Why in the News?

Reserve Bank of India (RBI) released State Finances: A Study of Budgets Of 2024-25 Report with theme 'Fiscal Reforms by States'.

Fiscal Position of the State Governments as per Report

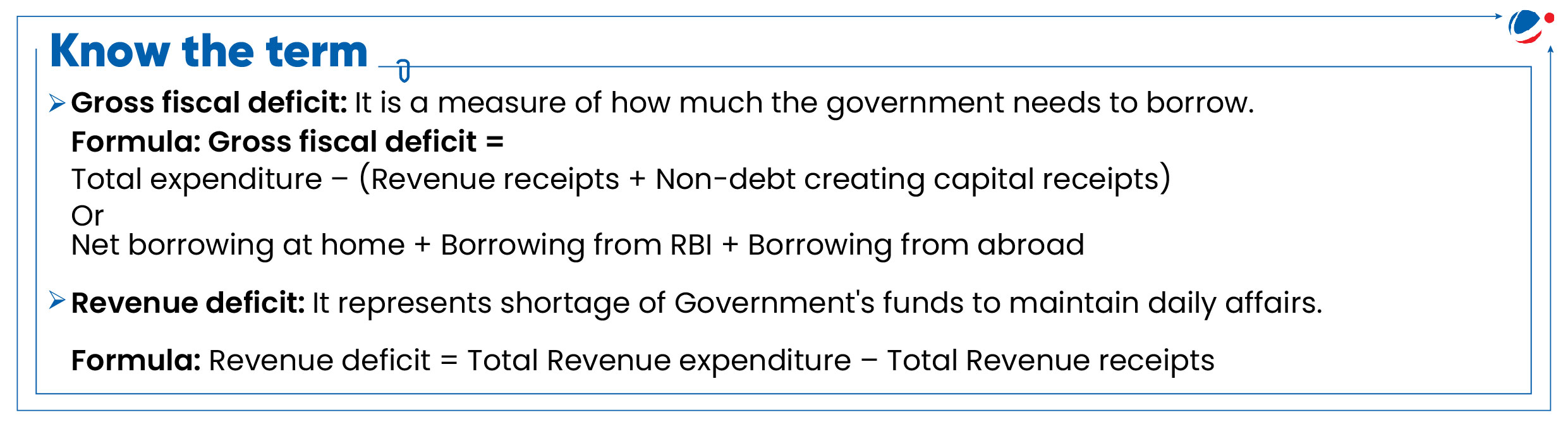

- Decline in consolidated Gross Fiscal Deficit (GFD): State governments contained their gross fiscal deficit within 3% of Gross Domestic Product (GDP) during 2021-22 to 2023-24.

- GFD of the Indian States fell from an average of 4.3% of GDP during 1998-99 to 2003-04 to 2.7% of GDP during 2004-05 to 2023-24.

- Revenue Deficit: States maintained the revenue deficit at 0.2% of GDP during 2021-22 to 2023-24.

- Expenditure quality improved: Capital outlay, expenditure that leads to creation of physical/financial assets, increased to 2.6% of GDP in 2023-24 from 2.2% in 2022-23.

- Debt of States: Declined from 31.8% of GDP at end-March 2004 to 28.5% of GDP at end-March 2024

- However, it remains well above the level of 20% recommended by the Fiscal Responsibility and Budget Management (FRBM) Review Committee (2017) and FRBM Act.

About FRBM Act, 2003

|

Why Fiscal Deficit is still high in some States?

- Reduction in Transfer of Money from Centre to state: There has been a decline in grants from the Centre attributed to the cessation of GST compensation and the tapering of Finance Commission grants.

- E.g., Finance Commission Grants under proviso to Article 275(1) have reduced by more than 18% in 2022-23 to 2023-24. (Budget 2024-25)

- Power Sector Losses: Electricity distribution companies (DISCOMs) continue to remain a drag on State finances with total accumulated losses at ₹6.5lakh crore by 2022-23 (2.4% of GDP). (Power Finance Corporation, 2024).

- Rising subsidy burden: Driven by farm loan waivers, free/subsidised services (like electricity to agriculture and households, transport), cash transfers to farmers, youth, women etc.

- Unreliable fiscal data and reporting: States reporting standards are often inconsistent with those of the Finance Commissions, the Union Ministry of Finance, and the Reserve Bank.

- This leads to ambiguities in reporting, differential treatments of public account items, non-uniform nomenclature, and underreporting of debt liabilities.

- Other issues in fiscal management in states:

- Absence of Fiscal Data: Quarterly data release is hampered by non-availability in the case of a few States/UTs and delays in others.

- Delays in the setting up of State Finance Commissions (SFCs): It hampers fund transfer to Local government bodies which remain heavily reliant on transfers from the State governments.

- Too many Central government schemes: They reduce flexibility of State government spending and dilute the spirit of cooperative fiscal federalism.

- Economic, climatic and geopolitical uncertainties: They exacerbate the fiscal risks, leading to large divergences of actual revenues and expenditures from the budgeted estimates.

Fiscal Reforms undertaken by States

- Fiscal Responsibility Legislations (FRLs): Enactment of FRBM Acts/FRLs by State government has incentivised formulation of fiscal policy strategies, creation of Medium-Term Fiscal Plans (MTFPs) and improvement in transparency.

- Institutional Reforms: Setting up of State Institutions of Transformation with help of NITI Aayog by several states Assam, Gujarat and others.

- Expenditure Reforms:

- Moving towards Direct Benefit Transfer (DBT to remove duplicate/fake beneficiaries and plug leakages;

- Adoption of the National Pension System (NPS) (replacing the Old Pension Scheme);

- Implementation of a Single Nodal Agency (SNA) for the centrally sponsored schemes etc.

- Tax Reforms:

- Adoption of goods and services tax (GST);

- Modernisation of Tax Administration through e-governance measures such as e-registration, e-filing, and e-payment streamlining compliance and reducing costs while addressing revenue leakages.

- Greater reliance on market-based financing: Share of market borrowings in financing of GFD increasing from 17% in 2005-06 to 79% in 2024-25.

- Power Sector Reforms: UDAY scheme, fifteenth finance commission allowed an additional borrowing space of 0.5% of GSDP for States for power sector reforms.

Best practicesFor Streamlining compliance and enhancing transparency:

Leveraging technology to boost revenue

|

Way Forward: Recommendations of the report

- "Next generation" fiscal rules:

- Some space for counter-cyclical fiscal policy to provide flexibility in the face of large exogenous shocks.

- Switzerland stands as a prime example of decentralised fiscal governance (States have autonomy to create fiscal rules).

- Risk-based fiscal framework that considers state-level fundamentals. E.g., States with higher debt levels and slower growth rates may require stricter fiscal rules than States with lower debt levels.

- Medium-Term Expenditure Framework (MTEF) which links policymaking to budgeting by ensuring forward planning for fund availability and improving accountability.

- Some space for counter-cyclical fiscal policy to provide flexibility in the face of large exogenous shocks.

- Data Driven Fiscal Policy Making: Data analytics, machine learning and artificial intelligence can be used for improved taxation system.

- Improving fiscal data generation and dissemination processes: E.g., data on outstanding liabilities can be provided in a uniform format.

- Contain DISCOM Losses: Through Initiatives aimed at enhancing productivity, reducing transmission and distribution losses, rationalising tariffs in accordance with the underlying cost of power supply, privatising generation and distribution etc.

- Other recommended measures:

- Rationalisation of subsidies and centrally sponsored schemes (CSS).

- Implementing of the 'golden rule', which requires that all current/revenue expenditures be financed from current revenue while capital expenditure is financed through borrowings.

- Refine the process of appointment of SFCs so that timely and adequate resources are available to the local bodies.

- Outcome budgeting, i.e., linking spending to measurable outcomes, to foster accountability and targeted resource use.

- Adoption of climate budgeting.

Conclusion

The State governments have demonstrated fiscal prudence. However the state finances will increase due to several developmental expenditure and liabilities. Therefore, the reforms have to be undertaken which would strengthen public finances and ensure fiscal sustainability and management.