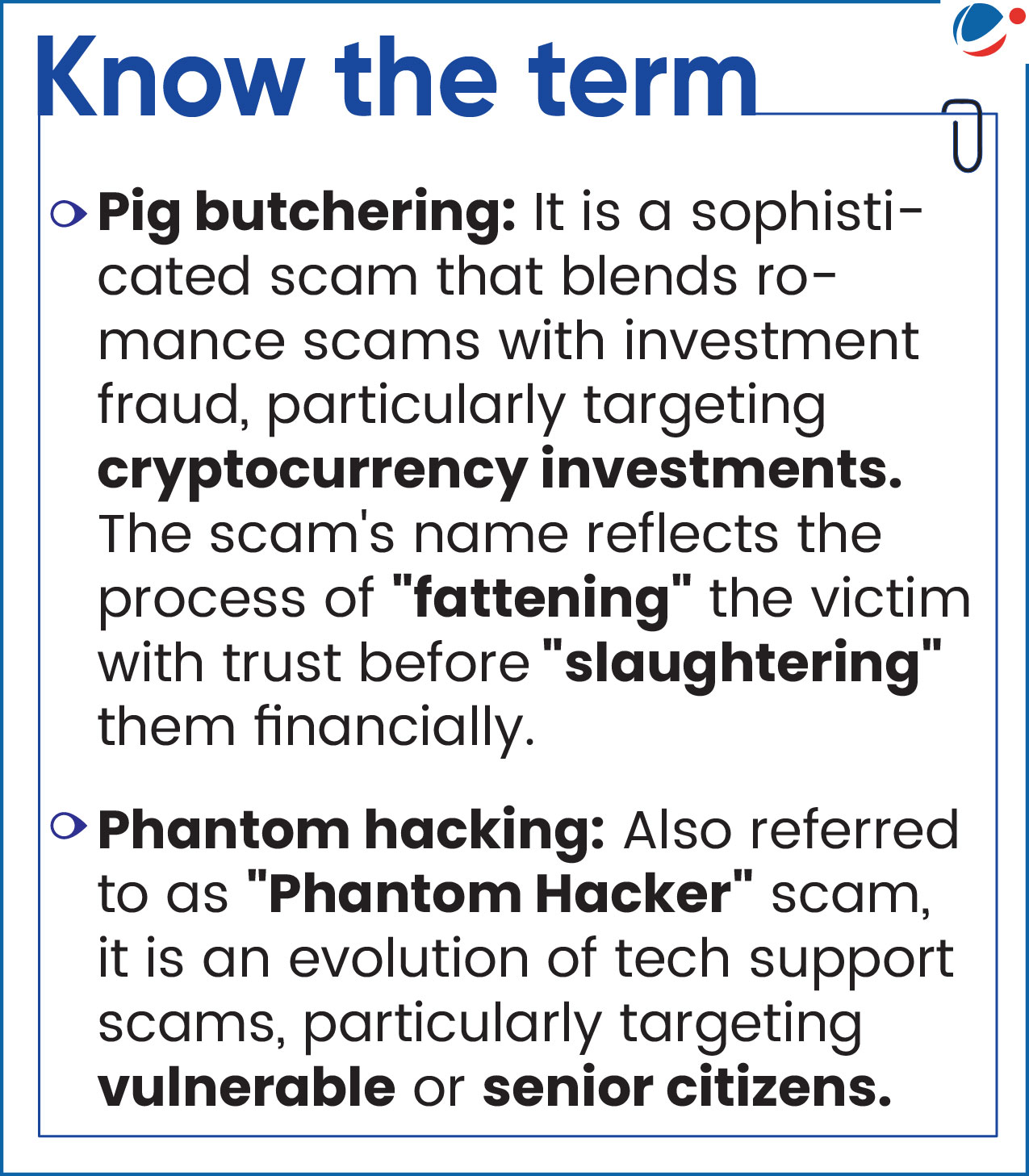

- Surge in Digital and Crypto Fraud: ED faces a rapidly evolving financial crime environment marked by a notable surge in cyber and crypto-related frauds such as Pig Butchering and Phantom Hacking.

- Implementation Gaps: FATF evaluation flagged gaps in AML/CFT implementation among smaller financial entities, Virtual Asset Service Providers (VASPs) and weak due diligence for domestic Politically Exposed Persons & poor cash monitoring by precious metal/stone dealers.

Key Judgements regarding ED:

|

Way Ahead for Strengthening the Enforcement Directorate

- Strict adherence to Due Process: Strict adherence to due process through well-defined Standard Operating Procedures can help counter allegations of political bias and harassment.

- Evidence-Based Investigations: Reorienting the ED towards intelligence-driven probes and focusing on evidence-backed prosecutions can improve conviction rates and strengthen institutional credibility.

- Enhance Human Resources and Expertise: There is a need to increase manpower of ED based on the country's size, risks, and the volume and complexity of ML investigations, as recommended by the FATF.

- Deployment of latest technology: E.g. ED uses advanced analytical AI/ML tools of the Financial Intelligence Unit (FIU) to detect suspicious monetary patterns.

- Harmonization among different agencies: E.g: Insolvency and Bankruptcy Board & ED have arrived at a solution to address problem related to the interface between the insolvency law and the PMLA in resolving stressed assets.