Why in the News?

Recently, Prime Minister of India inaugurated the Vizhinjam International Transhipment Deepwater Multipurpose Seaport in Kerala.

About Vizhinjam International Seaport

- It is India's First Deep-Water Container Transshipment Port. This ambitious project is taken up by Government of Kerala.

- Purpose: It is designed primarily to cater container transhipment besides multi-purpose and break-bulk cargo.

- Developmental model: The port is being currently developed in landlord model with a Public Private Partnership (PPP) component on a Design, Build, Finance, Operate, and Transfer (DBFOT) basis.

- Key advantages of Vizhinjam Port

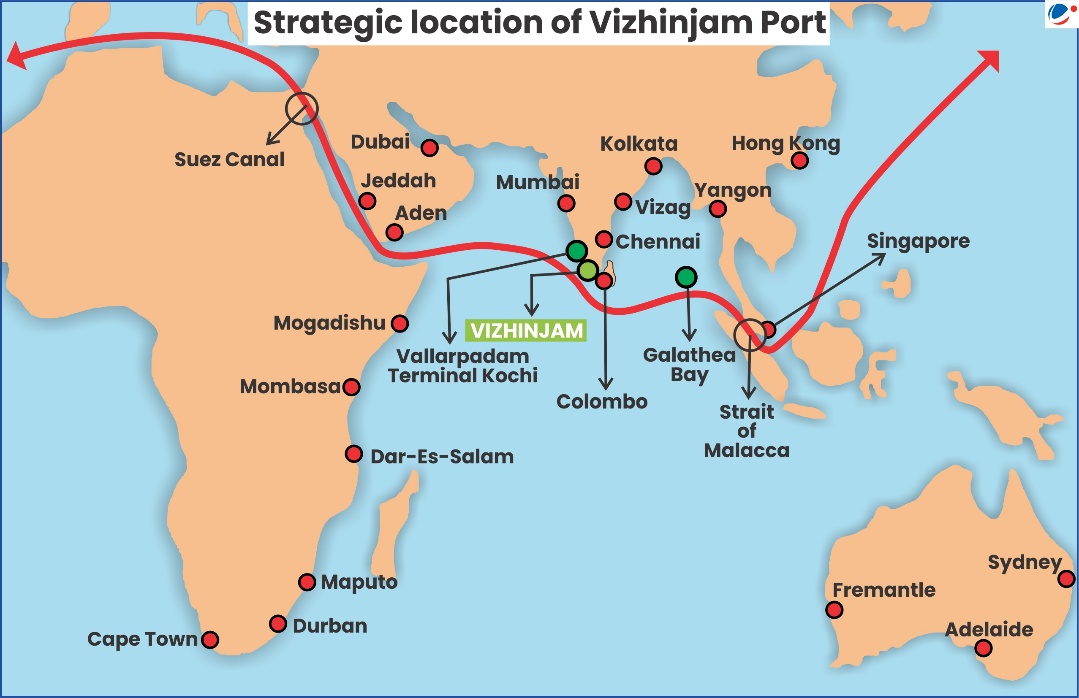

- Strategic Location: Located just 10 nautical miles from the busy international shipping route connecting Europe, Persian Gulf and Far East.

- Naturally Advantaged: Vizhinjam can leverage its natural depth to host even ultra-large next-gen container ships requiring 20m+ drafts.

- Scalable infrastructure: With capacity for 18,000+ TEU (Twenty-Foot Equivalent Unit) ships, scalable infrastructure to match cargo growth and minimal siltation.

What is Transshipment?

- It is the transfer of cargo or containers from one vessel to another during transit to the final Port of Destination (PoD).

- The three primary ways a transshipment hub can be inserted into existing maritime networks are:

- Hub-and-spoke: It connects short-distance feeder lines and ports with long distance deep-sea lines, linking regional and global shipping networks.

- Intersection: It usually involves the movement of cargo between large ships since deep-sea routes are prone to economies of scale.

- Relay: Where transshipment hub connects shipping routes along the same region, but serving different port calls.

Need to develop India as Transshipment hub

- High Dependency on Foreign Transshipment Hubs: Currently, nearly 75% of India's transshipped cargo is handled at ports outside India.

- Colombo (Sri Lanka), Singapore and Klang (Malaysia) handle more than 85% of this cargo.

- Proximity to major trade routes: Liners prefer minimum deviation from their courses when selecting a transshipment port. East–West trade route (Far East to Europe and US via Malacca Straits and Suez Canal) is the global trade route.

- Vizhinjam and Galathea Bay are promising locations given their position at ~6-10 Nautical Miles deviation (0.2-1 hours) from the Suez route.

- Loss of Revenue: Indian ports lose up to $200-220 Million of potential revenue each year on transshipment handling of cargo originating/destined for India.

- Lack of deep-draft ports: The current ports in southern India (such as Cochin and V.O. Chidambaranar) have insufficient drafts of 14.5m and 14.2m respectively whereas major transshipment hubs across the world have at least 18-meter draft.

- Infrastructure: In line with global ports, India needs to develop world-class infrastructure and dedicated superstructure (up to 6 cranes may be required for a ship towards ensuring international standards in productivity of about 200 moves per hour).

Challenges in developing India as Transshipment hub

- High Cost: Total transshipment charges at Indian ports such as JNPT are 43% higher as compared to Colombo port (13%) mainly on account of vessel related charges.

- Far distance to international maritime trade route: All current ports on East and West coasts of India are at a distance of greater than 5 hours of voyage from the international shipping route in comparison to Colombo which is at 0.5-1 hours of voyage.

- Lack of tax benefits: There is currently no major incentive available for setting up of the transshipment free trade zone as the fiscal incentives available under the SEZ policy have been withdrawn.

- Land availability on islands: Based on the current guidelines, minimum 25 hectares (~61 acres) of land is required for developing a Free Trade Zone.

- Due to their existing ecology on islands, the availability of the contiguous land as per area requirement of the guidelines would be difficult.

- Custom process: Customs clearance process in Indian ports is perceived to be more complex and time-consuming than global ports which lead to a high turnaround time and cargo lead times.

Other Initiatives taken to promote Transshipment in India

- International Container Transhipment Port (ICTP), at Galathea Bay, Great Nicobar Island: Greater Nicobar is in close proximity to Malacca Strait (the route for East West trade route) and also to Singapore (a major transshipment and bunkering hub).

- Kochi International Transhipment Terminal: The Terminal is located on the Vallarpadam Island in Kochi. It can handle cargo up to one million TEUs (Twenty-foot equivalent units) per annum.

- Amrit Kaal Vision 2047: Formulated by the Ministry of Ports, Shipping & Waterways, builds on the Maritime India Vision 2030 and aims to develop world-class ports and promote inland water transport, coastal shipping etc.

- Cabotage Law Relaxation: Cabotage rule under section 407 of the Merchant Shipping Act, 1958 has relaxed the licencing requirements of foreign flag ships for transportation of EXIM laden containers for transhipment purposes in India.

- Cabotage is the practice of imposing restrictions for movement of domestic cargo by foreign flagged vessels.

Way Forward

- Positive economics of cargo logistics: Need to ensure ~15-20% lower costs in comparison to Colombo through lower port charges and potential waiver of service tax (at least for initial ~5 years).

- Globally competitive: In countries such as US and Sri Lanka, dredging cost is partly borne by National Government. On similar lines, dredging cost would need to be partly borne by Government in order to make Indian ports globally competitive.

- Develop word class Mega Ports: 3 Ports (Vadhavan-JNPT Cluster, Paradip Port, and Deendayal Port) have been identified to be developed into Mega Ports with >300 million Tonnes Per Annum (MTPA) capacity.

- Simplify customs process: To promote ease of doing business, customs processes need to be digitized for Gateway Cargo. Further, there should be no customs involvement for transshipment cargo.

- Infrastructure Modernization: As part of the long-term strategic interventions, Major ports need to move to a landlord model and bring in more private sector participation to drive operational efficiency.

Conclusion

With its strategic location, natural depth, and scalable infrastructure, Vizhinjam port holds the potential to reduce dependency on foreign ports and reclaim transshipment revenue. However, realizing this vision will require concerted efforts in policy reform, infrastructure modernization, and cost competitiveness to fully leverage India's maritime advantage.