Why in the news?

The Reserve Bank of India (RBI) has issued new Priority Sector Lending (PSL) guidelines, which came into effect on April 1, 2025.

More on the news

- These guidelines are issued under the Banking Regulation Act, 1949 (Sections 21 & 35A read with Section 56).

- Applicability: To every Commercial Bank [including Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank (LAB)] and Primary (Urban) Co-operative Bank (UCB) other than Salary Earners' Bank.

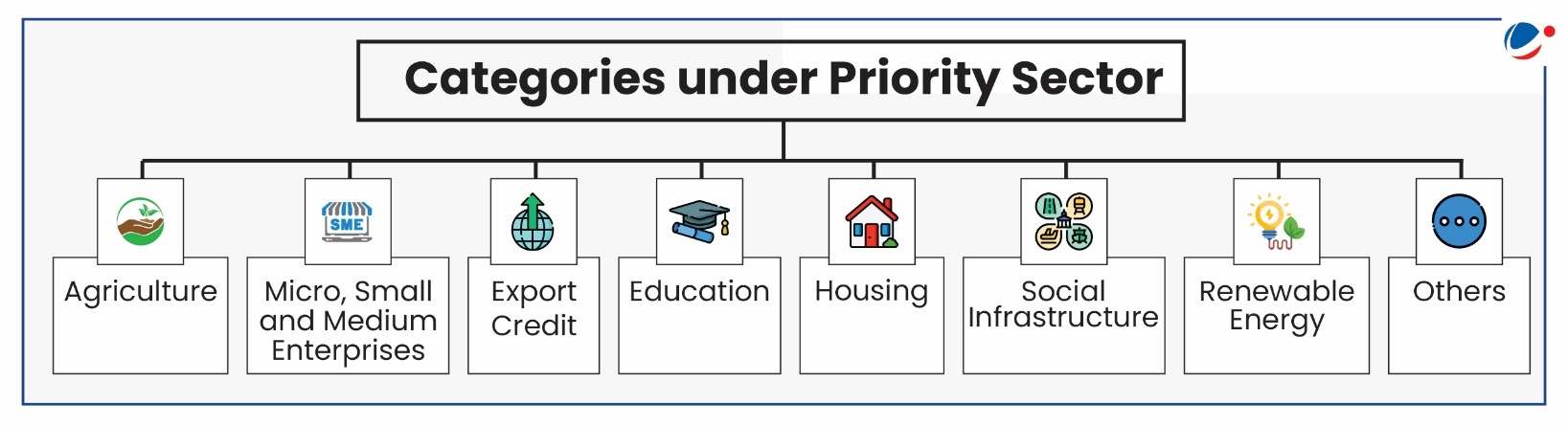

About Priority Sector Lending

- Priority Sector means those sectors which Government and RBI consider important for the country's development and are to be given priority over other sectors.

- Historical Background:

- 1969 – Gadgil Committee: Recommended the Area Approach, leading to the adoption of the Lead Bank Scheme.

- 1972 – Formalization of PSL: Aimed to ensure credit flow to sectors that were creditworthy but lacked access to institutional finance.

- 1982 – Ghosh Committee: Recommended revision and reclassification of priority sector categories.

Details of Revised Guidelines

- Enhancement of several loan limits:-

- Education: Up to ₹25 lakh for individuals (including vocational courses)

- Social Infrastructure: Up to ₹8 crore per borrower for setting up schools, drinking water facilities etc

- Other: Housing Loan Limits, Agriculture Loans etc

- Expanded Renewable Energy Loans:

- Upto ₹35 crore for renewable energy-based power generators and renewable energy-based public utilities such as street lighting systems, remote village electrification.

- The limit is ₹10 lakh for individual households.

- Upto ₹35 crore for renewable energy-based power generators and renewable energy-based public utilities such as street lighting systems, remote village electrification.

- Revision of PSL target for Primary (Urban) Co-operative Bank (UCBs)

- Total Priority Sector: 60% (Earlier 40%)

- Micro Enterprises: 7.5%

- Advances to Weaker Sections: 12%

- Expansion of the category of 'Weaker Sections', including

- It now includes Transgenders along with earlier categories of:-

- Small and Marginal Farmers, Distressed farmers indebted to non-institutional lenders, Artisans, Individual members of SHGs or Joint Liability Groups,

- Scheduled Castes & Scheduled Tribes, Persons with disabilities, Minority communities notified by Government of India

- Individual women beneficiaries up to ₹2 lakh (This limit does not apply to UCBs)

- It now includes Transgenders along with earlier categories of:-

Targets/Sub-targets for Priority sector

Categories | Targets/ Sub-targets | |||

| Domestic Commercial Banks & Foreign Banks with 20 branches and above | Foreign Banks with Less than 20 branches | Regional Rural Banks | Small Finance Banks |

Total Priority Sector | 40% | 40% (upto 32% in form of Export Credit and not less than 8% can be to any other priority sector.) | 75% | 75% |

Agriculture | 18% | NA | 18% | 18% |

Micro Enterprises | 7.5% | NA | 7.5% | 7.5% |

Weaker Sections | 12% | NA | 15% | 12% |

Note: Percentages mentioned above are as a percentage of Adjusted Net Bank Credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposures (CEOBSE), whichever is higher. | ||||

Additional Provisions

- NBFC & Housing Finance Companies (HFCs) on-lending are now included under PSL.

- Co-lending model (banks + NBFCs) recognized for PSL eligibility.

- Securitisation norms updated, excluding gold-backed loans from NBFCs.

- Trading of Priority Sector Lending Certificates (PSLCs) allowed to meet targets.

- PSLCs are tradable instruments that allow banks to meet their PSL targets by purchasing credit achievements from other banks.

- IBPCs & Direct Assignment norms updated to ensure proper classification.

- Inter-Bank Participation Certificates (IBPCs) and Direct Assignments are key instruments used by banks for managing liquidity and transferring credit risk.

Other recent reforms

- Priority Sector Lending Certificates (PSLCs): Introduced in April 2016 to enhance efficiency.

- Allows banks falling short of PSL targets to purchase PSLCs from overachievers.

- Four types: PSLC-Agriculture, PSLC-MSME, PSLC-General, and PSLC-Weaker Sections.

- Co-Lending Model (CLM): Introduced in 2020 for NBFCs and banks to jointly lend in priority sectors, improving last-mile credit delivery.

- Recently, RBI proposed a draft framework for co-lending arrangements between all regulated entities for all loans, priority sector or otherwise.

Conclusion

Priority Sector Lending in India stands at a critical juncture of transformation. While the framework has successfully channelled institutional credit to underserved sectors over decades, its evolution now demands both structural reforms and technological innovation. By implementing data-driven credit scoring, integrating advanced technologies like AI and satellite imaging, reforming the PSLC market for greater transparency, and transitioning from input-based targets to outcome-based approaches, India can revitalize its PSL framework