Why in the News?

An announcement was made in the Union Budget 2025 regarding the revision of the model Bilateral Investment Treaty (BIT) text to make it more investor-friendly.

About Bilateral Investment Treaties (BITs)

- Also referred to as International Investment Agreements (IIAs), they are a tool for providing assurance to foreign investors against measures that may adversely impact their investments while assuring state's sovereign right to regulate.

- Concept: They provide rights to investors (through the investor-state dispute settlement) or to home states like investing state like US (through state-state dispute settlement), to bring a claim against a host state (receiving foreign investment, e.g., India).

- India approved new Model BIT Text in 2015, which replaced Indian Model BIT, 1993.

- Since then, Model text 2015 is used for (re)negotiations of BITs and investment chapters of Comprehensive Economic Cooperation Agreements (CECAs)/ Comprehensive Economic Partnership Agreements (CEPAs) / Free Trade Agreements (FTAs).

- Recent countries with which BITs were signed: Uzbekistan (2024), UAE (2024)

Key Features of Model BIT 2015

|

Issues with India's present BIT Architecture

- Ambiguity: It lacks clarity in terms such as "investment," "customary international law (CIL)" etc. leading to disputes and challenges in treaty interpretation by ISDS tribunal.

- E.g., India has received 37 notices of dispute, with 8 still active at various arbitration stages. (Committee on External Affairs (2021-22))

- Mandatory waiting period to exhaust local remedies: Given India's overburdened judiciary, this requirement could delay dispute resolution and increase legal uncertainties for investors.

- Restrictions on the jurisdiction of ISDS tribunals: They are barred from reviewing the "merits" of a decision made by the domestic court without defining what "merits" means.

- Limited rights to foreign investors: Due to following issues in model BIT -

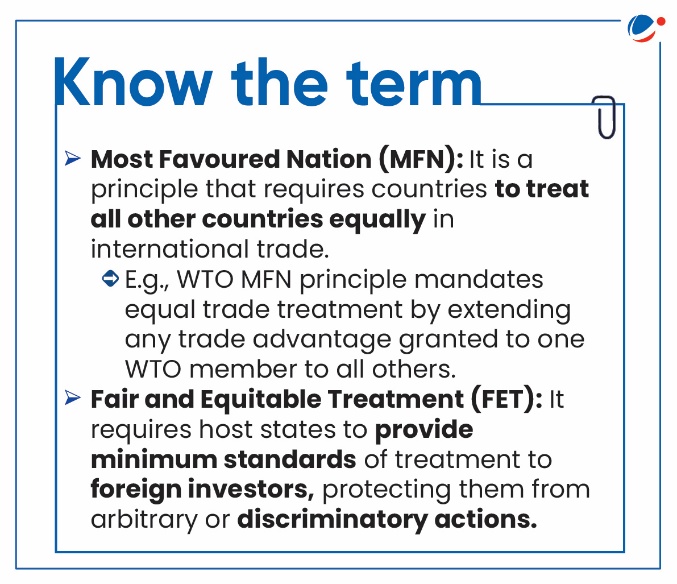

- Exclusion of Most Favoured Nation (MFN) provision and the Fair and Equitable Treatment (FET) standard.

- Exclusion of tax-related regulatory measures reduces investor confidence.

- Tribunals cannot mandate policy changes, restricting awards to monetary compensation.

- Exclusion from ICSID Convention: India is not a member of International Centre for Settlement of Investment Disputes (ICSID), which limits options for investors seeking enforcement within India.

- ICSID, established in 1966 by the ICSID Convention, is a World Bank institution that provides facilities for conciliation and arbitration of investment disputes between contracting states and nationals of other contracting states.

Way forward

- Providing greater clarity of terminologies for states and investors and curbs arbitral discretion.

- E.g., India-UAE BIT specifically lists when state action will amount to a treaty violation instead of linking it to terms like customary international law (CIL).

- Eliminating/Reducing mandatory waiting period and allowing investors to choose between domestic courts or international arbitration upfront.

- Including MFN provision with appropriate qualifications to prevent "treaty shopping" while ensuring non-discrimination.

- Treaty shopping typically involves the attempt to indirectly access the benefits of a tax treaty between two jurisdictions by a person who is not a resident of one of those jurisdictions, often through complex structures and arrangements.

- Adopting a narrowly defined FET provision, similar to that in the European Union's new-generation investment treaties, to better balance investor and state rights by outlawing arbitrary state behaviour.

- Becoming a signatory to the ICSID Convention to enhance investor confidence by providing a globally recognized enforcement mechanism.

- Removing the blanket exclusion of tax measures, while allowing ISDS tribunals to review abusive or discriminatory tax actions while deferring to national authorities on policy matters.

- Developing Domestic architecture in Investment Arbitration to reduce reliance on foreign legal firms and control arbitration costs.

- Promote and develop the New Delhi International Arbitration Centre (NDIAC) to make India a global hub for investment arbitration.

- Create a pool of domestic lawyers and law firms specialized in international investment arbitration.