India Secures 14.3% of Global Remittances: World Bank

According to the World Bank, India secured 14.3% of Global Remittances in 2024, highest share ever.

- Remittances are financial transfers made by individuals working abroad to support their families in their home country.

Trend in Remittances flow

- Top five recipients in 2024: India at $129 billion (Compared to $125 billion in 2023), Mexico, China, Philippines, and Pakistan, driven by recovery in job markets in high-income countries of OECD.

- Remittances to Low- and Middle-Income Countries are projected to surge to $685 billion in 2024, with 5.8% growth rate.

- China's share of global remittances dropped to 5.3% in 2024, its lowest share in two decades, due to reduced low-skilled emigration stemming from its rising economic prosperity and aging population.

Factors responsible for High Remittances in India

- Scale of Migration: India has one of the largest diaspora populations in world, with over 18 million Indians living abroad as of 2023 (UN World Migration Report 2024).

- Shift in Destination Trends: Increasingly, Indian migrants are moving to high-income economies like US, UK, and Australia.

- Skilled and Unskilled Labor: Indian migrants range from highly skilled professionals (IT, healthcare) to semi-skilled and unskilled labourers.

Significance of High Remittances

- For Recipient Households: used for essential expenses like food, healthcare, and education, directly improving living standards.

- For Macro-economy: Major source of foreign exchange, reduced reliance on foreign aid, funding current account deficits and fiscal shortfalls etc.

- Tags :

- Remittances

India Remains the Fastest-Growing Economy: Word Bank

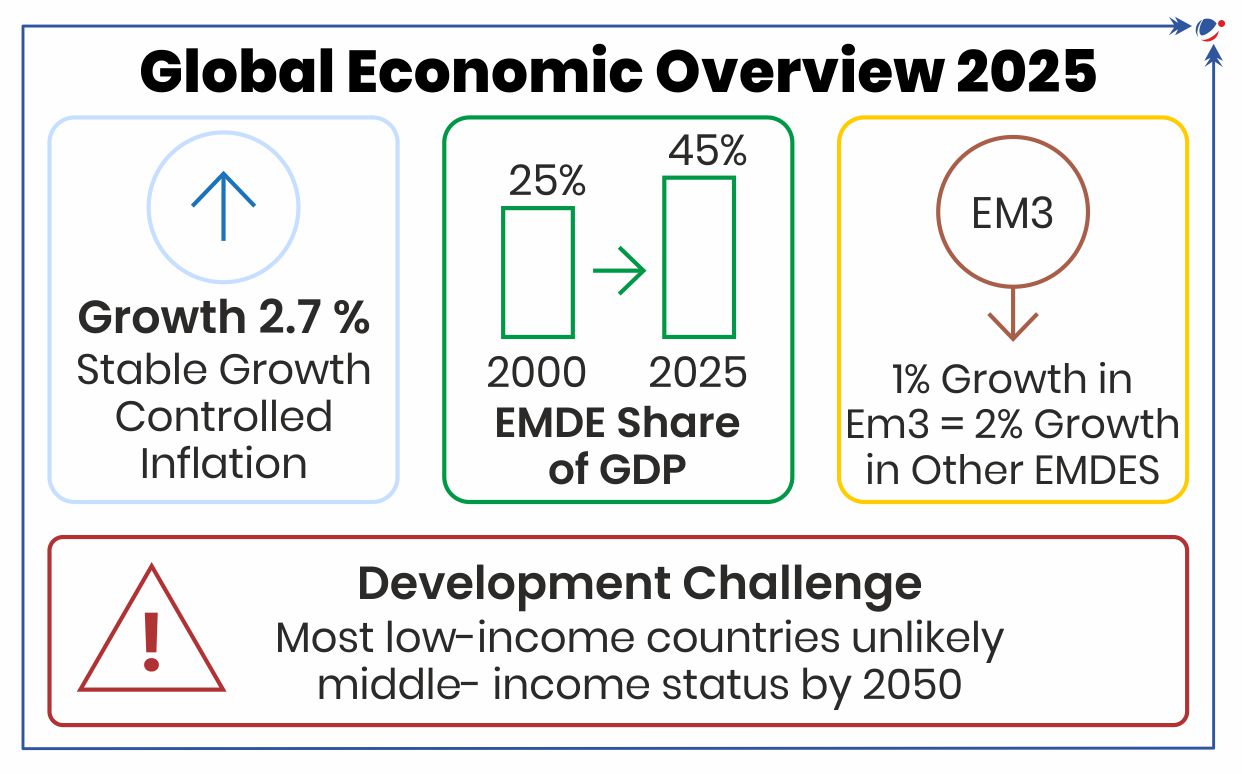

World Bank's latest Global Economic Prospects Report gives overview of Global Economy for the 1st quarter of 21st Century (refer to the infographic).

Key Highlights

- Rising influence of EMDEs: Emerging Market and Developing Economies (EMDEs), led by the EM3 nations (China, India, and Brazil), have significantly increased their share in the global economy from 2000 to 2025.

- India's Growth Leadership: India remains the fastest-growing economy, with projected 6.7% annual growth through FY26–FY27, slightly below the 7% achieved in 2022.

Factors reflecting robustness of Indian Economy

- Strong Sectoral Performance:

- Services: The services sector is set for sustained expansion, with rising service exports boosting trade integration in South Asia since 2000.

- Manufacturing: Manufacturing is strengthened to grow, driven by government initiatives to improve logistics and tax reforms.

- Solid Economic Foundation

- Fiscal Health: Shrinking fiscal deficits and increasing tax revenues.

- Investment Outlook: Investment growth overall is expected to be steady, with rising private investment, supported by healthy corporate balance sheets and easing financing conditions.

- Consumption outlook: Private consumption growth is expected to be boosted by a strengthening labor market, expanding credit, and declining inflation.

- However, government consumption growth is likely to remain contained.

The report identifies key challenges, including rising protectionism, geopolitical tensions, mounting debt burdens, and climate change-related costs. Success requires focused policies on boosting investment, productivity, and macroeconomic stability while effectively managing external pressures.

- Tags :

- Indian Economy

- fastest growing economy

Articles Sources

Government To Borrow Rs 3.94 Lakh Crore Via Treasury Bills (T-Bills)

Recently, RBI notified the calendar for issuance of T-Bills, one of the types of Government Securities (G-Sec).

Government Securities Market in India

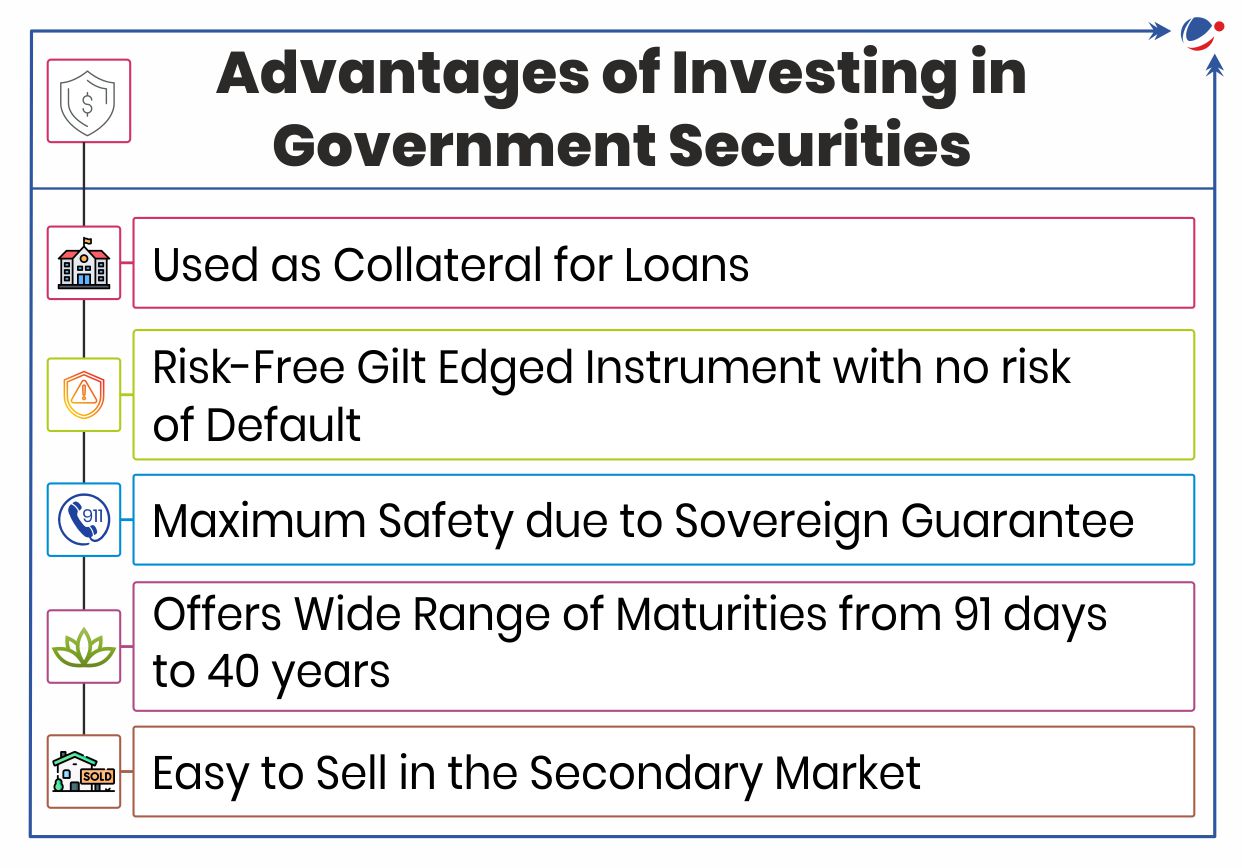

- About: It is a tradeable instrument issued by the Central or State Governments acknowledging the Government’s debt obligation.

- Issued by: RBI through an auction on its electronic, E-Kuber platform.

- RBI’s Public Debt Office (PDO) acts as its registry/ depository.

- Major Participants: Commercial banks, Primary Dealers, Insurance companies, co-operative banks, regional rural banks, mutual funds, retail investors (non-competitive bidding section), etc.

Types of G-Secs

- Short term with original maturities less than a year. E.g., T-Bills

- Treasury Bills (T-bills)

- Money market and short term debt instruments issued by the Government of India (GOI)

- Zero coupon securities and pay no interest.

- Issued at a discount and redeemed at the face value at maturity.

- Issued in 3 tenors, namely, 91 day, 182 day and 364 day.

- Cash Management Bills (CMBs)

- Short-term (maturities less than 91 days) instrument introduced by the GOI in 2010 to meet the temporary mismatches in its cash flows.

- Treasury Bills (T-bills)

- Long Term, with original maturity of one or more year. E.g., Government Bonds or Dated Securities.

- Dated G-Sec: They carry a fixed or floating interest rate paid on the face value, on half-yearly basis, with maturities ranging from 5 to 40 years.

- SDLs: Dated securities issued by State Governments with half-yearly interest payments.

- NOTE: In India, the Central Government issues both T-Bills and bonds or dated securities while the State Governments issue only bonds or dated securities, called the State Development Loans (SDLs).

- Tags :

- G-Secs

- Treasury Bills

Articles Sources

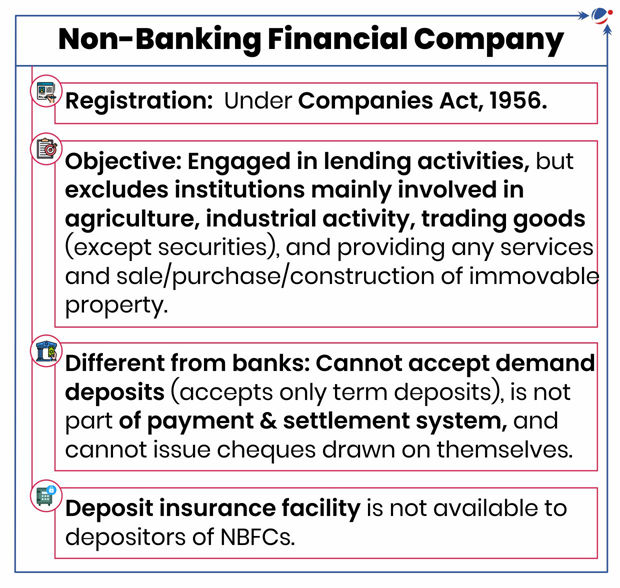

RBI Releases List Of NBFCs in The Upper Layer (NBFC-UL) For 2024-25

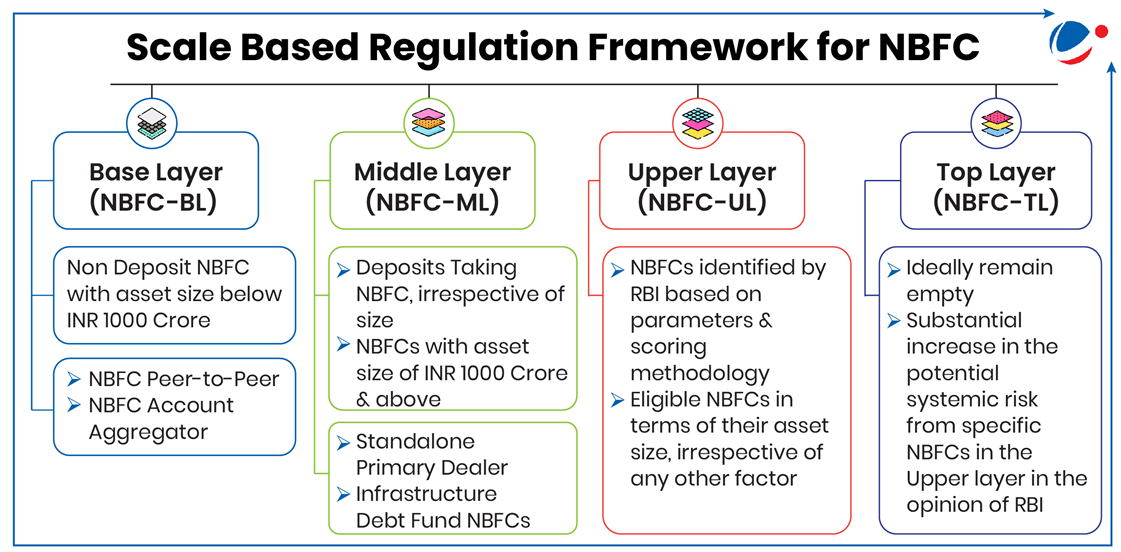

- The list includes LIC Housing Finance Limited, PNB Housing Finance Limited, Shriram Finance Limited etc and is in accordance with Scale Based Regulation (SBR) , a regulatory framework for NBFCs.

- Once an NBFC is classified as NBFC-UL, it is subjected to enhanced regulatory requirement, at least for a period of 5 years

- The framework has been introduced to mitigate contagion or systemic risks, apply the principle of proportionality in regulation and strengthen quality and improve risk management of NBFCs.

Scale Based Regulation Framework for Non-Banking Financial Company (NBFCs)

- Tags :

- NBFCs

- Scale Based Regulation

- Non-bank finance companies (NBFC)

BAANKNET (Bank Asset Auction Network)

Ministry of Finance launched a revamped e-auction portal ‘BAANKNET’.

About BAANKNET

- It consolidates information on e-auction properties from all Public Sector Banks and offers a one-stop destination for buyers and investors to discover a wide range of assets.

- The listings include residential properties such as flats, independent houses, and open plots, as well as commercial properties, industrial land and buildings, shops, etc.

- The platform is expected to unlock the value of distressed assets and boosting investor confidence.

- Tags :

- BAANKNET

- property auction by banks

Prepaid Payment Instruments (PPI)

RBI has allowed Prepaid Payment Instruments (PPIs) holders to make and receive Unified Payments Interface (UPI) payments through third-party mobile applications.

About PPI

- PPIs are instruments that facilitate the purchase of goods and services, conduct of financial services, enable remittance facilities, etc., against the value stored therein. E.g. Mobile wallets, digital wallets, gift cards

- PPIs can be issued by banks and non-banks.

- Classified under two types: small PPIs (issued after obtaining minimum details of the PPI holder) and Full KYC PPIs.

- Tags :

- UPI

- PPI

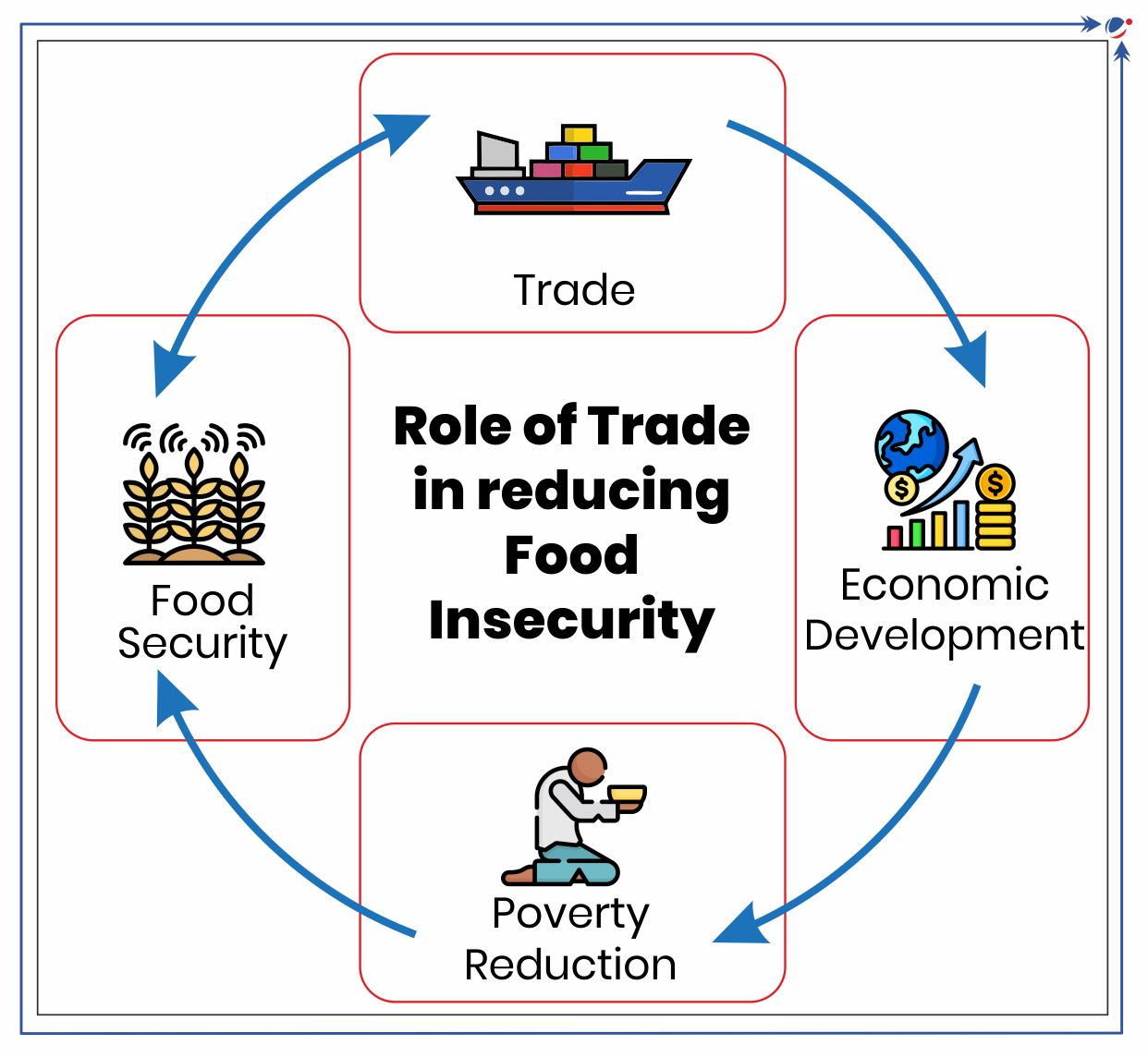

Role of Trade in Reducing Food Insecurity

The report analyses various drivers of food insecurity and how can trade play a mitigating role in addressing these challenges.

Role of Trade

- Sustainable supplies can ensure food availability: E.g. 30% of Africa’s cereal needs are met through imports

- Stabilizing prices and markets: E.g. Black Sea Initiative (brokered by UN and Türkiye) during Russia-Ukraine war facilitated food and fertilizer exports

Challenges

- Higher costs: E.g. non-tariff measures, such as sanitary standards, can increase food import costs by 20%.

- High Import dependency: It exposes countries to global price hikes and supply chain disruptions.

- Rising transportation costs: It affects developing and least developed countries disproportionately.

Recommendations

- Reach a “Short Term Export Facilitation Mechanism to Combat Severe Food Insecurity” at international forum, such as WTO

- Reduce trade barriers & boost export capacities of food insecure countries.

- Invest in trade infrastructure such as ports, transport networks and storage facilities to shorten supply chains and reduce vulnerabilities to global disruptions especially for low-income countries.

- Support climate-smart and sustainable farming in developing countries

Factsheet

Drivers of global hunger

|

- Tags :

- Trade and Food Security

- food insecurity