RBI Revised NPAs Provisioning Norms for Co-operative Banks

Need for New Norms arises as some banks were not recognizing required provisions for Non-Performing Assets (NPAs) as an expense.

- These new norms (applicable to Urban, state and central co-operative banks) will bring uniformity in treatment of Bad & Doubtful Debt Reserve (BDDR).

- Several co-operative banks established BDDR for financial stability (For managing bad loans).

New Norms

- All provisions (related to “BDDR” or other head) under Income Recognition, Asset Classification, and Provisioning (IRACP) norms must be charged as an expense to Profit and Loss Account.

- After accounting for all provisions as per IRACP norms and other regulations, co-operative banks may make appropriations of net profits to BDDR.

Co-operative Banks

- Works on principle of cooperation and are owned and operated by their members.

- Can be divided into Rural and Urban co-operative banks.

Issues with co-operative Banks

- Regional Disparity: Almost 82 per cent of total UCBs and around 90 per cent branches of all UCBs are concentrated in Western and Southern regions of country (2020).

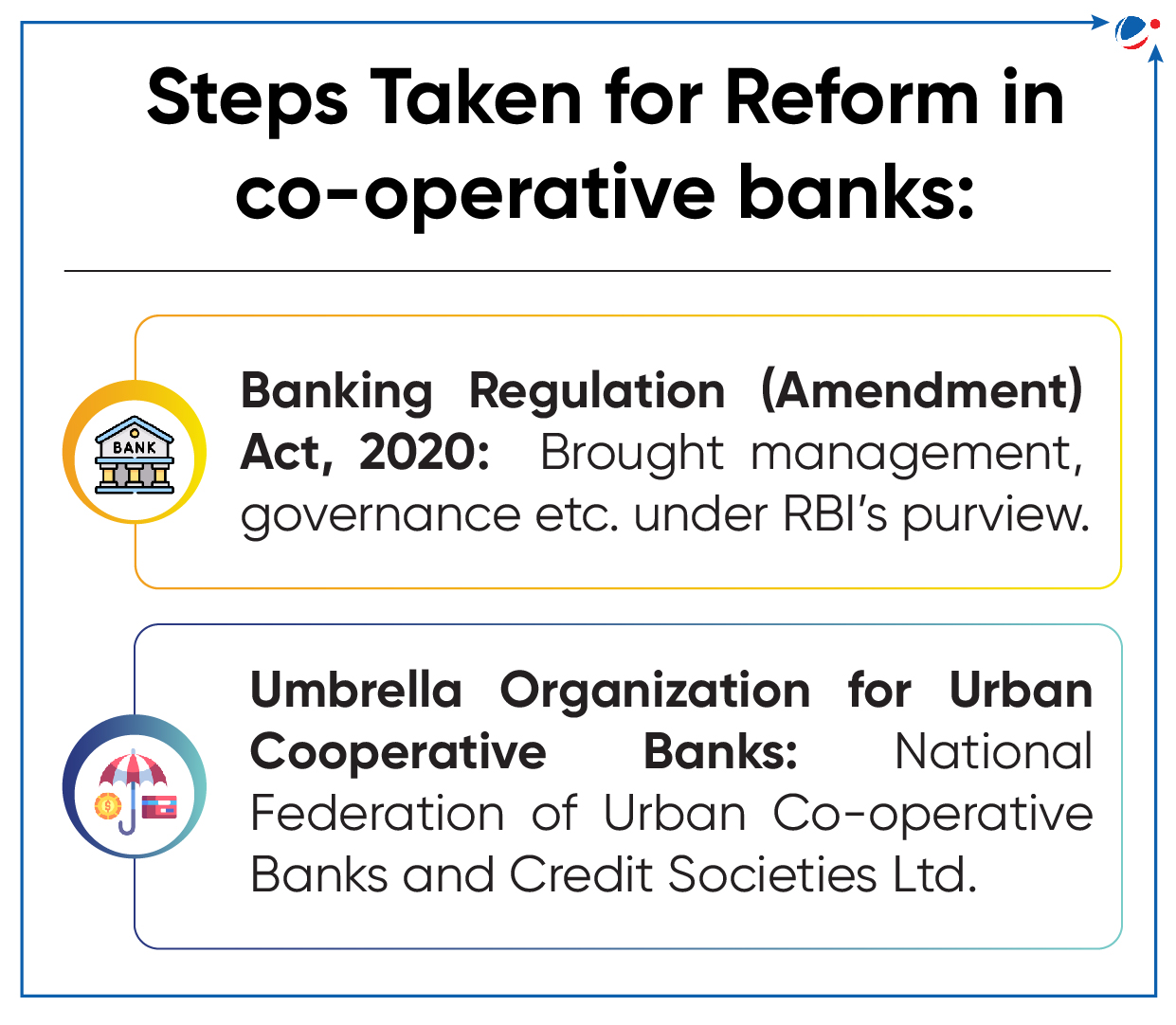

- Dual Regulation: Managerial, administrative activities are overseen by state governments while banking activities are regulated and supervised by RBI /NABARD.

- Other issues: Inadequate avenues for raising capital, High Gross NPAs etc.

- Tags :

- Non-Performing Assets

- Bad & Doubtful Debt Reserve

- Co-operative Banks

UN Global Tax Treaty

UN’s Ad Hoc Committee to Draft Terms of Reference for a United Nations Framework Convention on International Tax Cooperation approved a package of guidance for UN Global Tax Convention.

- It aims at establishing a UN Global Tax Treaty for legitimate, fair, stable, inclusive and effective international tax system.

- Developing countries (including India) largely voted in favour of treaty’s terms of reference while industrialized nations such as Australia, Israel, Japan, UK and USA voted against it.

Objectives of UN Global Tax Convention

- Strengthening international tax cooperation and making it inclusive and effective.

- Addressing existing tax-related challenges including digitalization and global operations of large Multinational Corporations (MNCs).

- Mobilize domestic resources and use tax policy for sustainable development.

- Accelerating implementation of Addis Ababa Action Agenda on Financing for Development and 2030 Agenda for SDGs.

Commitments of UN Global Tax Convention

- Fair allocation of taxing rights including equitable taxation of MNCs.

- Addressing tax-related illicit financial flows, tax evasion and tax avoidance by high-net worth individuals.

- Address taxation of income derived from cross-border services.

- Effective mutual administrative assistance in tax matters and resolution of tax disputes.

Other Global Initiative

|

- Tags :

- Global Tax Treaty

- UN Global Tax Convention

- OECD Global Minimum Tax

Articles Sources

Non-Tariff Measures (NTMs)

India is 2nd largest user of NTMs in 2023 as per WTO’s ‘World Tariff Profiles’ Report, 2024.

About Non-Tariff Measures (NTMs)

- NTMs are defined as policy measures, other than ordinary customs tariffs, that can be potentially detrimental to international trade in goods, changing quantities traded, prices, or both.

- Examples- Quotas or price controls, Sanitary and Phytosanitary measures, Technical Barriers to Trade, etc.

- Though many NTMs aim primarily at protecting public health or the environment, they also affect trade through information, compliance, and procedural costs.

- Tags :

- Quotas

- Sanitary and Phytosanitary Measures

- Non-Tariff Measures

Debt-for-Development Swaps (DEBT Swaps)

‘Debt for Development Swaps: An Approach Framework Paper’ has been released by the International Monetary Fund (IMF).

About Debt Swaps

- These are agreements between a government and one or more of its creditors to replace sovereign debt with one or more liabilities that include a spending commitment towards a specific development goal.

- Criteria that need to be considered in determining the appropriateness of swaps include country’s initial debt situation, net financial benefits etc.

- Classified into two categories, namely, bilateral (official bilateral debt is written-off) and commercial debt swaps (target debt held by private creditors).

- Development goals include nature conservation, climate action, education, nutrition, support for refugees, etc.

- Tags :

- International Monetary Fund (IMF)

- DEBT Swaps

- Debt for Development Swaps

World Trade Statistical Review (WTSR) 2023

It is the WTO’s flagship statistical publication.

- WTSR 2023 looks into the latest developments in world trade, featuring key data on global trade in merchandise and commercial services.

- Key highlights:

- India retains 8th position in global agriculture exports in 2023

- India ranked 18th in merchandise exports and 7th in services exports.

- China, USA and Germany remained the top three merchandise exporters in 2022.

- Tags :

- World Trade Organization

- World Trade Statistical Review