Why in the news?

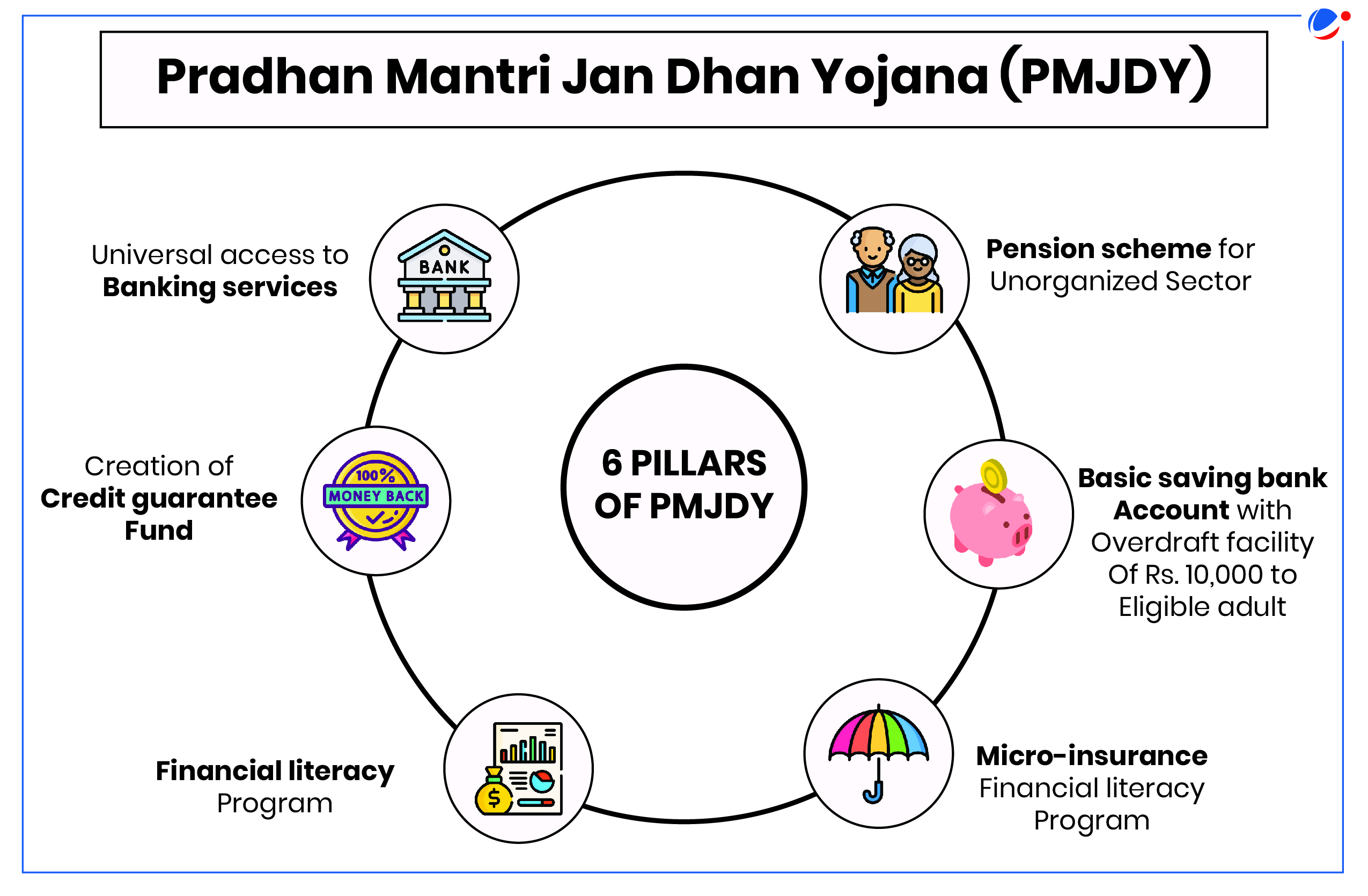

Recently, India celebrated the 10th anniversary of the Pradhan Mantri Jan Dhan Yojana (PMJDY), launched to promote Financial Inclusion in India.

What is Financial Inclusion?

- It means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered responsibly and sustainably (World Bank)

- Objective: To extend financial services to the large hitherto un-served population of the country to unlock its growth potential.

Significance of Financial Inclusion

- Plugging the Credit gap: Access to formal and adequate credit from the formal banking channels can fuel the enterprising spirit of the masses in order to create economic output and enhance income levels at the grassroots.

- It allows MSMEs to access credit, which can enhance their capacity to grow, generate jobs, and contribute to national GDP.

- Encouragement of Saving Habits: With access to banking services, people are encouraged to save money regularly.

- This can help increase capital formation in the country and provide an economic boost.

- Inclusive growth: Financial inclusion is critical for poverty reduction as this helps in transferring the benefits of economic growth and development to the lowest strata of the population.

- It creates a multiplier effect by encouraging investment in education and health, driving long-term economic development.

- Plug the subsidy gaps: The Government's push for Direct cash transfers to the recipient's bank accounts instead of providing subsidies inefficiently.

- Saving through Direct Benefit Transfer (DBT) during FY22-23 crossed ₹63,000 crore.

- Key enabler for the Sustainable Development Goals (SDGs): Financial inclusion has been identified as an enabler for 7 of the 17 Sustainable Development Goals.

- For instance, of the total accounts created through PMJDY, 55.6% of account holders are women, reflecting the scheme's significant impact on empowering women.

Challenges for Financial Inclusion

- Demand Side Factors: Lower income or asset holdings, lack of awareness about the financial products, high transaction costs, etc.

- Supply side challenges: Financial institutions' refusal to serve low-value and non-profitable consumers with uneven income.

- Digital and Infrastructure Gaps: The digital divide, inadequate mobile connectivity, and frequent power failures particularly in remote areas.

- Regulatory Barriers: Regulatory challenges, such as stringent Know-Your-Customer (KYC) requirements, make it difficult for low-income individuals to access financial services.

- Lack of Financial Literacy: Many potential users lack the basic financial literacy needed to effectively use formal financial services, which can lead to the exclusion of vulnerable groups.

- For instance, due to poor financial literacy, around 20% of the PMJDY Accounts are dormant and approximately 8.4% of the accounts currently have a zero balance.

- Gender and Socio-Economic Barriers: Women and rural populations still face significant barriers to financial access due to cultural norms, lower levels of literacy, and geographic isolation.

- Cybersecurity Risks: As financial systems increasingly rely on digital platforms, they become more vulnerable to cyberattacks, posing risks to the financial security of users.

Way Forward

- Foster Public-Private Partnerships: Collaborations between governments, financial institutions, and telecom companies can accelerate financial inclusion.

- Public policies should encourage private sector involvement in providing mobile money services and digital payment platforms.

- Promote Financial Literacy: RBI, in coordination with other banks and educational institutions, scan ensure financial inclusion as a subject from school to higher levels of education.

- Leverage Fintech Innovations: Fintech solutions like mobile banking, digital payments, and alternative credit scoring models can cater to unbanked populations by providing low-cost, scalable financial services.

- Tailored Financial Products: Financial institutions can offer customized products suited to the needs of low-income groups, such as microinsurance and pension schemes. E.g. PM Atal Pension Yojana.

About PMJDY

Key-achievements under PMJDY

|