Why in the News?

India along with 12 other developing countries and African Islands States Climate Commission (AISCC) announced plans to develop 'Country or Regional Platforms for Climate and Nature Finance'.

More on the News

- These plans were unveiled at the recently concluded Conference of Parties (COP30) to the United Nations Framework Convention on Climate Change (UNFCCC) at Belém, Brazil.

- 12 developing countries are Cambodia, Colombia, Kazakhstan, Lesotho, Mongolia, Nigeria, Oman, Panama, Rwanda, the Dominican Republic, Togo, and South Africa.

- About the Platforms: Country Platforms are strategic, country-driven mechanisms that translate climate priorities into programmatic investment approaches.

- They are designed to align global support and investment flows with the national priorities of each country.

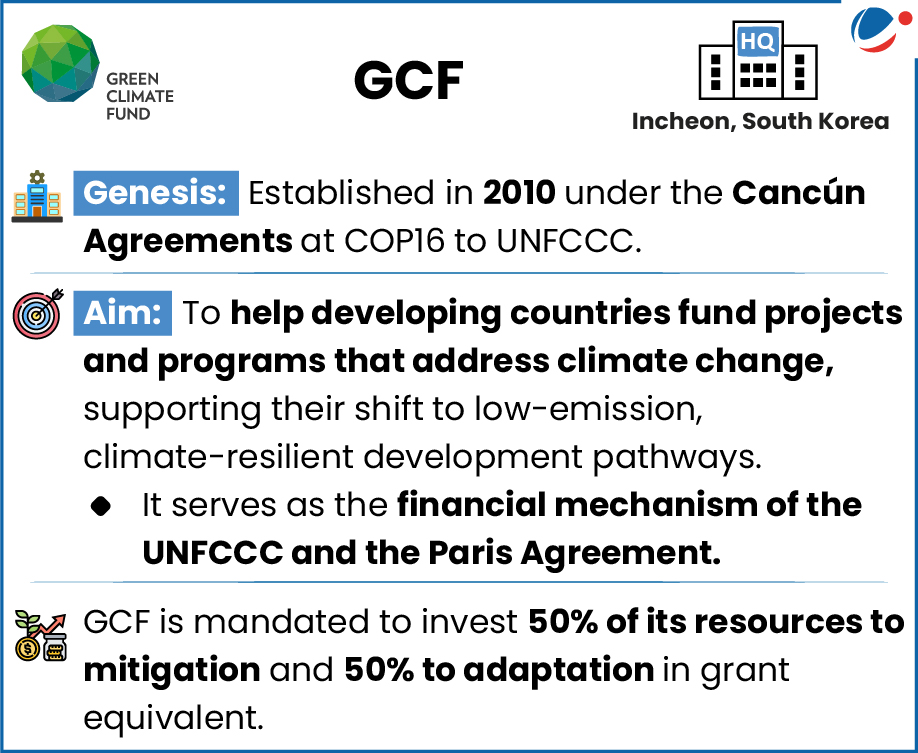

- Funding: The platforms will be supported under the Green Climate Fund's (GCF) Readiness Programme.

- The Readiness Programme is as the largest climate action capacity-building facility for developing countries.

- GCF funds already support two existing platforms, the Brazil Country Platform and the Caribbean Regional Platform.

- These platforms seek to replace a fragmented project approach, by helping to coordinate various public and private, international and local stakeholders.

Climate Finance Viewpoints

|

Issues related to climate finance

- Ambition without guaranteed delivery: Targets rely on voluntary pledges and private flows, not guaranteeing the public, concessional funding vulnerable countries need.

- Developing nations require an estimated US$1.3 trillion each year for climate action.

- However, the New Collective Quantified Goal (NCQG) agreed upon at COP29 is just US$300 billion annually.

- Concessionality and access issues: LDCs and SIDS face barriers to access; blended instruments risk creating debt unless grant elements are preserved.

- Overreliance on private finance: Private capital prefers bankable mitigation projects over adaptation and L&D, which require grants.

- Unspent Funds at GCF: Despite the GCF having over US$19 billion committed across 134 developing countries, it faces criticism from developing countries for it's difficult to comply with disbursal mechanisms.

- Of the total amount of GCF funding for projects under implementation, only ~40% has been disbursed.

- The 2035 problem (Slow Timelines): Targets pushing major increases to 2035 are politically easier but problematic for countries facing immediate climate impacts.

- Transparency and additionality: Concerns remain regarding double-counting and whether "mobilized" private finance is truly additional to existing ODA (Official Development Assistance).

Climate Finance and IndiaIndia's Climate Finance Needs (TERI)

Steps Taken to Mobilize Climate Finance (Domestic)

|

Way Forward for India and other developing countries

- Push for predictable public flows and a defined timeline for the USD 300 billion mobilization target.

- Safeguard concessionality: Insist on grant elements for adaptation/L&D and instruments avoiding harmful debt.

- Standardize "mobilization" accounting: Advocate for transparent methodologies to avoid double-counting.

- Strengthen Domestic Frameworks: Align climate finance taxonomy and disclosure norms with global standards (ISSB).

- Create bankable pipelines with domestic safeguards: Develop sovereign pipelines (renewables, resilience) tied to social/environmental safeguards.

- Regional cooperation on blended facilities: Explore South-South blended mechanisms aligning private capital with public interest.

Conclusion

The country platform initiative is an effort by the Global South to take leadership of climate finance and reshaping the architecture of global climate cooperation. COP30 created a political framework and introduced promising vehicles. But success now depends on implementation and transparency. Belém's credibility rests on turning commitments into predictable, public, and concessional finance. Most importantly, delivery instruments must protect vulnerable countries from taking on new debt.