Why in the News?

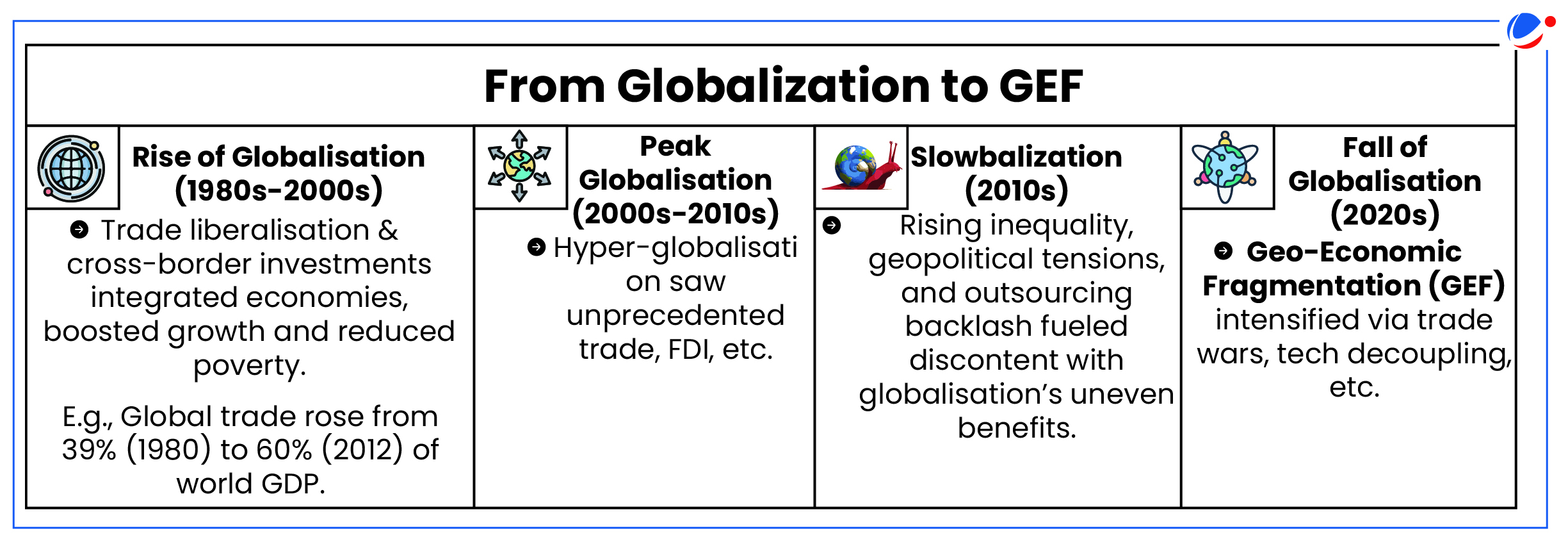

The Economic Survey 2024-25 highlights a global shift from economic integration to geo-economic fragmentation (GEF), signalling the replacement of globalization.

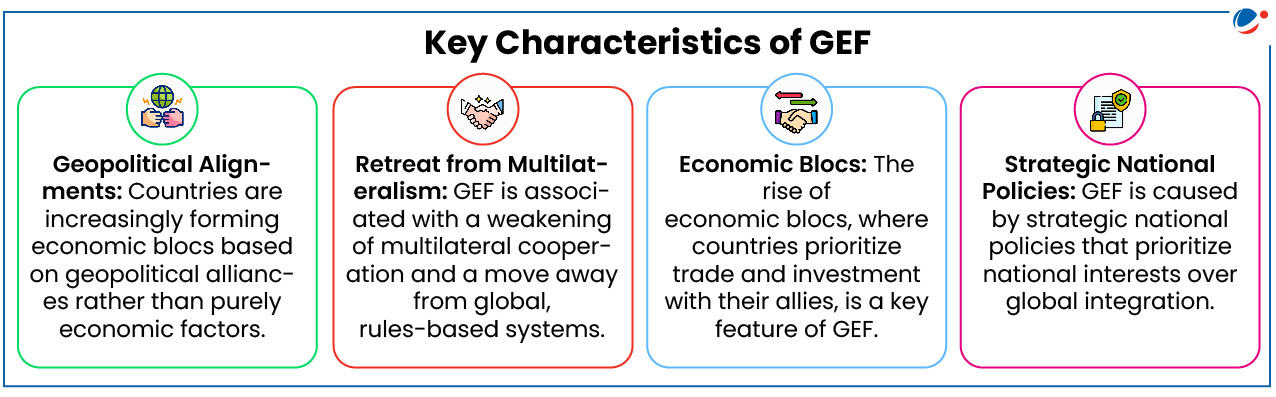

About Geo-Economic Fragmentation (GEF): The New Global Reality

- Geo-Economic Fragmentation (GEF): Is defined as a policy-driven reversal of global economic integration often guided by strategic considerations. Examples:

- 'Friendshoring': Growing trade practice where supply chain networks are focused on countries regarded as political and economic allies.

- E.g., Apple is shifting some of its iPhone production to India from China.

- 'Nearshoring': When a company chooses to work with a supplier that's located in a nearby country.

- E.g., a German company outsourcing customer service to a team in Poland.

- 'Friendshoring': Growing trade practice where supply chain networks are focused on countries regarded as political and economic allies.

- Channels of GEF: GEF manifests through various channels, including trade restrictions, reduced capital movements, disruptions in technology diffusion, Tech Decoupling etc.

- Technological decoupling involves reducing or ending international trade and investment in high-tech industries due to national security, intellectual property, and data privacy concerns.

- E.g. USA's Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act (2022) aims to boost domestic manufacturing of semiconductor whereas China's 'Made in China 2025' initiative focuses on achieving global leadership in high-tech industries.

- Technological decoupling involves reducing or ending international trade and investment in high-tech industries due to national security, intellectual property, and data privacy concerns.

Impact of Geo-Economic Fragmentation (GEF)

- Economic Output Losses: Reduced trade due to increased barriers (e.g., tariffs, non-tariff barriers) can lower global domestic growth.

- India's goal to become a USD 5 trillion economy by FY28 and USD 6.3 trillion by FY30 can be threatened.

- Relocation of Foreign investment: Foreign investment moving towards geopolitically aligned countries isolates emerging markets, especially in developing economies.

- E.g., Foreign direct equity investments into India fell to a five-year low in FY24.

- Labor Market Effects: Limits on cross-border migration can deprive host economies of skills and reduce remittances to migrant-sending countries.

- Hinders multilateralism: GEF hinders multilateral efforts on climate change, pandemics, and other global challenges.

- Decline in globalization: Overall decline in globalization limits access to new markets, spread of technological innovation, access to capital, competition and cultural exchange.

Way Forward

- Strengthening Domestic Supply Chains: So as to ensure self-reliance in critical sectors like manufacturing, energy, and technology.

- E.g., Khanij Bidesh India Limited (KABIL) to secure mineral supplies, particularly lithium and cobalt, through overseas exploration and acquisition, with projects in Argentina, Australia, and Chile.

- Leveraging Regional Partnerships: Within the Indo-Pacific and build stronger trade and diplomatic relations with countries that share similar interests, ensuring better access to markets and resources.

- Groupings like BIMSTEC, Indo-Pacific Economic Framework for Prosperity (IPEF) can be utilized by India.

- Innovation and Technology: Particularly in sectors such as renewable energy, digital transformation, and AI.

Conclusion

Geo-economic fragmentation marks a shift from the post-Cold War free trade model that fuelled globalisation and hyper-globalisation. However, it would be too early to say that world is heading toward de-globalization where there is a fall in trade volumes or overall ratio of trade to GDP.

India's success in achieving its 2047 goals hinges on adapting to geo-economic fragmentation, focusing on domestic reforms, innovation, and strategic partnerships to drive sustainable growth and secure its global position.