Why in the News?

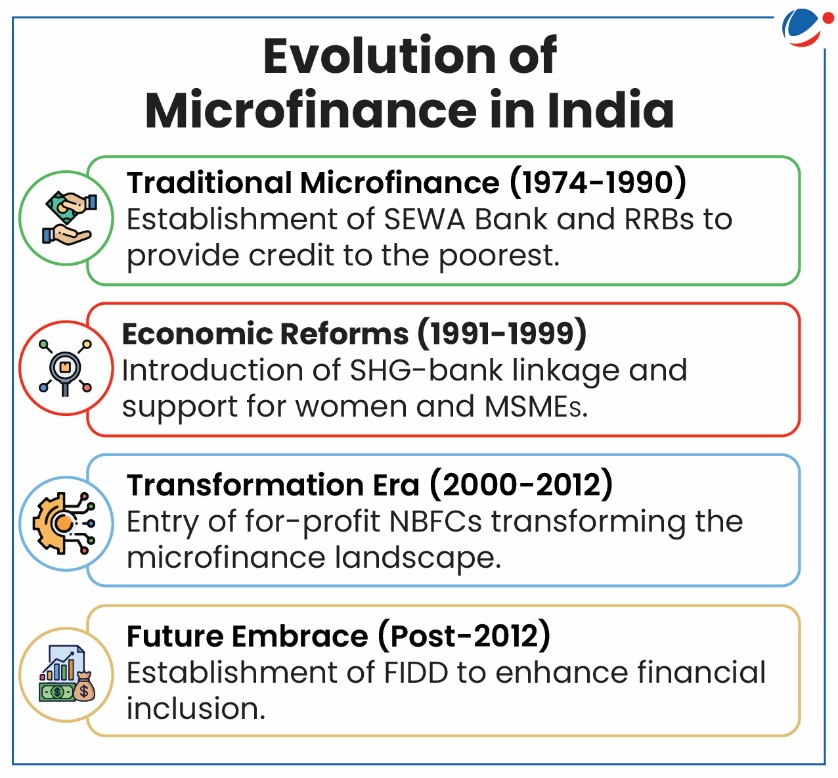

Self Employed Women's Association (SEWA) Bank, started in Gujarat in 1974 as a cooperative bank marks the completion of 50 years of microfinance institution (MFI) in India.

What is Microfinance?

- Definition: Microfinance, also called microcredit, is a banking service targeting poor households and small enterprises in rural areas.

- Like conventional bankers, microfinance service providers also need to earn interest on loans and construct clear repayment schemes involving periodic installments.

- Services: Providing credit to poorer households and small enterprises, but many also take deposits, some MFIs offer other financial services, such as insurance, or advice and training to their clients for financial management.

- Nobel Laureate Muhammad Yunus laid the foundation of modern MFIs with establishment of Grameen Bank in Bangladesh in 1976.

Significance of Microfinance in India

- Poverty Alleviation: NABARD through Self Help Group Bank Linkage Programme which is the largest microfinance programme in the world, today empowers 17.8 crore households through more than 144 lakh SHGs.

- Economic growth and Entrepreneurship Promotion: 46% of microfinance loans are provided to families having monthly income less than Rs. 20,000, for working capital for their income generating activities and assets including livestock.

- Empowerment of Women: Women-led SHGs have been instrumental in improving socio-economic conditions, with 88% of SHGs linked to banks being women-led.

- Kudumbashree in Kerala, plays a vital role in enhancing the financial status of the less privileged women in the State through its thrift and credit program.

- Financial Inclusion: Microfinance fills the gap left by traditional banks and brings marginalized populations into the formal financial system.

- Social Impact: By providing access to financial services, microfinance contributes towards the improvement of education, healthcare, and reduction in family violence, nutritional status of the children, and health outcomes due to financial empowerment.

- Client of MFIs had grown substantially within the last ten years touching 140 million families in FY 2024 with 7 crore active borrowers from NBFC-MFI alone.

- Ujjivan Small Finance Bank Chote Kadam initiative, have made significant contributions to the healthcare sector by renovating multiple Primary Health Centres (PHCs) and hospitals.

Challenges in Microfinance in India

- Over-Indebtedness: In some cases, individuals take loans from multiple microfinance institutions (MFIs) to repay existing loans, leading to a debt trap.

- 8-10% of the sector's total assets under management (AUM) is linked to borrowers with more than four lenders.

- Interest Rates: While microfinance is intended to be an affordable source of credit for the poor, high-interest rates can make it difficult for borrowers to repay loans, leading to a cycle of poverty.

- They usually offer micro credits at interest rates starting from 12% and can go up to 30%.

- Regulation and Governance: Multiple regulatory authorities as they are registered as societies, cooperatives and companies affect effective control and lead to lack of transparency.

- MF Banks in India are regulated by the RBI, State governments through State Cooperative Societies Acts (for cooperative banks) regulate microfinance cooperative banks and cooperative societies.

- Lack of collateral and risk of default: Microfinance loans to low-income groups saw a significant surge in portfolio at risk (PAR) loans with an overdue of 31-180 days doubled to Rs 28000 crore from previous year.

- Sustainability of Microfinance Institutions: Striking a balance between social impact and financial sustainability is an ongoing challenge as very few MFI are actually profitable.

- External Shocks: Economic and environmental factors, such as natural disasters and economic downturns, can have a significant impact on the ability of microfinance borrowers to repay loans.

- The gross non-performing assets (NPAs) may rise to 4.5 per cent in FY25 from 2.8 per cent in FY24 due to economic uncertainty.

Initiatives taken by government for strengthening microfinance

|

Way forward

- Limiting the number of lenders per borrower to three from four: By implementing self-regulatory organisation, Microfinance Institutions Network suggestion to cap outstanding loans per borrower at Rs 2 lakh from Rs 3 lakh.

- The integration of Artificial Intelligence (AI) and Machine Learning (ML): Machine learning models analyze repayment behavior and flag potential defaulters early, allowing preemptive action.

- MFIs can be classified under various sectors: such as affordable housing, climate action, water and sanitation, and health, to usher in holistic development at the bottom of the financial pyramid.

- Financial Literacy: Financial literacy can help improve financial inclusion, social security through insurance and growth of microfinance industry.

- Learning from best practices: Southern states including Tamil Nadu, Karnataka, and Kerala have well-developed microfinance distribution networks, making microfinance operations easier.