Why in the News?

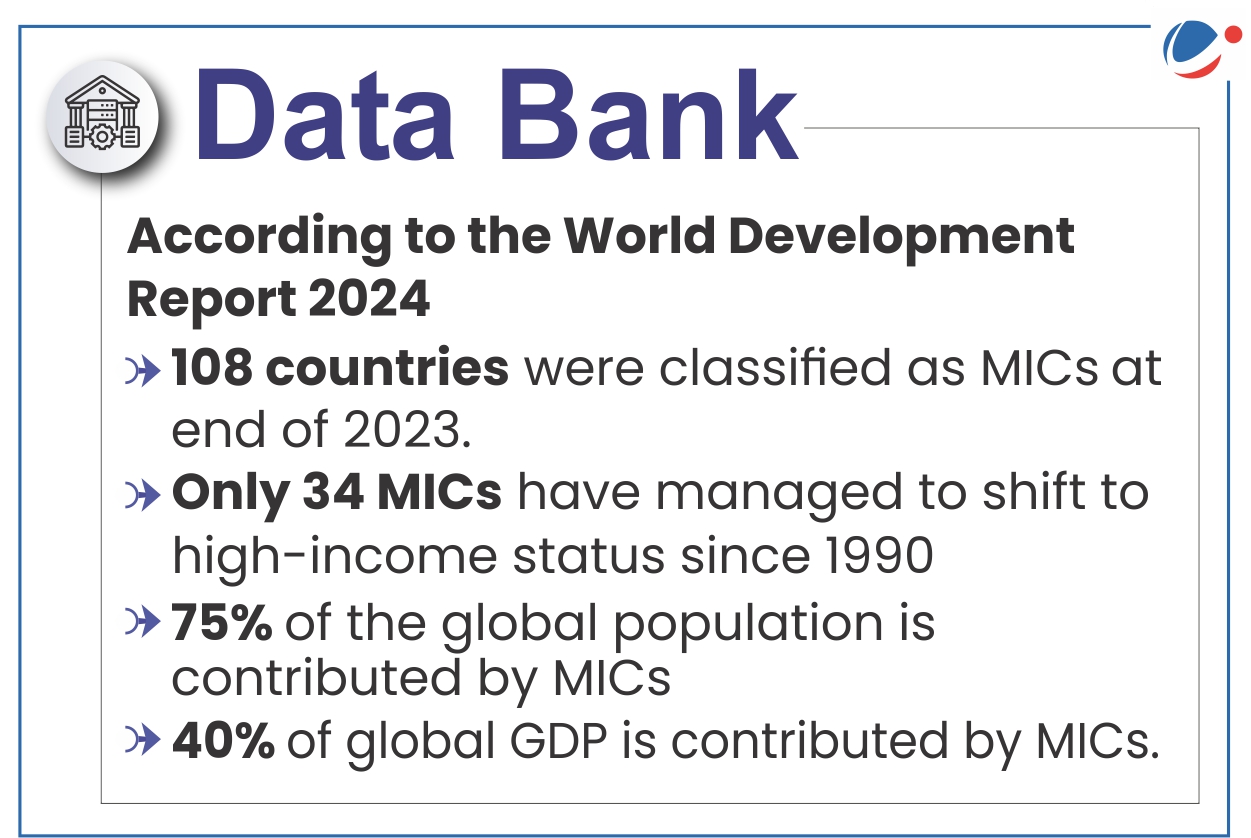

World Bank released the report titled the 'World Development Report 2024: The Middle Income' according to which various countries including India runs the risk of falling into the middle-income trap.

About Middle Income Trap

- Middle Income Countries (MIC): World Bank classifies Economies having per capita Gross National Income between US$ 1,135 to US$13,846 as MIC.

- Lower MIC: Per capita GNI is US$1,136 to US$4,465 (India has a per capita GDP of ~$2,500)

- Upper MIC: Per capita GNI is US$4,466 & US$13,845

- Middle income trap: In 2007, the term "middle-income trap" was coined by the World Bank in its report titled 'An East Asian Renaissance: Ideas for Economic Growth'.

- It refers to a situation wherein rapidly growing economies stagnates at middle-income levels and fails to graduate into the ranks of high-income countries.

- Trend: During the last decade the prospects of MICs migrating to High Income Countries have worsened.

- This is due to the rapidly aging populations and burgeoning debt, fierce geopolitical and trade frictions, and the growing difficulty of speeding up economic progress without fouling the environment.

What makes India vulnerable to Middle Income Trap?

- Untapped Human Capital

- Skill Gap: Only ~51% graduates are employable (Economic Survey 2023-24) and only ~2.3 % of workforce in India has undergone formal skill training in India.

- Lack of innovation capability: India's R&D investment as a percentage of GDP stands at just 0.64% against 2.4% by China and 3.47% by US.

- Rising Income inequality: India's top 1% own 22.6% of income (World Inequality Lab,2022-23).

- It may result in lower tax revenue for government and may give rise to social tension and political instability which have adverse impact on economic growth.

- Stagnated Industrialization: India leapfrogged from agricultural to services sector and manufacturing share in output and employment has generally remained below 20%.

- Inadequate development of manufacturing resulted in unemployment and disguised unemployment particularly in agriculture.

- Contemporary Global Headwinds:

- Middle Income Countries find themselves "caught between the rapidly changing advanced technology of rich countries and competition in mature products from poor countries with low wages." (IMF).

- Foreign trade and investment are in danger of becoming constricted by geopolitical tensions, and populism is shrinking the room for governments to act.

- Rising external debt (it rose by 6.4% in March 2024 as compared to the previous year)

- Accelerating Climate Action presents new challenges of accelerating growth without causing environmental damage.

Way Ahead

The World Bank report suggests countries aiming for high-income status should follow the 3i strategy: Investment, Infusion of global technologies, and Innovation. However, to achieve the shift from 1i to 2i to 3i 'Creative Destruction' would play the crucial role.

Investment (1i) for lower-income countries | Investment + Infusion (2i) for Lower MICs | Investment + Infusion + Innovation (3i) For Upper MICs |

Economic success in lower-income countries stems largely from accelerating investment. It requires improving the investment climate to increase domestic and foreign investment. | As lower-income countries move to middle-income status, continued progress requires complementing a good investment climate with measures deliberately designed to bring new ideas from abroad and diffuse them across the economy—so-called infusion. | Once a MIC has begun to exhaust the potential of infusion in the most promising parts of its economy—running out of technologies to learn and adopt—it should expand its efforts to become an innovation economy.

|

About Creative Destruction

|

Other Initiatives that can be taken

- Human Capital

- Skilled Workforce: Invest in secondary education and vocational training, focusing on including women and marginalized groups for better social mobility.

- Atal Innovation Mission (AIM), National Intellectual Property Rights (IPR) Policy 2016, etc. will play critical role in this direction.

- Brain Gain: Leverage the diaspora's expertise and build partnerships with top universities. Focus research funding on strategic areas like STEM, health, and energy.

- Skilled Workforce: Invest in secondary education and vocational training, focusing on including women and marginalized groups for better social mobility.

- Market reforms

- Avoid Blanket Support for Small Firms: Avoid over-supporting unproductive small businesses, as it can hinder growth and waste resources.

- Connect with Global Markets: Open up to foreign investors and global value chains to help domestic firms access larger markets and advanced technologies.

- Some key initiatives in this direction include 'Buy (Indian)' and 'Buy and Make (Indian)' categories of capital acquisition in Defence, PLI Schemes, 100% FDI is allowed in space sector, etc.

- Strengthen Competition: Strong anti-competitive agency and antitrust laws can help prevent abuse of dominance by established incumbents and foster the development of new technologies.

- Deepen Capital: Equity markets can be instrumental in supporting innovative activities, especially in private firms, which typically face larger financing gaps than publicly listed firms.

- Leverage Digital Technologies: Digital technologies—such as the internet, mobile phones, social media, and web-based information systems can promote both social mobility and talent development

- For example, digital footprints (like payment histories) created through Aadhar can help people access credit and prove financial credibility.

- Tackle global headwind: For example, Middle-income countries should join global low-carbon supply chains, but success depends on advanced economies reducing protectionist trade policies.

Conclusion

India and other MICs need to adopt a well-sequenced and increasingly sophisticated set of policies tailored to their specific circumstances and developmental stage in order to move up the income ladder successfully and avoid middle income trap.