Why in the news?

Recently, the Government set a target of 500 million tonnes of steel production by 2034.

About the Steel Sector in India

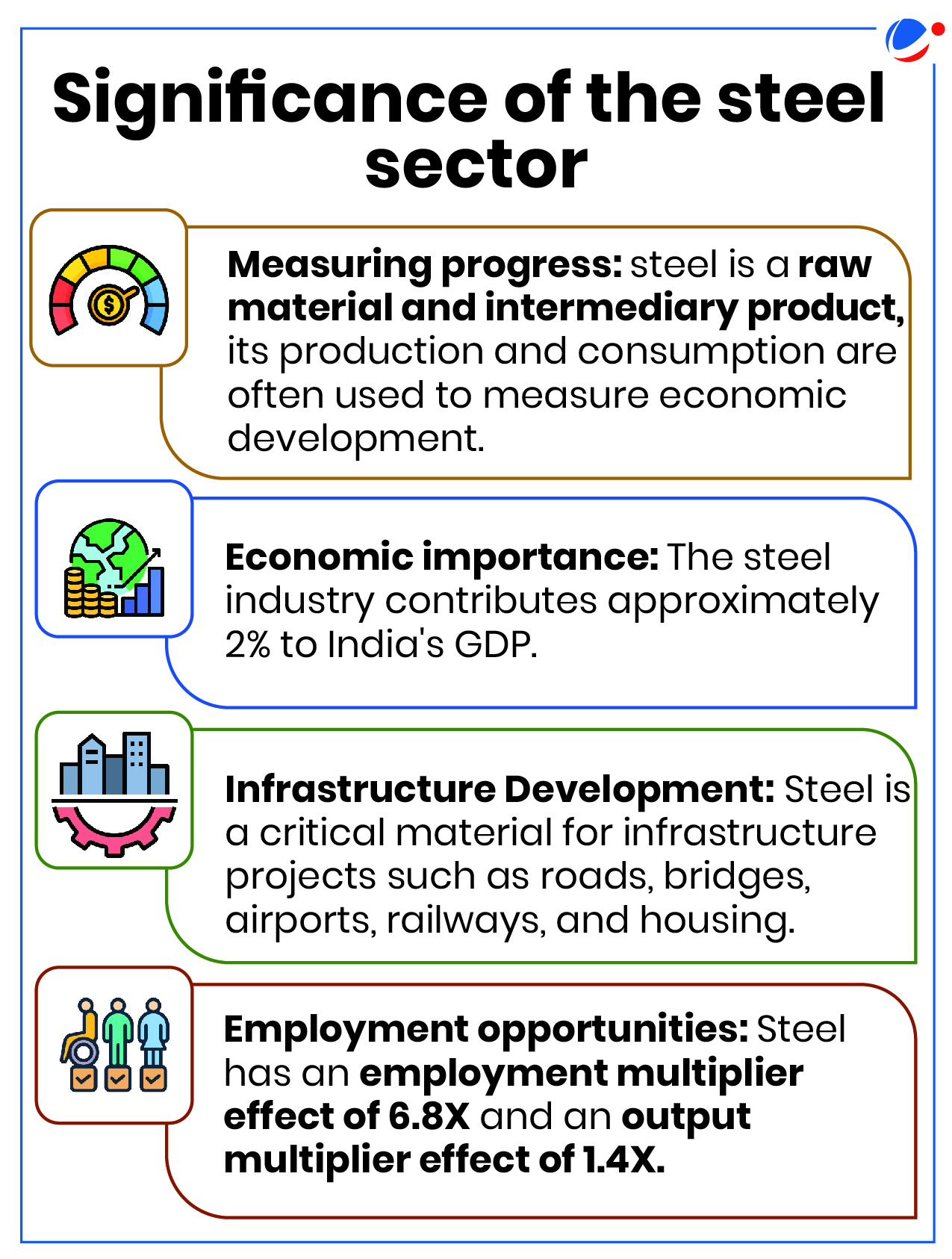

- Steel has traditionally occupied a top spot among metals and one of the primary forces behind industrialization.

- Steel is an alloy of iron and carbon containing less than 2% carbon and 1% manganese and small amounts of silicon, phosphorus, sulphur and oxygen. (with higher carbon content, it is known as cast iron)

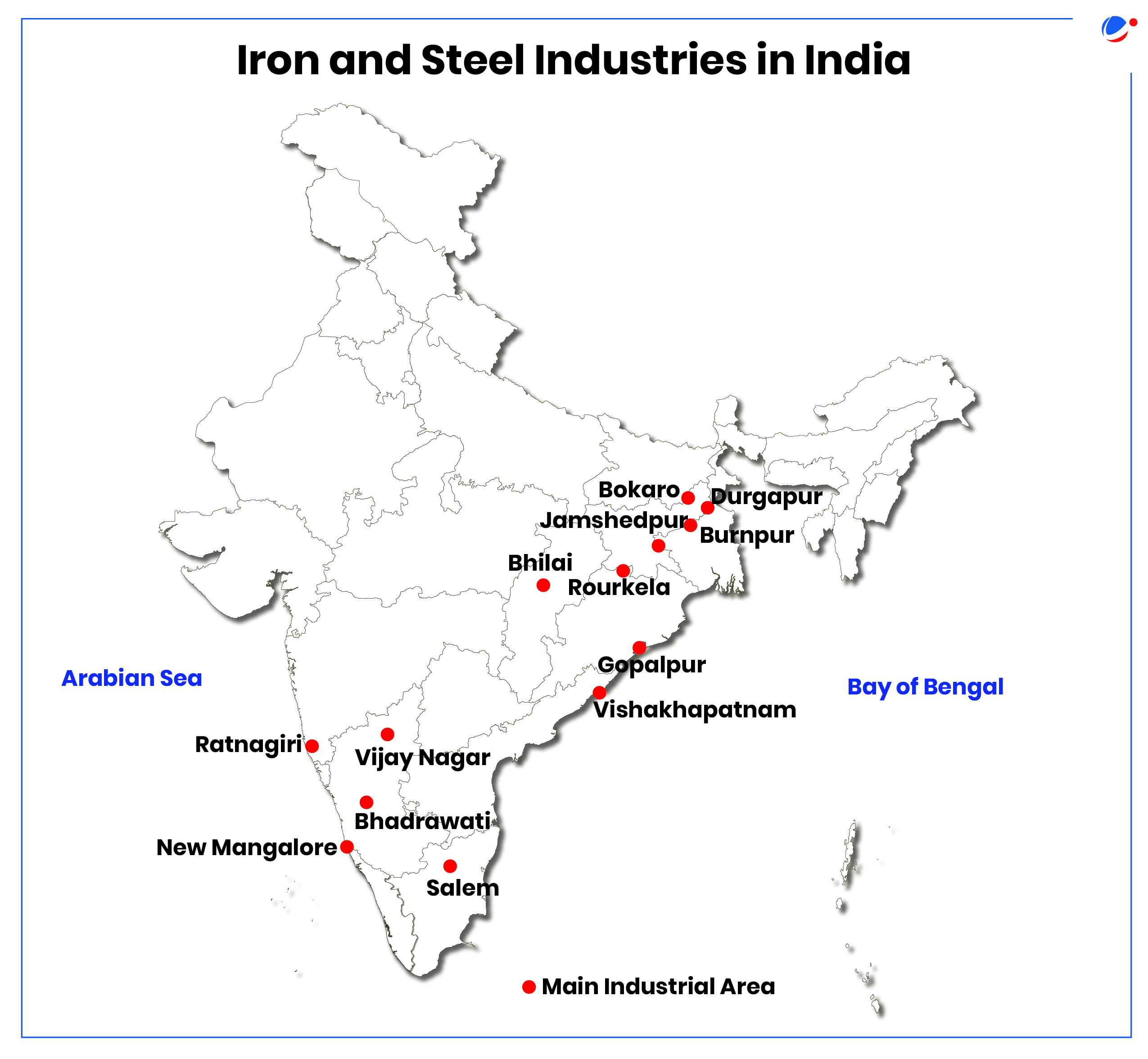

- Growth of the sector is driven by domestic availability of raw materials such as iron ore (fifth-highest reserves of iron ore), cost-effective labour (e.g. Durgapur in West Bengal), and increased infrastructure construction and the thriving automobile and railways sectors.

- Other Location Factors of Steel Industry in India: Access to water (e.g. Tata Steel in Jamshedpur near the Subarnarekha River), Proximity to Markets (e.g. Bhilai plant in Chhattisgarh) and Transportation (e.g. Vizag Steel Plant in Andhra Pradesh near Visakhapatnam Port).

What are the major challenges faced in the Steel sector in India?

- Lack of Capital: Steel is a capital-intensive sector. Nearly INR 7,000 crore is required to set up 1 tonne of steel-making capacity through the greenfield route.

- Steel demand is cyclical. So, during a downturn, the return on investments gets eroded.

- High LogisticsCosts: NITI Aayog estimates the freight cost from Jamshedpur to Mumbai can be as high as USD 50/tonne in comparison with USD 34/tonne from Rotterdam to Mumbai.

- Lack of Raw Material: Although India has abundant reserves of iron ore and coal, it has negligible reserves of coking coal.

- India largely fulfils its coking coal requirements through costly imports from Australia.

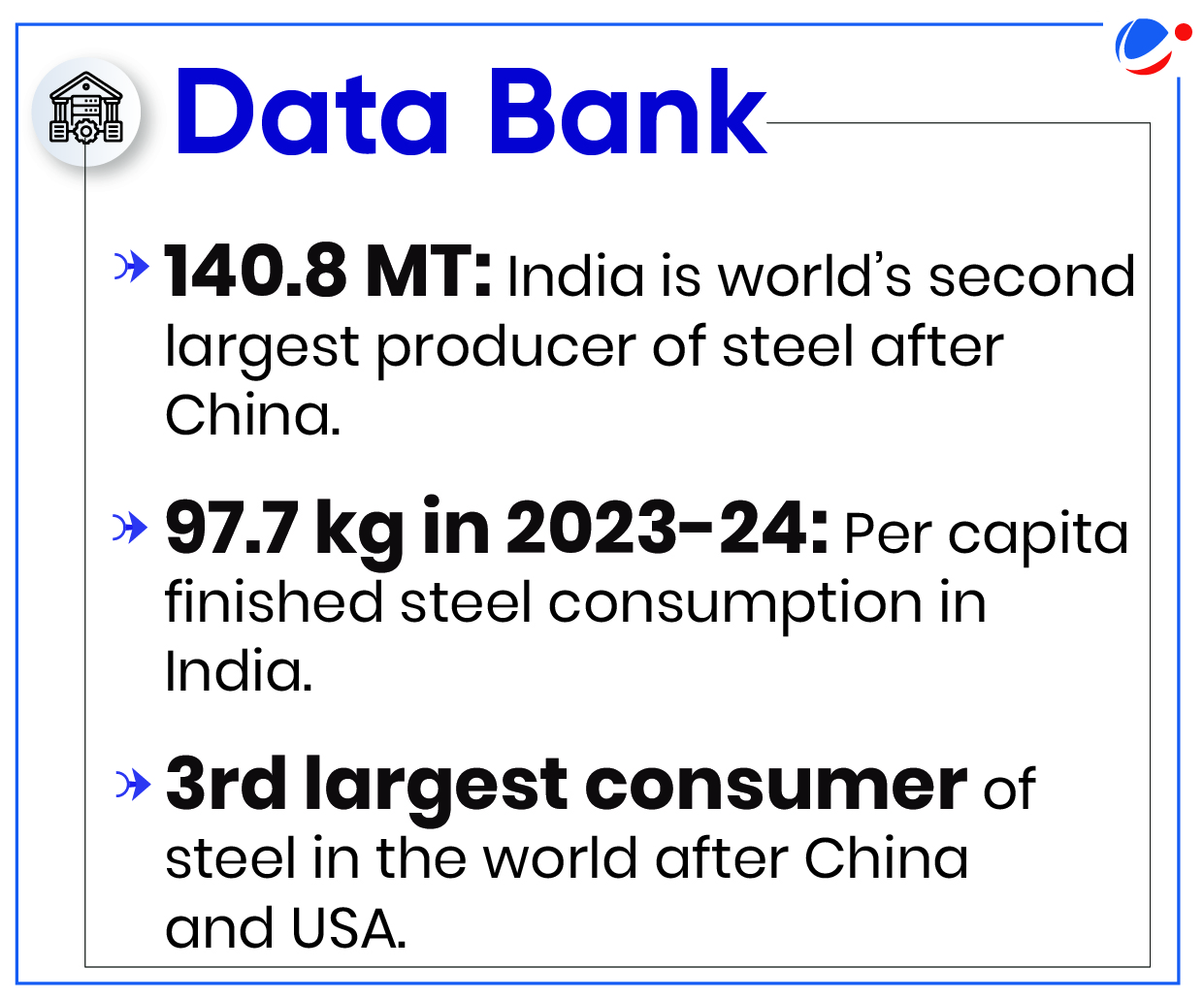

- Low per capita consumption: Per capita finished steel consumption in 2023 was 219.3 kg for the world and 628.3 kg for China. The same for India was 97.7 kg in 2023-24

- Extremely energy-intensive industry: Steel in the world is the largest carbon-emitting manufacturing sector. Hence, it has a high level of carbon footprint.

- Challenges in export: E.g., India's major iron and steel exports to the European Union (EU) will face threat due to the imposition of carbon tax ranging from 19.8% to 52.7%.

What are the initiatives taken by the government to promote the steel sector?

- National Steel Policy, 2017 envisages 300 million tonnes (MT) steel-making capacity and 160 kg per capita steel consumption by 2030-31.

- 'Make in India' initiative, supported by the PM Gati-Shakti National Master Plan: To intensify engagement with key sectors—including Railways, Defence, Housing, etc. to boost steel usage.

- Production-linked incentive (PLI) scheme for speciality steel: to stimulate the production of specialty steel within India and to reduce imports by attracting significant capital investment.

- Mission Purvodaya: Accelerated development of eastern India (Odisha, Jharkhand, Chhattisgarh, West Bengal, and Andhra Pradesh) through the establishment of integrated steel hub in Kolkata.

- Revamped Steel Import Monitoring System (SIMS) 2.0: intended to more effectively monitor steel imports and address concerns affecting the domestic steel industry.

Way Ahead

- Policies needed to decarbonise the sector: Need for investment in cleaner technologies such as electric arc furnaces and green hydrogen to reduce the steel industry's carbon footprint.

- Technological Advancements: Investment in R&D is crucial for improving efficiency and product quality.

- Industry 4.0 technologies such as Automation, AI, and machine learning can enhance productivity and enable the Indian steel industry to meet domestic and global demands.

- Product Diversification: Such as advanced structural steels for construction, specialized alloys for automotive and aerospace applications, etc.

Related ArticleDecarbonising the steel sector

Initiatives to decarbonise steel sector

|