PSL was formalized in 1972 to facilitate flow of credit to such sectors, which though creditworthy, are unable to access credit from formal financial institutions.

Key findings of the study:

- Improved asset quality: PSL is responsive to asset quality, with higher PSL growth enhancing overall bank asset quality.

- Developing niche in specific PSL segments: Since introduction of Priority Sector Lending Certificates (PSLCs), share of PSL in total bank credit has increased, enabling certain banks to specialize in specific PSL segments.

- Achieving PSL Targets: Lending to the priority sector has consistently exceeded 40% across various periods and bank categories, influenced by individual banks’ strategies.

- PSBs have frequently met their 18% agricultural lending target.

About PSL

- Objective: To ensure that vulnerable sections of society and underdeveloped areas get access to credit.

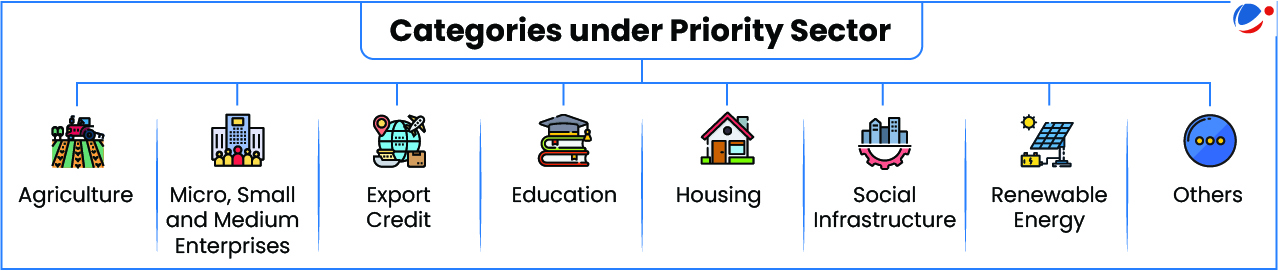

- PSL Targets: Banks have to mandatorily allocate a portion of their Adjusted Net Bank Credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposure (CEOBE), whichever is higher, towards PSL.

- Mandated target differs for different banks and is 40% for Scheduled commercial banks and foreign banks (with 20 or more branches) while it is 75% for Regional Rural Banks and Small Finance Banks.

- Urban Cooperative banks have to allocate 65% to PSL in FY 2024-25 but will have to increase to 75% in FY 2025-26.