IEEFA’s report examines five critical minerals - cobalt, copper, graphite, lithium and nickel - from perspectives of import dependency, trade dynamics, domestic availability, and global price fluctuations.

- Report finds that India remains heavily reliant on imports for these critical minerals, with 100% external dependence for lithium, cobalt, and nickel.

- India’s demand for critical minerals is expected to more than double by 2030.

About Critical Minerals

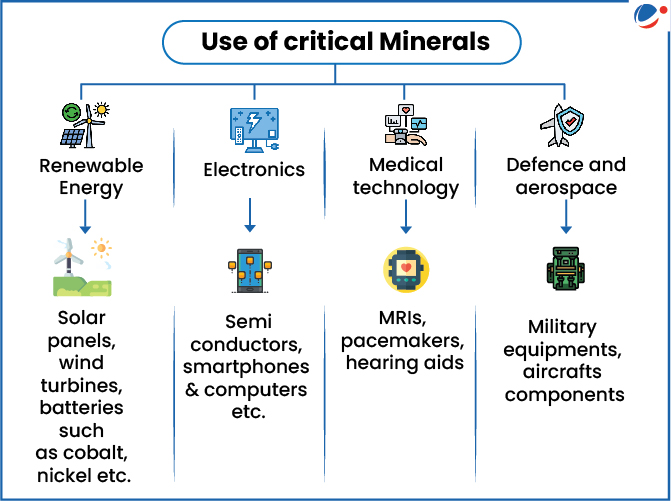

- A mineral is labelled as critical when risk of supply shortage and associated impact on economy is (relatively) higher than other raw materials.

Concern related to Critical Minerals import dependence

- Strategic Vulnerability: Dependence on a few key suppliers, especially China.

- Price Volatility: Fluctuations in global demand and supply may impact manufacturing cost and energy production.

- Economic Implications: Rising import costs can erode India's competitiveness in global markets.

- Renewable Energy Goals at Risk: High import could hinder India’s transition to clean energy and its electric vehicle ambitions.

Report Suggestions

- India must develop strategies to mitigate risks associated with mineral dependencies and foster domestic production.

- Explore investment opportunities in resource-rich, friendly nations, like Australia, Chile, Ghana and South Africa.

Measures taken by India

|