Why in the news?

The Standing Committee on Finance presented a report on the Performance Review and Regulation of the Insurance Sector to the Lok Sabha.

Status of Insurance Sector in India

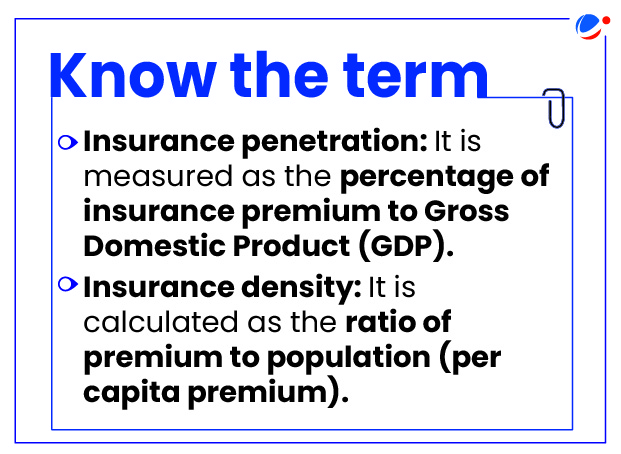

- Insurance penetration: Insurance penetration increased from 2.71% in 2001-02 to 4.2% in 2021-22.

- The global average was 7% in 2021-22.

- Insurance density: Insurance density has increased from $11.5 in 2001-02 to $91 in 2021-22.

- The global average was $874 in 2021-22.

- Insurance business: India ranked 10th in the global insurance business with a market share of 1.85% in 2021.

- Number of insurers registered increased from 6 in 2000 to 70 in June 2023.

- Sector concentration: Indian insurance sector is heavily tilted towards the life insurance segment which has a share of 76%.

- Globally, the share of the life insurance business in total premiums was 43.7% in 2021.

Regulation of the Insurance Sector in India

- Insurance Act 1938: It provides the legislative framework for the functioning of insurance businesses and regulates the relationship between an insurer, its policyholders, its shareholders, and the regulator.

- Insurance Regulatory and Development Authority of India (IRDAI): It is a statutory body, established under the provisions of the Insurance Regulatory and Development Authority Act, 1999.

- Its functions include regulation, promotion and ensuring orderly growth of the insurance business and reinsurance business.

- It also certifies insurance companies, protects the interests of policyholders, and adjudicates disputes.

- Insurance Division: Insurance Division of the Department of Financial Services, the Ministry of Finance is responsible for policy formulation and administration of the following Acts:

- The Insurance Act, 1938,

- The Life Insurance Corporation Act, 1956,

- The General Insurance Business (Nationalisation) Act, 1972

- The IRDA Act, 1999,

- The Actuaries Act, 2006

Issues and Recommendations highlighted by the Committee

Parameters | Issues and Challenges | Recommendations |

Microinsurance distribution |

|

|

Composite Licensing |

|

|

Health Insurance |

|

|

Performance of Public Sector Insurance Companies |

|

|

Government Insurance Schemes |

|

|

Other recommendations

- Awareness: There is an imminent need to create mass-level awareness about the need and benefits of having necessary insurance protection of diverse insurance products, not just life insurance.

- Such campaign can be similar to the successful campaign by Association of Mutual Funds of India (AMFI).

- Open Architecture: Introduce ‘open architecture’ concept for insurance agents, which enables agents to associate with multiple insurance companies.

- It can result in higher insurance penetration, financial inclusion and lower distribution costs.

- Goods and Services Tax (GST): Rationalize GST rate on insurance products, especially health and term insurance, which is 18% at present.

- High GST rate results in a high premium burden, which acts as a deterrent to getting insurance policies.

- Unclaimed policies: A central portal like UDGAM (RBI portal for claiming unclaimed deposits) be created as there are a significant number of unclaimed policies that are currently being transferred to the Senior Citizen Fund.

- Capital requirement: RBI, on behalf of the Government of India, can issue ‘on-tap’ bonds of up to 50 years (current maximum tenure – 40 years) for investment by insurance companies.