A recent article by the RBI titled ‘Peeling the Layers: A Review of the NBFC Sector in Recent Times’ highlighted that the Non-Banking Financial Companies (NBFCs) remain resilient post introduction of Scale-based Regulation (SBR) in 2022.

- NBFCs are companies registered under the Companies Act, 1956/ 2013 engaged in business of loans and advances, acquisition of marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business, etc.

What is SBR for NBFCs?

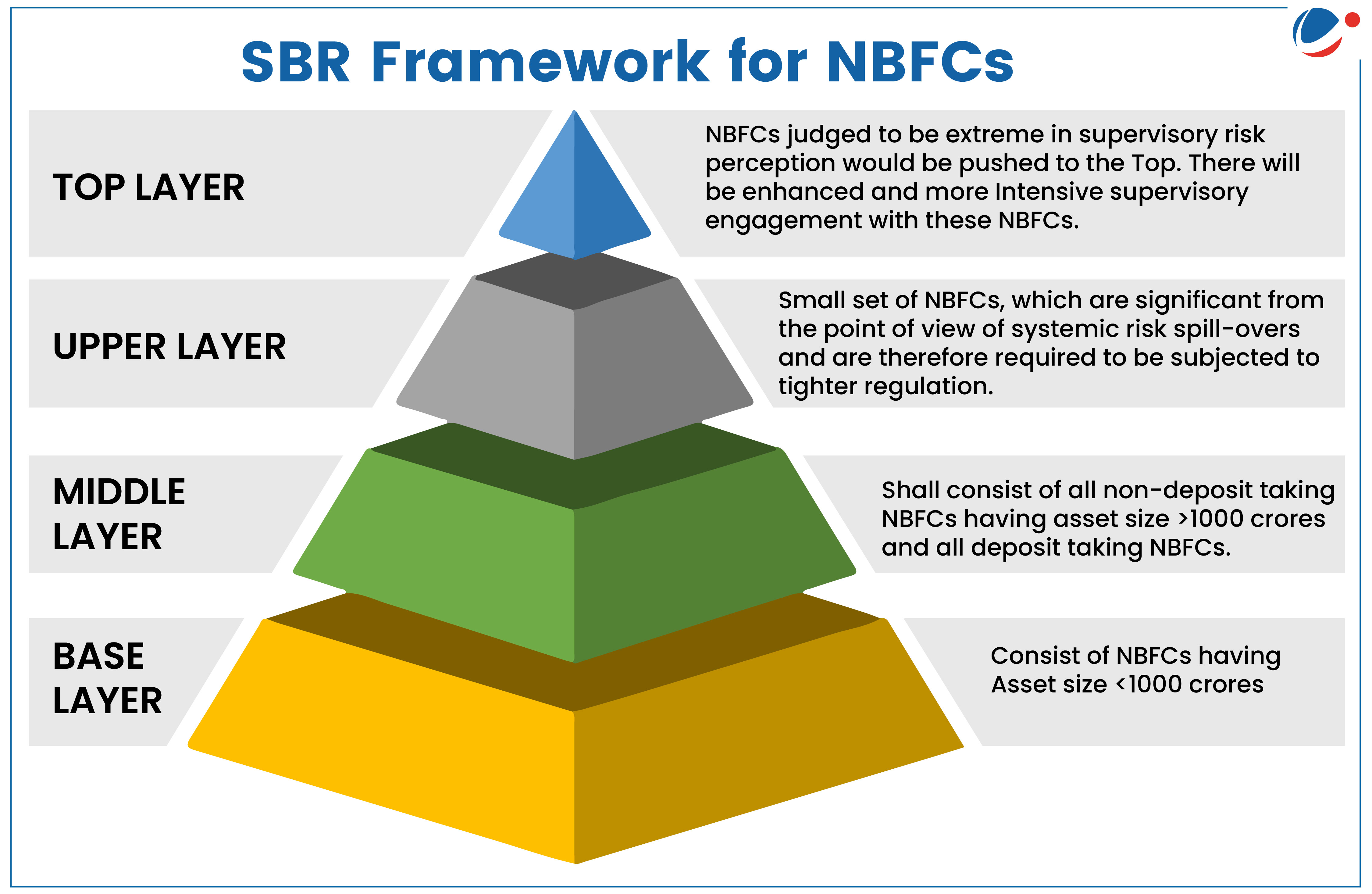

- Segregation of NBFCs: NBFCs are segregated into four layers based on their size, activity, and perceived level of riskiness. (Refer to Infographic).

- Differential regulations: Each tier is subject to different regulatory requirements, tailored to its size and risk profile.

Key Highlights of the RBI Article

- Resilient Financial Landscape: The sector maintained double-digit credit growth, adequate capital levels, a low delinquency ratio, and registered a consistent rise in profitability.

- Improved Asset Quality: Gross Non-performing Asset (GNPA) ratio has decreased, from 4.4% & 10.6% in December 2021 to 2.4% & 6.3% in December 2023 for government NBFCs & nongovernment NBFCs respectively.

- Concerns: Emerging risks and challenges, especially from cyber-security and climate risks.