India’s Outlook to positive from stable

S&P Global Ratings revised its outlook on India to positive from stable and affirmed its ‘BBB-‘ long-term and ‘A-3’ short-term unsolicited foreign and local currency sovereign credit ratings.

Sovereign Credit Ratings

- Definition: A sovereign credit rating is a measurement of a government’s ability to repay its debt.

- Credit ratings map the probability of default and therefore reflect the willingness and ability of borrower to meet its obligations.

- Parameters: Typically, rating agencies use various parameters to rate a sovereign including growth rate, inflation, government debt, short-term external debt as a percentage of GDP, and political stability.

- Ratings: Sovereign credit ratings broadly rate countries as either investment grade or speculative grade, with the latter projected to have a higher likelihood of default on borrowings.

- The ratings vary from AAA (highest rating) to D (lowest rating) and the threshold of Investment grade is considered to be BBB- for S&P and Fitch and Baa3 for Moody’s.

- Significance: When favorable, these ratings can facilitate countries to access global capital markets and foreign investment.

- Tags :

- Credit Rating Agencies

- Sovereign Credit Ratings

Global Economic Prospects Report’

World Bank released ‘Global Economic Prospects Report’

- Report called for a significant acceleration in public investments by Emerging Markets and Developing Economies (EMDEs) to meet their development goals.

Key highlights

- Investment Level:

- Public investment averages about 25% of total investment in the median EMDE.

- Public investment in these economies has experienced a historic slowdown in the past decade

- Benefits

- Economic growth: Increasing public investment by 1% of GDP can boost GDP by over 1.5% and raise private investment by 2.2% in the medium term.

- However, public investment may also crowd out private investment, especially when fiscal space is limited and additional fiscal stimulus raises sovereign risk and borrowing costs for the private sector

- Sustainability of growth: Public investment can be critical in delivering public goods or services that may not be privately profitable, such as public health care and education.

- Economic growth: Increasing public investment by 1% of GDP can boost GDP by over 1.5% and raise private investment by 2.2% in the medium term.

Recommendations (“three Es” package of policy priorities) to harness the benefits of public investment

- Expansion of fiscal space: Improve tax collection efficiency, enhance fiscal frameworks, and curtail unproductive spending.

- Efficiency of public investment: Tackling corruption, and poor governance, facilitating public-private partnerships, etc.

- Enhanced global support: Coordinated financial support and effective technical assistance are imperative for structural reforms.

About public investment

|

- Tags :

- World Bank

- Public Investment

- Global Economic Prospects Report’

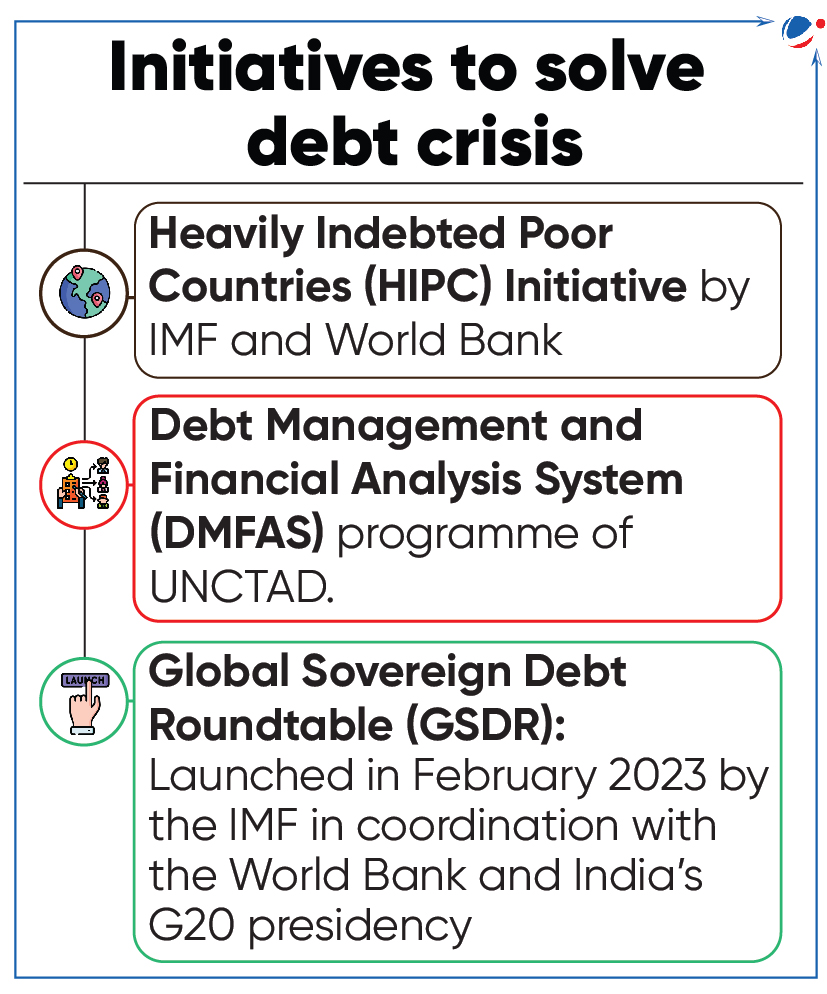

UNCTAD’s Report on Growing Public Debt

‘A World of Debt Report 2024: A growing burden to global prosperity’ released by UN Trade and Development (UNCTAD). Report highlights alarming surge in global public debt and proposes a plan to revamp global financial system to tackle current debt crisis.

- Public debt refers to general government domestic and external debt.

Key highlights of Report

- Debt surge: In 2023, global public debt reached historic peak of $97 trillion.

- Drivers: Cascading crises and sluggish and uneven performance of global economy.

- Regional Disparity: Public debt in developing countries (accounting for 30% of global total) is rising at twice the rate of developed countries.

- In 2023, India’s public debt reached US$ 2.9 trillion, accounting for 82.7% as a share of GDP.

Implications of high public debt:

- High fiscal burden: More than half of developing countries allocate at least 8% of government revenues to interest payments.

- Decreased developmental spending: 3.3 billion individuals reside in nations where interest payments exceed spending on education and health combined.

- Climate inaction: Interest outweighs climate investments in emerging and developing countries.

Roadmap to finance sustainable development:

- Inclusive International Financial Architecture with increased participation of developing countries in its governance.

- Provide greater liquidity in times of crisis expanding contingency finance through IMF instruments.

- Scaling up affordable long-term financing through transformation and expansion of Multilateral Development Banks.

- Tags :

- UN Trade and Development

- Global Debt

- A World of Debt Report 2024

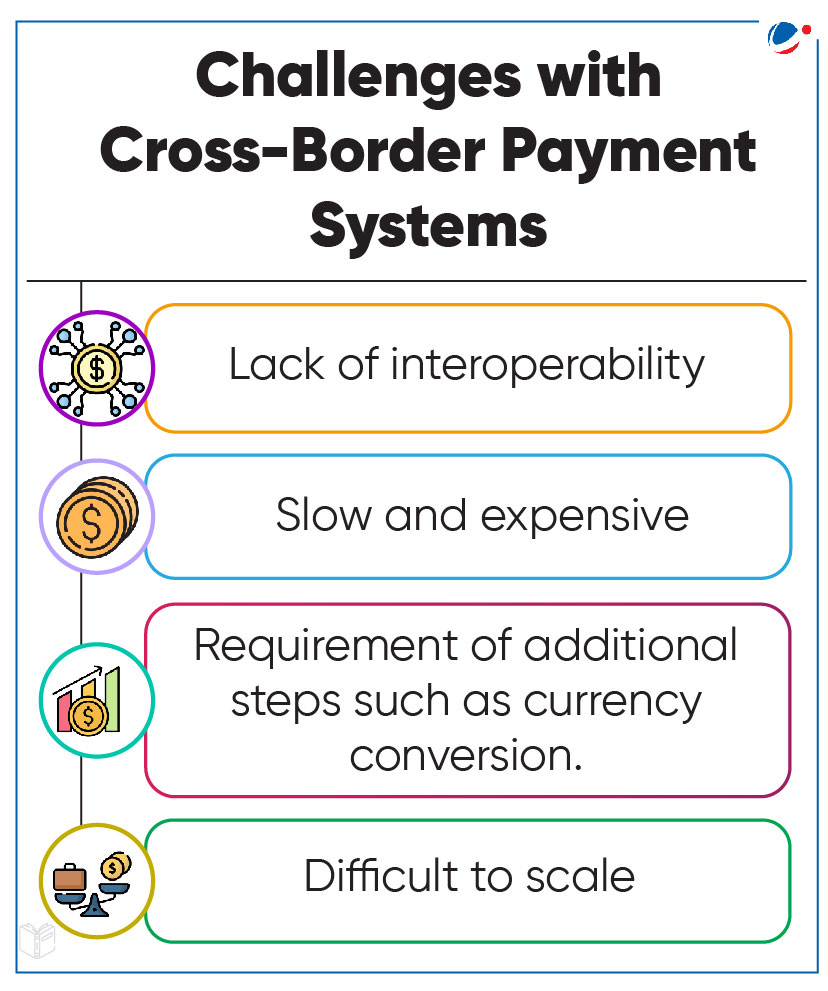

Reserve Bank of India (RBI) joins Project Nexus

Nexus is a multilateral international initiative to enable instant cross-border retail payments by interlinking domestic Instant Payments Systems (IPS).

- An IPS is an electronic payments system which facilitates inter-bank fund transfer and sends confirmation of payment to the receiver and originator within a minute or less. E.g. Unified Payments Interface (UPI).

About Project Nexus

- Conceptualized by the Innovation Hub of the Bank for International Settlements (BIS).

- BIS was established in 1930 with its head office in Basel, Switzerland and is owned by 63 central banks, including RBI.

- It will connectIPS of four ASEAN countries (Malaysia, Philippines, Singapore, and Thailand) and India and is expected to go live by 2026.

- Nexus is designed to standardize the way domestic IPS connects to one another.

- Rather than an IPS operator building custom connections for every new country to which it connects, the operator only needs to make one connection to Nexus.

- It aims to achieve G20 targets of enabling cheaper, faster, more transparent and accessible cross-border payments.

Benefits of Project Nexus

- Simplifies cross-border payments, reducing complexity, cost, and transaction time.

- It offers complementary low-cost and scalable rail for all payment service providers.

- It bridges gaps in interoperability by fostering standardisation and harmonisation across diverse systems.

- Tags :

- Cross-Border Payments

- Project Nexus

- Instant Payments Systems

Variable Repo Rate (VRR)

The recent VRR auction by Reserve Bank of India (RBI) witnessed a good response from banks.

About VRR

- When RBI desires to infuse liquidity in the economy but Banks are not eager to borrow from RBI at Repo Rates as interest rates in economy may already be lower, in that case RBI allows Banks to borrow at VRR decided by market generally lower than Repo Rate (though not less than Reverse Repo Rate) for duration more than One Day.

- Repo Rate is the rate at which Banks borrow money from RBI which is fixed by RBI.

- The borrowing duration is more than One Day and usually up to 14 days.

- It is a tool to inject short-term liquidity into the banking system.

- Similarly Variable Rate Reverse Repo (VRRR) is conducted to absorb the excess liquidity from the system.

- Tags :

- Repo Rate

- Variable Repo Rate (VRR)

Secured Overnight Financing Rate

SBI raised 100 million dollar through its London branch by selling 3-year senior unsecured floating-rate bonds above the Secured Overnight Financing Rate (SOFR).

About SOFR

- It is the overnight interest rate for US dollar-denominated loans and derivatives.

- It sets the rate at which banks can borrow cash from individuals or other banks overnight.

- It is collateralised by the US treasury securities market.

- It is the US replacement for London Interbank Offered Rate (LIBOR).

- LIBOR provided loan issuers with a benchmark for setting interest rates on different financial products

- Tags :

- Secured Overnight Financing Rate

- London Interbank Offered Rate