Why in the News?

The RBI Financial Inclusion Index (FI-Index) has risen to 67 in 2025, up by 24.3% since 2021

More on the News

- FI-Index captures financial inclusion across the country while representing different sectors such as banking, investment, insurance, pension etc.

- With boost in the index, the growth was witnessed across all three sub-indices of index i.e. Access, Usage and Quality.

- Improvement in the FI-Index in FY2025 is a reflection of enhancement in usage and quality dimensions, which indicates strengthening of financial inclusion and financial literacy initiatives.

Understanding Financial Inclusion Index

- RBI's FI-Index is designed to provide a comprehensive measure of financial inclusion in India.

- Planning Commission (2009) viewed financial inclusion as "universal access to a wide range of financial services at a reasonable cost," including banking, insurance, and equity products.

- Score of Index: It operates on a scale from 0 to 100.

- 0 signifies complete financial exclusion and 100 represents full financial inclusion.

- No base year: Released annually since 2021 and reflects cumulative progress of all stakeholders over the years towards financial inclusion.

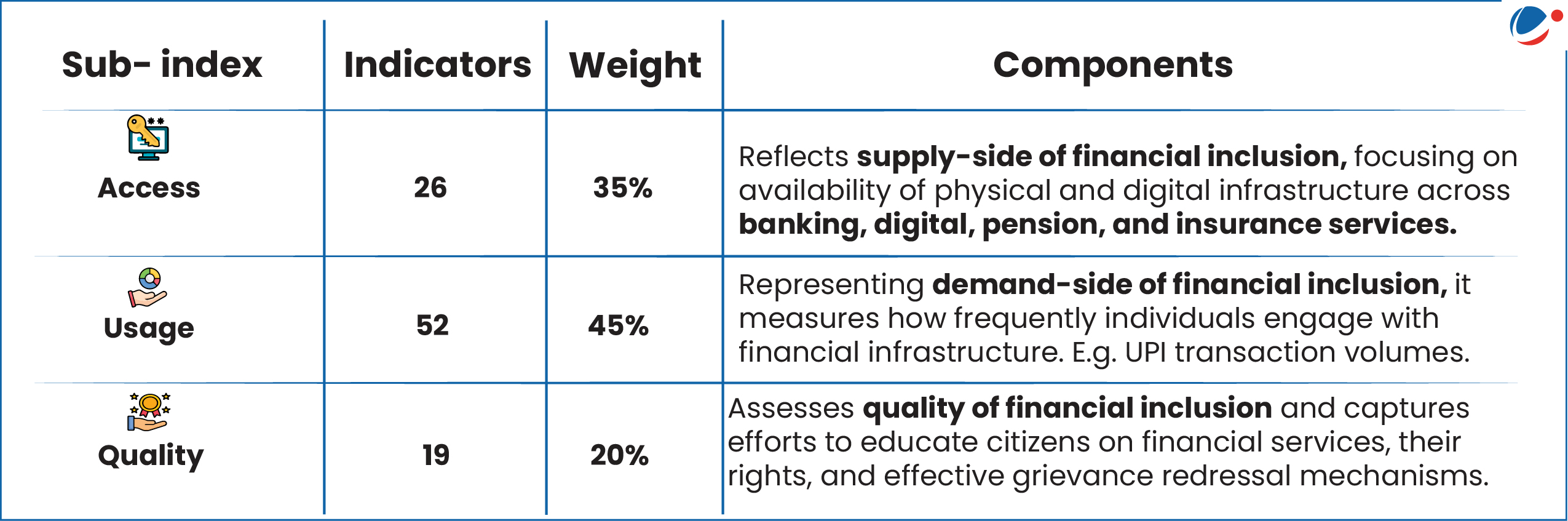

- Structure of Index: Comprises three broad parameters (sub-indices), each with assigned weights and numerous indicators:

Key Driving Factors of Financial Inclusion in India

- Government Initiatives

- Pradhan Mantri Jan Dhan Yojana (PMJDY) (2014): Facilitating the opening of over 56 crore bank accounts.

- National Strategy for Financial Inclusion (NSFI 2019-2024): Provides a roadmap for universal access to financial services.

- Aadhaar: Simplified KYC processes, significantly aiding account opening and direct benefit transfers. Boosted Direct Benefit Transfer (DBT) efficiency.

- Digital India: Expanded access to digital financial services.

- Transformative Role of Technology:

- Unified Payments Interface (UPI): UPI has become the most preferred transaction mode for nearly 38% of individuals in rural and semi-urban India, especially those aged 18-35.

- JAM Trinity (Jan Dhan-Aadhaar-Mobile): This framework has provided the necessary digital public goods infrastructure to leverage increasing mobile penetration, forming the backbone of digital financial inclusion.

- Artificial Intelligence (AI) and Machine Learning (ML): AI is revolutionizing financial services by Inclusive Credit Scoring, Chatbots and Voice Assistants, Fraud Detection etc.

- Role of Financial Institutions:

- Microfinance Institutions (MFIs): India holds the position of having the second-largest global outreach in microfinance (after China), with over 140 million clients.

- Self-Help Groups (SHGs): Over 13.4 million SHGs, with 84.25% comprising women, impact 160 million households (2023).

- They provide platforms for savings and credit, fostering financial literacy, and significantly reducing reliance on high-cost informal credit.

- "Bank Sakhis" (women business correspondents) are key for last-mile service delivery.

- Commercial Banks: RBI mandates Priority Sector Lending (PSL) to critical sectors like agriculture and MSMEs.

Challenges to Financial Inclusion

- Account Inactivity: Approximately 35% of accounts (2021) in India remain inactive due to lack of trust in banks, physical distance, insufficient funds, and discomfort in using accounts independently.

- Gender Disparities: In digital payments, a notable gender gap persists i.e. 45% of men have made or received digital payments, whereas only 32% of women have done so.

- Rural and Geographical Barriers: Remote areas lack access to basic banking services due to limited physical infrastructure and low digital device penetration. E.g. Rural smartphone penetration remains low at 28%.

- Financial Illiteracy: Financial literacy levels among women are lower than man, highlighting the need for targeted education.

- Digital Divide: Technological barriers, including lack of internet-enabled smartphones and low digital literacy, prevent certain segments from accessing digital financial services.

- Smartphone ownership stands at 82% in rural areas and 91% in urban areas.

- Other Challenges: Limited access to credit due to lack of knowledge, High Transaction Costs, Quality of Services, Lack of Trust and Documentation, Inadequate Risk Protection etc.

Way Forward

To achieve universal and meaningful financial inclusion, India needs a multi-pronged, collaborative approach:

- Focus on Under-banked and Unbanked Segments: The immediate goal for under-banked individuals is to subscribe to more financial products, while for the unbanked; it is to open a bank account by ease of application and reduced costs.

- Develop a Tech-Driven Financial Ecosystem: Leveraging AI and advanced automation to provide personalized, accessible, and secure financial services in rural and remote areas.

- E.g. Successful case studies include use of Robot investment assistants (RIAs) and central bank digital currency Yuan (e-CNY) in china.

- Promote Open Systems: Advocate for and adopt interoperable open banking systems like Open Network for Digital Commerce (ONDC) and Open Credit Enablement Network (OCEN) to foster innovation and inclusion.

- Consumer Protection: Strengthen data privacy laws and cyber security measures to protect individuals' financial information.

- Targeted Policies: Encourage banks to provide affordable and accessible credit to women, small and marginal farmers, microenterprises, and the informal sector.

- Financial institutions can offer tailored financial products suited to the needs of low-income groups, such as microinsurance and pension schemes.

- Public-Private Partnerships: Collaborations between governments, financial institutions, and telecom companies can accelerate financial inclusion.

- Public policies should encourage private sector involvement in providing mobile money services and digital payment platforms.

Conclusion

By persistently addressing challenges and integrating successful strategies, India can deepen meaningful financial engagement, enhance resilience, and continue its trajectory toward becoming a global leader in inclusive finance, fostering greater economic opportunities for all citizens.