Why in the News?

Launched on September 25, 2014, the "Make in India" initiative has recently completed 10 years.

About 'Make in India'

- Aim: The 'Vocal for Local' initiative was devised to transform India into a global design and manufacturing hub.

- Objectives

- To increase the growth rate of Indian industry to 12-14% per year.

- To create 100 million industrial jobs by 2022.

- To increase the share of the manufacturing sector to 25% of GDP by 2022 (the target year has been revised to 2025).

- Sectors: At present, Make in India 2.0 (launched in 2021) focuses on 27 sectors implemented across various Ministries/ Departments and state governments.

- Pillars of 'Make in India'

- New Processes: The motto 'Ease of doing Business' became the core for promoting entrepreneurship.

- New Infrastructure: Development of industrial corridors and smart cities, integrating state-of-the-art technology and high-speed communication to create world-class infrastructure.

- New Sectors: FDI opened up in Defence Production, Insurance, Medical Devices, Construction, and Railway infrastructure.

- New Mindset: The government embraced a role as a facilitator rather than a regulator.

Major Achievements under 'Make in India'

- India's new manufacturing prowess: It is evident across sectors – India produces 400 million Toys annually and it's the world's 4th largest renewable energy producer.

- India is the second-largest mobile manufacturer in the world and has significantly reduced its reliance on smartphone imports, now manufacturing 99% domestically.

- Improved Ease of doing Business: Through policy reforms such as the Insolvency and Bankruptcy Code, the GST for indirect taxation, the Jan Vishwas Act, etc.

- India climbed from 142nd in 2014 to 63rd in the World Bank's Doing Business Report (DBR), 2020 before its discontinuation.

- Boosted India's manufacturing competitiveness: India has now one of the lowest corporate tax rates in Asia, enhancing its global economic appeal. Other steps taken:

- Over 40000 compliances have been reduced and 3,800 provisions decriminalized.

- National Single Window System: Over seventy-five thousand approvals granted simplifying investor processes.

- Resource Mobilization: FDI inflows have steadily risen, starting from ~$45 billion (Bn) in 2015 to a record ~$85 Bn in 2022.

- Merchandise exports: Export of ~$437 Bn recorded in 2024, reflecting the country's growing role in global trade. India also ventured in high-end products Export growth.

- E.g., Drugs and pharmaceutical ($27 Bn); India supplies nearly 60% of the world's vaccines.

- Defense exports: Major defence platforms such as the Dhanush Artillery Gun System, Main Battle Tank (MBT) Arjun, Light Combat Aircraft (LCA) Tejas, submarines, etc., have been developed and exported to various countries.

- Prioritization of high-value manufacturing and R&D: As a result, India has risen 42 spots in the Global Innovation Index since 2015, currently ranking 39th, ensuring its global competitiveness.

- A path taken towards Sustainable growth: E.g., National Green Hydrogen Mission will generate over six lakh jobs and reduce reliance on imported natural gas and ammonia, leading to savings of ₹1 lakh crore.

Concerns with 'Make in India'

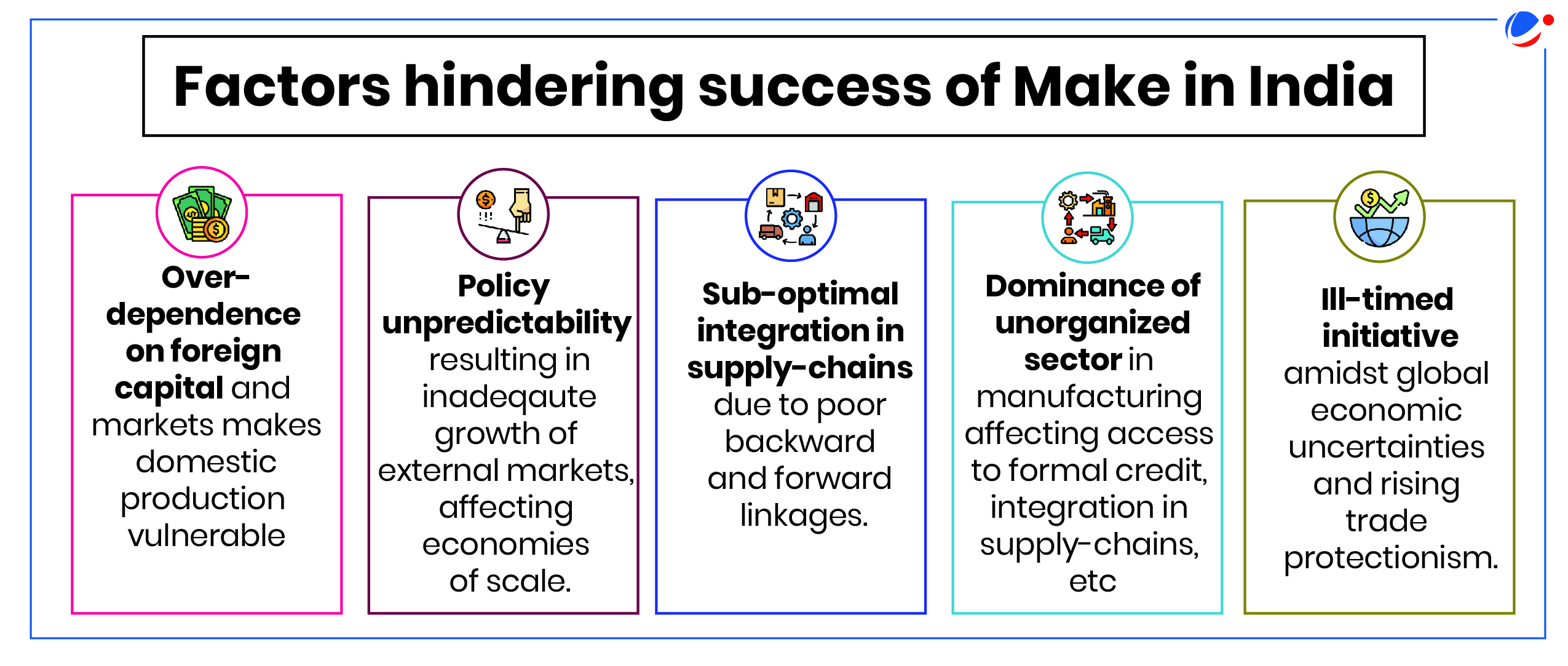

- Manufacturing sector falls short of 25% GDP target: Despite 'Make in India' scheme, the manufacturing sector's contribution was still stagnant at 17.7% in 2023.

- Manufacturing growth rate has averaged around 6% since 2014, lower than the benchmarked 12-14%.

- Job losses in manufacturing sector: Despite a goal of creating 100 million jobs, the manufacturing workforce declined from 51 million (2017) to 35 million (2023).

- Slowdown in real GVA: According to the National Accounts Statistics (NAS), the manufacturing real gross value added (GVA) growth rate has slowed down from ~8% (2012) to 5.5% (2023).

- Declining investment rates: India's rate of productive investment (Gross Capital Formation) has weakened, falling from 39.1% in 2008 to 32.2% in 2023.

- FDI-driven development strategy has had limited success: FDI as a percentage of GDP has averaged ~1.8% from 2015 to 2023, down from ~2.1% in the previous decade.

- The majority of FDI since 2017 has been concentrated in just 9 sectors, starting with services (especially IT), while 53 other sectors – mainly manufacturing – have received just 30% of total FDI.

- Weakening export performance: In spite of substantial FDI inflow in absolute terms, India's merchandise exports have fallen steadily in relative terms from ~10% of GDP in 2013-14 to just ~8% in 2022-23.

- Concerns related to viability of PLI Schemes: The growing cost of PLI schemes, such as the $2.75 billion microprocessor factory set up by Micron in Gujarat where the government financed most of the investment.

Way Forward

- Improving Capabilities: By adopting new technologies (AI, machine learning, etc), rapidly skilling the labour force, strengthen education ecosystem, etc.

- Encourage entrepreneurial spirit: By creating conditions for better educated workers to be entrepreneurial: E.g., India currently produces about 2.2 million STEM graduates, post-graduates and PhDs.

- Enhance innovation ecosystem: A triple helix model of academia-industry-government collaboration is essential for translating knowledge into wealth and in this regard, India should establish institutions dedicated to scouting early-stage IP from academia.

- Recently established Anushandhan National Research Foundation (ANRF) as an apex body to provide high-level strategic direction of scientific research in the country is a step in right direction.

Conclusion

As the "Make in India" initiative celebrates its 10th anniversary, it stands as a testament to India's determination to reshape its manufacturing landscape and enhance its global standing. With strategic reforms, investment-friendly policies, and a strong focus on infrastructure development, the initiative has significantly enhanced India's industrial capabilities.