PAC Calls for Review of GST

Parliamentary Committee on Public Accounts sought comprehensive review of GST Framework.

Key Issues Highlighting the Need for Review of GST Framework

- Issues of MSMEs: Struggle with compliance due to complexity of Inverted Duty Structure and administrative burden.

- Issues of Exporters: Face delays in input tax credit (ITC) refunds, causing cash flow issues and reducing global competitiveness.

- Issues of steel rolling mills: Pay dual taxes as scrap dealers evade GST (thus, hindering ITC claims by mills); some businesses relocate to states with GST relaxations.

- Tax evasion by Online Gaming Sector: Despite recent amendments to the GST law targeting this sector, tax evasion persists due to varied business models.

- From October 1, 2023, online gaming is taxed at 28% GST.

- Suppliers of online money gaming must register under the Simplified Registration Scheme of the IGST Act.

- The Directorate General of GST Intelligence (DGGI) can direct intermediaries to block unregistered offshore gaming platforms violating the IGST Act.

Way ahead

- Simplified GST compliance framework specifically designed for MSMEs,

- Dedicated fast-track refund processing system for exporters, ensuring that ITC claims related to exports,

- A detailed independent study to understand the revenue streaming models adopted by various gaming platforms and accordingly develop a comprehensive guidelines specifically tailored to the online gaming sector.

- Tags :

- GST

UNCTAD Released ‘A World Of Debt Report 2024’

Public debt can drive development by funding critical expenditures, but excessive debt growth poses challenges, especially for developing nations.

- United Nations Conference on Trade and Development (UNCTAD) ’s 2024 report warns of rising debt risks, urging immediate global action to ensure stability.

Key Findings of the Report

- Global Debt Surge: Public debt reached $97 trillion in 2023, with developing countries' debt rising twiceas fast as developed nations.

- India's public debt was recorded at 2.9 trillion US dollars.

- Debt Servicing Strains: 54 developing nations spend more on interest payments than on social sector.

- Unequal Financial System: Developing nations pay 2 to 12 times more in interest than developed countries.

Challenges Posed by the Rising Global Public Debt

- Debt Overhang: High debt levels can stifle economic growth by discouraging investment and consumption.

- Liquidity Challenge: The withdrawal of nearly $50 billion by private creditors from developing countries has worsened liquidity constraints.

- The creditor base with West-dominated institutions (private, multilateral, and bilateral creditors) makes debt restructuring expensive.

Recommendations

- Debt restructuring mechanisms to address coordination challenges.

- Expand contingency financing to prevent debt crises.

- Enhance participation of developing countries in global financial governance.

- Tags :

- UNCTAD

- public debt

Articles Sources

Largest INVIT Monetization In Roads Sector

National Highways Infra Trust (NHIT) completed largest INVIT monetization in roads sector.

- NHIT is the Infrastructure Investment Trust (InvIT) set up by National Highways Authority of India (NHAI) in 2020 to support India's Monetization programme.

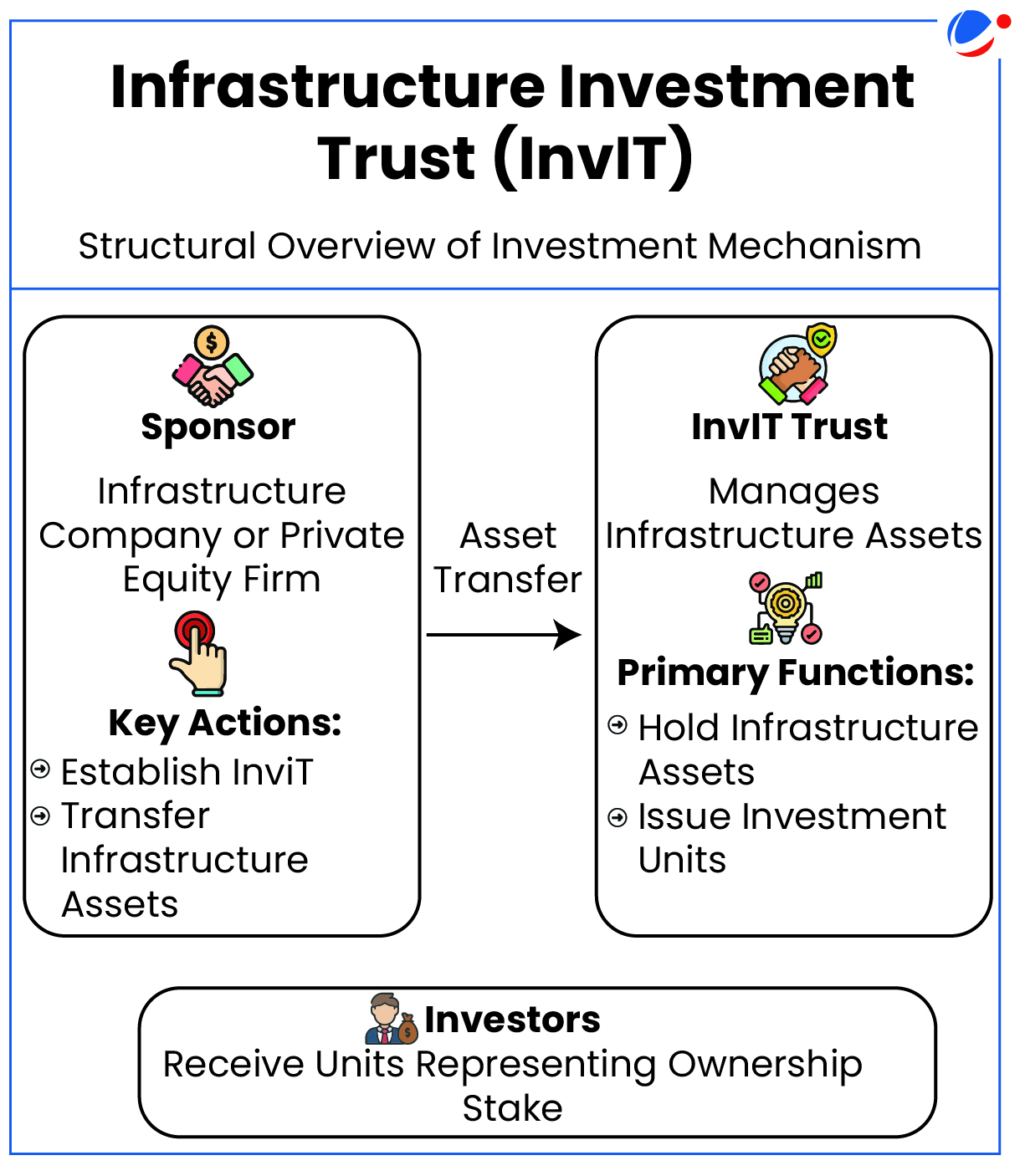

Infrastructure Investment Trust (InvIT)

- Definition: It is an investment vehicle, like a mutual fund or Real Estate Investment Trusts (REITs).

- InvITs enable direct investment of money from individual and institutional investors in infrastructure projects.

- Investments can be made directly or through SPV (Special Purpose Vehicle)/Holding Company by the InvIT.

- InvITs earn income through tolls, rents, interest or dividends from their investments.

- The interest, dividend, and rental income are taxable in the hand of the unitholder.

- Regulation: InvIT are regulated by the SEBI (Infrastructure Investment Trusts) Regulations, 2014.

- SEBI requires InvITs to distribute at least 90% of their income to investors.

- InvITs are recognized as borrowers under the ‘Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002’.

- Types of InvITs: Public InvITs, Private listed InvITs and Private unlisted InvITs.

- Advantages of InvITs: Access to retail investors to invest in large infrastructure projects, low ticket size, liquidity (as units are listed on stock exchanges), etc.

- AM is the process of creating new sources of revenue for the government and its entities by unlocking the economic value of unutilised or underutilised public assets.

Asset Monetization (AM)

|

- Tags :

- InvITs