The guidelines have been issued in exercise of powers conferred by Sections 21 and 35A read with Section 56 of Banking Regulation Act, 1949.

Revised Guidelines

- Enhancement of several loan limits:-

- Education : upto ₹25 lakh for individuals (including vocational courses)

- Social Infrastructure: upto ₹8 crore per borrower for setting up schools, drinking water facilities etc

- Other: Housing Loan Limits, Agriculture Loans etc

- Focused on ‘Renewable Energy’:

- Upto ₹35 crore for renewable energy-based power generators and for renewable energy based public utilities such as street lighting systems, remote village electrification.

- The limit is ₹10 lakh for individual households.

- Upto ₹35 crore for renewable energy-based power generators and for renewable energy based public utilities such as street lighting systems, remote village electrification.

- Revision of PSL target for Primary (Urban) Co-operative Bank (UCBs)

- Total Priority Sector: 60%

- Micro Enterprises: 7.5%

- Advances to Weaker Sections: 12%

- Expansion of the category of ‘Weaker Sections’:-

- It now includes Transgenders along with earlier categories of:-

- Small and Marginal Farmers, Distressed farmers indebted to non-institutional lenders, Artisans, Individual members of SHGs or Joint Liability Groups,

- Scheduled Castes & Scheduled Tribes, Persons with disabilities, Minority communities notified by Government of India

- Individual women beneficiaries up to ₹2 lakh (This limit is not applicable to UCBs)

- It now includes Transgenders along with earlier categories of:-

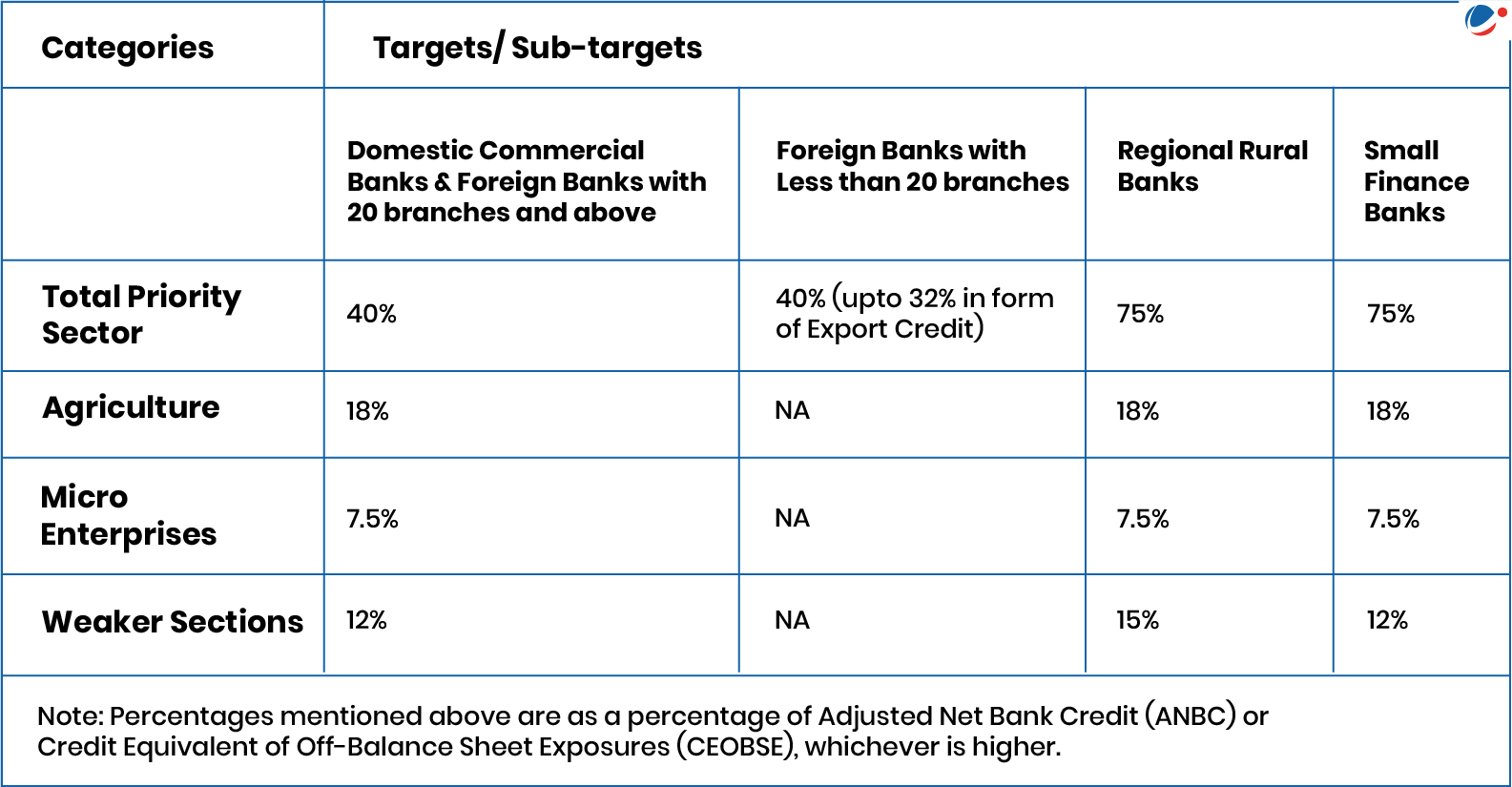

Targets/Sub-targets for Priority sector